-

About

- About Listly

- Community & Support

- Howto

- Chrome Extension

- Bookmarklet

- WordPress Plugin

- Listly Premium

- Privacy

- Terms

- DMCA Copyright

- © 2010-2025 Boomy Labs

David Allsup

David Allsup

Listly by David Allsup

Poor credit is like a bad dream that lingers in our minds for a long time. Just as a bad dream ends, a person can also come out of bad credit. In fact, chin up, as you can always work towards improving your credit rating. The first step to improving your credit rating is to...

Doug Parker, founder and CEO of RMCN, has been selected as a key speaker for the 2015 Credit Repair Summit. During the event, Mr. Parker will share his thoughts and ideas about the developments and trends in the credit repair Industry, presenting the topic, 'Why I'm Proud to be in the Credit Repair Business'.

"Effective money management." How many times did your parents tell you about it when you were a child? Not sure. At least, you know why they reiterated the term whenever they got a chance. Time for you to do the same. The reason, teaching your child how to effectively handle their finances lays the foundation...

For a healthy and prosperous financial life, a good credit score is quintessential. A large number of people are acquainted with this universal fact but somehow run into bad scores due to certain adversities or lack of foresight. People with bad credit scores, i.e. a score below 600, are often troubled and keep seeking answers...

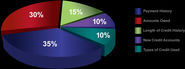

Before it too late to undo the wrong, it is always a wise decision to follow the norms and maintain your credit score at first place. There are numerous benefits of maintaining a good credit score, for instance people with good credit score have to pay lower interest rate on mortgages and credit cards as compared to people with poor credit score.

You must have heard from your peers, elders or any financial advisor that having a good credit score is a must, but ever wondered why? Well, let's suppose you want to buy a beautiful home that you saw on your way back home. Odds are that you may have to get a mortgage or take...

Bad credit score is a testament of your inability to keep up with credit agreements and failure to get approved of a new credit. It means you haven't made required payments on time, or haven't paid them at all. People who have had sent accounts to a collection agency, filed bankruptcy or had a vehicle...

Low credit scorers, often, have to face multiple challenges such as high interest rates, denied mortgage and auto loan applications, and the difficulty to get utilities, without paying a security deposit. It is a fact that a good credit score is necessary for smoothly running your life and therefore, people with a poor credit score don't have a choice except finding ways to repair it.

A loan is a process in which one party (lender) agrees to lend money to another party (borrower) in exchange for a promise to repay the amount in future. Not many borrowers are aware of the fact that a loan can have negative as well as positive implications on their credit score, which in turn may impact the borrower's potential to apply for other financing options.

A low score can give rise to a lot of issues. Avoiding some of the common mistakes will help you in maintaining your credit score. What's the big deal with having a low credit score? Well, it plays a vital role in helping you to make wise investments.

"To err is human". This is a common phrase that applies to all, and credit bureaus are no exception. According to a study by the Federal Trade Commission, it has been noticed that one out of four consumer credit reports have errors. These may include everything from minor to serious mistakes that could ruin your financial life.

If you are asking yourself the question 'How can I repair my credit score?', use the following checklist to help you choose the right credit repair specialist: To begin with, disputing your credit with a credit bureau is not the only thing that you will be required to do if you are to increase your...

Are you planning to apply for a home loan but have a low credit score? According to a survey from the National Foundation for Credit Counseling, people are more apt to tell you their weight than their credit score. Your credit score plays an important role in determining your ability to obtain credit and get...

The financial life of Brenda F. Campbell was in shambles after credit reporting agencies misidentified her for someone with a similar name, and a series of unpaid bills. As a result of this mistaken identity, she was denied credit. This real-life story was published in USA Today (February of 2013).

Professional credit repair expert not only help you in restoring your credit score, they also educate you about how to maintain a good credit score.

How many of you have requested your free credit report this year? We hardly take the pain of checking our credit scores until we make a critical financial decision. What if you find out that your low credit score is creating obstacles in getting a mortgage, a good job or an apartment for rent?

Many people who want to buy a home or a car can't afford it by making a full cash payment. Hence, in order to fulfill their financial needs, they take out loans. However, it's not easy to be able to secure one as you need a good credit score.

Poor credit is like a bad dream that lingers in our minds for a long time. Just as a bad dream ends, a person can also come out of bad credit. In fact, chin up, as you can always work towards improving your credit rating.

Claims like "We can improve your bad credit instantly, no questions asked!" "Contact us to make a new credit identity - legally" or "Credit problems? Fix them in a month" are common in TV ads, radio, flyers, emails, and online space. According to the attorneys at the Federal Trade Commission (FTC), no legitimate credit restoration company claims credit repair is a quick-fix solution.

Credit blues weighing you down? You're not alone. It's common for people to feel shame or embarrassment when they find themselves with bad or damaged credit. But don't let these feelings keep you from asking for the help you need. With the help of a credit repair specialist, you can repair your credit.