-

About

- About Listly

- Community & Support

- Howto

- Chrome Extension

- Bookmarklet

- WordPress Plugin

- Listly Premium

- Privacy

- Terms

- DMCA Copyright

- © 2010-2025 Boomy Labs

Listly by jemiekremi

Once all other financial aid options have been exhausted, student loans are another choice to help pay for college. There are two classifications for student loans, subsidized and unsubsidized. Subsidised student loans are loans which interest on the loan does not start accruing while the student is still enrolled in school. Unsubsidized loans accrue interest while the student is still in school but do not require payment on the loans until schooling is completed.

With the ever rising costs of a college education, It is vitally important that we teach our young adults about their student loan options, and the resulting consequences of making the important decision of taking out student loans. Lack of this simple education can easily lead to having large amounts of debt to repay for 10+ years once school has been completed. You might be surprised to learn that for some college graduates today, their student loan payments are equal to a mortgage payment each month!

The good thing about student loans is that they are typically pretty easy to get if you are a student. However, this ease of borrowing is also the number one bad thing about student loans. Oftentimes, young adults rack up a lot of debt in the form of student loans and graduate with years and years of large student loan payments to make.

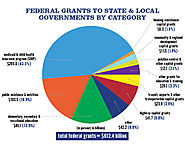

Students today have many options when it comes to paying for a college or university education. Financial aid options typically include a combination of the following: federal grants, state grants, work-study, scholarships, student loans and parent loans.

The first step in applying for financial aid starts with filling out and submitting the FAFSA form online prior to starting college. The FAFSA, which stands for Free Application for Federal Student Aid, can be found online at www.fafsa.ed.gov. Students are typically required to submit their FAFSA form in the spring to be considered for fall financial aid. To complete the FAFSA the student will need information from their own, as well as their parents, tax forms. In addition, a pin is required to serve as an electronic signature for online. The FAFSA pin can be applied for at https://studentaid.ed.gov/sa/fafsa/filling-out/fsaid#pin-replacement.

Once the FAFSA has been processed, the information is then sent to any college or university's financial aid office for which you have directed to recieve the information. From the FAFSA, a determination is made on how much the family contribution should amount to and what financial aid will likely be needed for the student. At this point, it is up to the financial aid office at the student's school to make a determination of what student aid options will be granted.

Federal grants for education, such as Pell Grants, are offered to qualified students based on their FAFSA application. A Pell Grant amounts to a few thousand dollars per semester and is awarded to qualifying students who are working on their first bachelor's degree. Pell grants do not have to be repaid unless the student drops out of school and does not complete their classes.

Many states have programs where additional grant money is awarded to students who have shown financial need. This grant can vary from a few hundred dollars per semester to a few thousand dollars per semester.

Many colleges and universities set aside jobs which can be completed by students to help off-set their educational and living expenses. Such jobs are known as work-study and are typically assigned to students who show an interest in working to help pay for their educations. Many of the jobs available allow students the opportunity to study during slow times at their jobs.

Scholarship opportunities exist for many students today. There are scholarships available for just about anyone, simply for doing some research and taking the time to apply. While many scholarships look at high school grades as their criteria, many others are available for simply having a specific last name or being left-handed. The best place to research scholarship opportunities online is through the studentloanplans website.

Once a student has maxed out their other financial aid options, loans are typically available to the student's parent to help pay for the costs of the education. Some parents agree to taking out loans to pay for their child's education and some prefer not to.

The biggest downfall to student loans is that they have to be repaid from future earnings. This means that a student has to make a wise decision on how much their income after college is likely to be and what amount of payments each month they will be comfortable paying. This decision is often hard for students because they simply do not have enough life experience to judge what their realistic monthly expenses will be post university. For this reason, parents need to take the time to become educated on financial aid options and speak to their children about the long-term ramifications of student loans.