-

About

- About Listly

- Community & Support

- Howto

- Chrome Extension

- Bookmarklet

- WordPress Plugin

- Listly Premium

- Privacy

- Terms

- DMCA Copyright

- © 2010-2025 Boomy Labs

Sandi Martin

Sandi Martin

Listly by Sandi Martin

August's list of the best Canadian personal finance news, articles, and blog posts from around the internet, expertly curated for interest and relevance. You can follow this list right here in List.ly, by following me on Twitter (@sandimartinspf), or by signing up for Spring in your inbox here: https://springpersonalfinance.com/contact/

Source: http://blog.springpersonalfinance.com

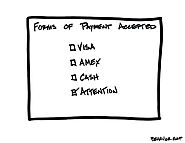

Attention is a currency. We choose how to spend it, just like we spend our time, energy and money. Unlike money, however, there’s no way to store attention for later use. It’s a bit like time in that way; we use it or lose it.

July's list of the best Canadian personal finance news, articles, and blog posts from around the internet, expertly curated for interest and relevance. You can follow this list right here in List.ly, by following me on Twitter (@sandimartinspf), or by signing up for Spring in your inbox here: https://springpersonalfinance.com/contact/

Just because you have a Ph.D. in economics doesn't mean you know how to invest for retirement. Alicia Munnell, the director of Boston College's Center for Retirement Research, was a member of the president's Council of Economic Advisers for two years before joining Boston College as a professor of management sciences in 1997. "But taking responsibility for your own investing is 'too hard,' she says. Like everyone else out there, Munnell, 72, is nervous about whether she's doing the right thing. She did make a couple of smart financial decisions in her early 50s that firmed up her financial footing. They had nothing to do with stocks or bonds."

This week, I'm trying something a little different. Below, you'll find the column I wrote for the New York Times. However, you'll also find a companion audio recording where I shared this story. So you choose: you can listen or read on to see what I learned from the $70...

Decluttering enthusiasts say that getting organized and making do with less stuff helps them think clearly and frees them up to focus on what's really important. Many of those same virtues can be extended to decluttering a portfolio, a practice I've enthused about in the past.

"Ever feel like your finances are managing you instead of you managing your finances? Late fees pile up, interest charges multiply, and as soon as you find your 401(k) participation paperwork, you’ll fill it out and start participating.

If you felt stressed reading that last sentence, you can understand why people choose to automate their finances. The fewer decisions you have to make in a day, the better.

Automating your finances can help put your financial life in order and free up some of your time … or it could turn into a costly experiment. The trick is to create a solid financial system — and to monitor it."

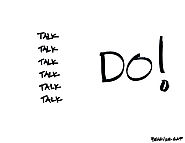

"I have plenty of clients who did nothing special besides the financial equivalent of put one foot in front of the other, spent less than they earned, didn’t try to shoot for the moon with crazy investments involving pork snout futures or cousin Willy’s new-fangled sweater knittings made from belly button lint that will sweep the nation, and they either have retired or they’re on track to retire.

Did they do something special?

No.

They had a positive attitude that they could live within their means, work to earn more, invest wisely, and do what they needed to do to achieve the goals that they had."

"Our view is that the economy in the U.S. continues to _______, and we foresee _______ problems overseas ______. China is _______, and that has ramifications for the Pacific Rim’s ______. Greece is ______ in Europe. The commodity complex is causing _____ for emerging markets. But many sectors of the U.S. economy remain _______, and some sectors overseas are still _______. The valuation issue continues to be _____, and that means _____ for investors. That has ramifications for corporate profits that will be ______. We think the economy is going to do ______, and you know that means inflation will be _____, which will force interest rates to ______. Under these conditions, the sectors most likely to benefit from this are ______, ______ and ______. "

"The only accurate way to determine the right replacement ratio in retirement might just be to throw the concept of replacing a percentage of income out the window. What we really need to do is maintain our standard of living in retirement. This means figuring out what we spend before retirement, how much of that spending we want to maintain, covering unknown risks of long-term care and any bequest needs, and then figuring out how much we need in savings to close the gap."

"So, when someone complains that CPP doesn’t pay out to your estate when you die early, what they are really calling for is a big drop in CPP payments or a big increase in CPP premiums. Don’t fall for this. Whatever problems we may have with our CPP system, having payments stop when you die is not one of those problems."

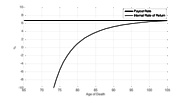

In sum, assuming a more aggressive rate of return — or planning to some arbitrary age — and then claiming that retirement has suddenly become “cheaper” is a dangerous fallacy that will end up costing many retirees quite dearly. Ask anyone who assumed a 6.5% investment return over the last decade — or the 100,000 American centenarians — how their retirement is panning out.

Don't say you weren't warned. A few months ago, with markets on a hot streak, you were given the Solomonic heads-up that "this, too, shall pass." Your portfolio was basking in the sun at that moment, but as always, winter is coming. U.S. markets had climbed to all-time highs.

Over the past few months, I've wanted to explain ... well ... why this website exists. I've been imagining a "12 Principles"-style list, one that summarizes what this website stands for, what we're all about. But this created awkward questions. Notably: When is the list ever truly complete?

"It is important to recognize that the payout rate is not a return on the annuity, which may create some confusion. I have seen explanations which may suggest something along the lines of: You can earn 1% by holding a CD and 5% from an income annuity, so the income annuity is 5x more powerful than the CD. The problem is that the 1% number for the CD only represents its interest payments. The principal value is returned at maturity."

"Crashes, corrections, drawdowns, losses, system resets or whatever you want to call them are a feature of the financial markets, not a sign that they are broken. These things have to happen every once and a while for the system to function properly and wash out the excesses. It makes sense to learn from them and you definitely have to mentally prepare yourself for dealing with losses. But the infatuation with down markets can be taken too far when loss aversion begins to cloud your judgment."

Fee only/advice only financial planner at Spring Financial Planning, ex-banker, curmudgeon.

Co-host with the really loud laugh on Because Money