-

About

- About Listly

- Community & Support

- Howto

- Chrome Extension

- Bookmarklet

- WordPress Plugin

- Listly Premium

- Privacy

- Terms

- DMCA Copyright

- © 2010-2025 Boomy Labs

Sandi Martin

Sandi Martin

Listly by Sandi Martin

The best scholarship on turning retirement savings into retirement income.

This article has incorrect information in it. On purpose. Read it, see if you can find the flaw, and then read "Beware the Rules of Thumb" to find out why I put the flaw in there! "I'm spending a year dead for tax reasons."

Should bonds be kept in mutual funds or purchased as individual securities and held to their maturity dates? The former option receives much far more attention, as managers compete in a performance-driven marketplace. But investing, especially for retirement, shouldn't be driven by maximizing risk-adjusted returns. Advisors must focus on securing a client's future spending needs.

Retirees who decide they want to fund at least some of their retirement income with Treasury Inflation-Protected Securities, or TIPS bonds, have a choice between investing in a ladder of individual bonds or a fund of TIPS bonds. Wade Pfau recently asked at his blog which retirees should prefer.

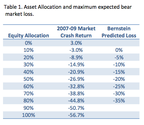

By Roger Nusbaum, AdvisorShares ETF Strategist After the second 50% drawdown of the US equity market in one decade, the investment industry began to reassess the idea of what asset allocation should look like.

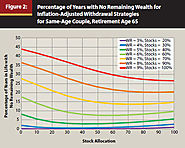

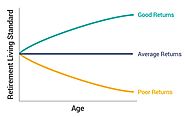

Retirement researchers Michael Kitces and Wade Pfau published papers on glide paths in the Journal of Financial Planning in 2014 and 2015, including Retirement Risk, Rising Equity Glide Paths, and Valuation-Based Asset Allocation, suggesting a rising glide path for retirees beginning with a low equity allocation early in retirement and rising throughout.

Should retirees place greater faith in stocks' ability to outperform bonds over reasonable holding periods or in insurance companies and bond issuers' ability to meet their contractual guarantees? Your position on this fundamental question will determine how you choose to build retirement income strategies for your clients.

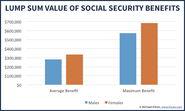

As a guaranteed income stream that cannot otherwise be liquidated or reinvested, most retirees don't think of their Social Security benefits as an asset. Nonetheless, its value actually can be calculated, given known payments and reasonable assumptions regarding interest/growth rates and life expectancy.

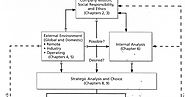

In the past, I've described two fundamentally different philosophies for retirement-income planning: probability-based and safety-first. Those philosophies diverge on the critical issue of where an individual must place their trust: in the risk/reward tradeoffs of an equity portfolio, or on the contractual guarantee of insurance products.

Originally published on InvestmentNews.com on June 15, 2015. Retirement income planning has emerged as a distinct field in the financial services profession. And while it suffers from many growing pains as it gains recognition, increased research and brainpower in the field have benefited retirees and those planning for retirement.

A plan to meet housing needs is an important part of a retirement income strategy. A home provides an emotional anchor, providing daily comfort and shelter, memories, and nearness to friends and community. Homes are also a major source of wealth for retirees and near-retirees.

I have recently posted about bankruptcy risk, positive feedback loops, chaos theory and Kaplan-Meier estimators and now I'll try to tie all of those posts together. They're mostly about the unpredictability of spending in retirement compared to sequence of returns risk, the probability of outliving your retirement savings due to market volatility.

Eight key messages and themes have underscored my writing and research. Those guidelines serve as a manifesto for my approach to retirement income planning.

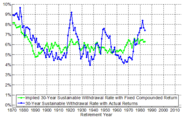

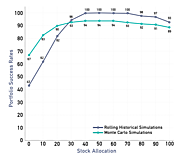

One of the classic approaches to studying retirement withdrawal rates is to use Monte Carlo simulations that are parameterized to the same historical data as used in historical simulations. This can be done either by randomly drawing past returns from the historical data to construct thirty-year sequences of returns (a [...]

"The challenge of retirement planning is to find a strategy (and there may be several) that meets the desires of our mission statement but also falls within the limits imposed on us by the economy and our household’s resources. "

Forbes Welcome page -- Forbes is a global media company, focusing on business, investing, technology, entrepreneurship, leadership, and lifestyle.

Shortfall risk retirement income analyses offer little insight into how much risk is optimal, and how risk tolerance affects retirement income decisions

This study models retirement income risk in a manner consistent with risk tolerance in portfolio selection in order to estimate optimal asset allocations and withdrawal rates for retirees with different risk attitudes

I recently completed my series outlining several retirement spending strategies, but how do you know which is right for you? The answer depends on several factors.

Fee only/advice only financial planner at Spring Financial Planning, ex-banker, curmudgeon.

Co-host with the really loud laugh on Because Money