-

About

- About Listly

- Community & Support

- Howto

- Chrome Extension

- Bookmarklet

- WordPress Plugin

- Listly Premium

- Privacy

- Terms

- DMCA Copyright

- © 2010-2025 Boomy Labs

Sandi Martin

Sandi Martin

Listly by Sandi Martin

December's list of the best Canadian personal finance news, articles, and blog posts from around the internet, expertly curated for interest and relevance. You can follow this list right here in List.ly, by following me on Twitter (@sandimartinspf), or by signing up for Spring in your inbox here: https://springpersonalfinance.com/contact/

Source: http://blog.springpersonalfinance.com

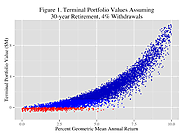

"The process I suggest may seem pointless given the amount of uncertainty involved, but a plan that results from our best efforts to quantify that uncertainty is better than no plan at all. If we can’t identify a plan that will work with certainty, we can at least rule out plans that probably won’t work and identify plans that are more likely to work. But, we have to recognize that uncertainty, even in the latter."

"Maybe for you it’s something simple like taking a class or two at the local college. Or maybe it’s more complicated, like moving to a new city to give your career a bump. In both instances, you can measure the results of these choices. A promotion at work or a new job would be a clear return on your investment.

To be clear, there’s a big different between real, human capital investments and expenses masquerading as investments. Yes, watching some great documentaries may help you learn more about the world and thus count as an investment. Buying a bigger television to watch those documentaries doesn’t."

"In the world of investing, nothing turns my stomach more than when a member of the investment industry misleads investors and then directly benefits from said misinformation. Usually only subtle trickery is at play. And most often I have seen this in the form of funds sporting unsustainable cash payouts - which I've been studying and writing about since 2001."

High costs are so damaging that even a perfectly-executed portfolio management strategy is likely going to underperform an imperfectly-executed strategy that costs dramatically less. If you’re paying 2.5% for investment management, you’d better hope you’ve found one of the few human beings in the world immune to behavioural mistakes.

"Here’s the problem. Do you want to reduce the volatility of your asset portfolio? I have the solution for you. Buy bonds and hold some cash."

Jason Zweig, who writes the Intelligent Investor column in the Wall Street Journal, is a distinct voice in the US financial press. Drawing inspiration from the value-investing principles developed by legendary American investor Benjamin Graham-and perfected by his pupil Warren Buffett-Zweig consistently urges investors to resist the temptations of chasing the latest market trends.

We're nearly halfway through the final month of 2015 and, despite how calm I might seem on the surface, I've definitely been experiencing some end-of-the-year stress.

"Some people will make lasting changes to their financial situation, but not because they lay out a strict budget, or invest in one mutual fund over another. They will change their relationship to money, and that will make all the difference. They won’t try to wrestle themselves into making “better” financial decisions that leave them feeling restricted or deprived. They will do something many people can’t imagine. They will make friends with their money. They will begin to see money as a trusted partner instead of something to battle against."

"Finance people tend to argue with each other about very minor details. Will factor investing still work in the future? What’s the optimal asset allocation? What is the true definition of active investing or forecasting?

In the grand scheme of things these topics are rather trivial to the majority of people seeking financial advice. What most people need are sources of advice that will aid them in making better, more informed decisions about their personal finances using imperfect information about the future. They need someone to make them feel comfortable with their decisions and ask the right questions before putting money to work"

In 2016, would you like to improve your money management, minimize taxes and ensure your loved ones have a financial road map? Then this holiday season, in between your family gatherings and trying to watch 2016 IIHF World Junior Championship games from Finland, consider undertaking a financial cleanup.

"Money and finances are often at the heart of the goals people set and so, for this week’s post, I thought it might be useful to share a series of money questions I use when evaluating my own financial situation and when helping others evaluate theirs."

You're convinced your advisor has breached the rules and made you lose money. Now what? Unfortunately, while it's easy to make a complaint, the chances of recovering all of your losses are relatively low unless the breach is flagrant and easily proven.

Ultimately, the fact that rebalancing may actually reduce long-term returns isn’t a reason to avoid it (even if returns are lower, risk-adjusted returns may be improved if the risk is reduced by even more), and sometimes returns really can be enhanced (when rebalancing across similar-return investments, such as amongst sub-categories of equities). Nonetheless, it’s crucial to recognize the role that rebalancing really does – and does not – play in a long-term portfolio!

Over the years, I've noticed that moment when each of my children started caring about what other people think of them. One by one, I've watched as the opinions of others become a big deal in their own decision-making. As smart, mature adults, we have a term for that: peer pressure.

November's list of the best Canadian personal finance news, articles, and blog posts from around the internet, expertly curated for interest and relevance. You can follow this list right here in List.ly, by following me on Twitter (@sandimartinspf), or by signing up for Spring in your inbox here: https://springpersonalfinance.com/contact/

Fee only/advice only financial planner at Spring Financial Planning, ex-banker, curmudgeon.

Co-host with the really loud laugh on Because Money