-

About

- About Listly

- Community & Support

- Howto

- Chrome Extension

- Bookmarklet

- WordPress Plugin

- Listly Premium

- Privacy

- Terms

- DMCA Copyright

- © 2010-2025 Boomy Labs

Sandi Martin

Sandi Martin

Listly by Sandi Martin

November's list of the best Canadian personal finance news, articles, and blog posts from around the internet, expertly curated for interest and relevance.

Source: http://blog.springpersonalfinance.com

Tadas Viskanta from Abnormal Returns made a great point in a recent post: In the financial blogosphere and financial media we are often confronted with debates about issues that really are important only the margin. Of late discussions about active … Continue reading →

Ready to leave the working grind? Here’s a checklist of exactly what you need to do as you start the big transition to retirement.

"International diversification might not protect you from terrible days, months, or even years, but over longer horizons (which should be more important to investors) where underlying economic growth matters more to returns than short-lived panics, it protects you quite well."

Each online investment management company has a slightly different fee structure and value proposition. Calculating their relative cost for your circumstances will let you compare their relative value depending on the kind of service you want to pay for. (Includes a link to the Canadian Online Investment Advisor Fee Calculator.)

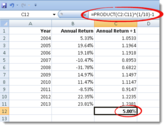

With Phase II of the Client Relationship Model (CRM II) fast approaching, Canadian investors will likely be on their own when trying to make sense of their reported rates of return (which will gene...

Answer these four lifestyle questions to determine if you're a good candidate to downsize in your retirement.

The best lack all conviction, while the worstAre full of passionate intensity. - William Butler Yeats The Second Coming Everybody loves an expert. Well

Fund Facts interactive sample - worth looking at if you own mutual funds and need a refresher (or first time) look at the details.

This article is by staff writer Kristin Wong. I get frustrated when people don’t understand what it means to be frugal. A few criticisms of frugality I’ve come across: Frugality is a waste of time. Frugality distracts you from earning more money. Frugal people deny themselves of any enjoyment. I’ve already written in detail about how these arguments are silly. They might apply to being cheap, but they don’t apply to being frugal. The point...

In the 1970s, nothing was scarier than walking around New York City. You know, all those alligators in the sewer. And if a murderous reptile didn’t attack you from an open manhole, you had to worry...

Pension expert Malcolm Hamilton told the crowd gathered at MoneySense's Retire Rich that Canadians are unduly and irrationally worried about retirement.

"There are those who know and those who don’t. All the advantages go to people who know.”

These words are from investor advocate Glorianne Stromberg in 1998. She was speaking to the ramifications of the ‘knowledge gap’ between investment professionals and ...

Raising one or more children? Get every penny you're entitled to when filing your 2014 tax return this April by understanding the new tax measures for families recently introduced by the federal Conservatives. Remember, some of these provisions could wither for the 2015 year if the current government does not regain its mandate at the next election and a new government overturns them.

Fee only/advice only financial planner at Spring Financial Planning, ex-banker, curmudgeon.

Co-host with the really loud laugh on Because Money