-

About

- About Listly

- Community & Support

- Howto

- Chrome Extension

- Bookmarklet

- WordPress Plugin

- Listly Premium

- Privacy

- Terms

- DMCA Copyright

- © 2010-2025 Boomy Labs

VonVictor Roesnchild

VonVictor Roesnchild

Listly by VonVictor Roesnchild

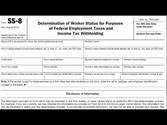

It is vitally important for businesses to fully understand the IRS Tax Term Status that should be given to Consultants and Contractors. There are primary factors that determine if a worker is classified as an Employee (W-2) or an Independent Contractor / Consultant (1099) and what you can do to help protect yourself from costly taxes and penalties for getting this wrong.

Foreign Account Tax Compliance Act (FATCA) The Foreign Account Tax Compliance Act (FATCA) improves tax compliance involving foreign financial assets and offshore accounts. Under FATCA, certain U.S. taxpayers with specified foreign financial assets must report those assets to the IRS on Form 8938.

Abusive Tax Shelters and Transactions The Internal Revenue Service has a comprehensive strategy in place to combat abusive tax shelters and transactions. This strategy includes guidance on abusive transactions, regulations governing tax shelters, a hotline for taxpayers to use to report abusive technical transactions, and enforcement activity against abusive tax shelter promoters and investors.

2008 Changes to Form 1065 - Frequently Asked Questions Form 1065 has a number of changes for 2008. For example, Schedule B and Schedule K-1 require reporting of ownership percentages. The FAQ page on Form 1065 changes offers helpful examples.

Business MeF Production Shutdown/Cut Over Schedule Shutdown is tentatively scheduled to begin on Thursday, December 26, 2013 at 11:59 a.m. A QuickAlert outlining the exact timeframes to Send Submissions or retrieve federal/state Acknowledgements will be issued in early December and the times will be posted on the MeF Status Page.

SB/SE serves taxpayers who file Form 1040, Schedules C, E, F or Form 2106, as well as small businesses with assets under $10 million. A-Z Index for Business Find it Fast! Know what you're looking for and want to find it fast?

http://bit.ly/Wx85YD Download Expense Tracker App for Free -- http://www.taxorganizer.biz?affId=135911 For More Tax Help Videos Check Out -- http://ExpenseTrackerApp.net What is a 1099 Form and When to Use it - Tax Help SUBSCRIBE to the Expense Tracker Channel to learn how to organize your business expenses so you can save your money on Taxes.

A 1099 form is filed when a person has an independent contractor working for them, and the IRS has stringent rules in regard to whether or not a person is considered to be an independent contractor. Discover how much a person must be paid to necessitate a 1099 with help from a tax bookkeeper in this free video on filing taxes.

This video covers the topics of IRS Federal Tax Form 1099. http://www.harborfinancialonline.com

This video covers the primary factors that determine if a worker is classified as an employee or an independent contractor and what you can do to help protect yourself from costly taxes and penalties for getting this wrong.