-

About

- About Listly

- Community & Support

- Howto

- Chrome Extension

- Bookmarklet

- WordPress Plugin

- Listly Premium

- Privacy

- Terms

- DMCA Copyright

- © 2010-2025 Boomy Labs

Sandi Martin

Sandi Martin

Listly by Sandi Martin

Sometimes - and I know it's hard to believe - other people ask me to write a post or give them a quote for their publication. Here's where you can find me when I'm not at home.

Do you ever feel like you spend most of your life saving and saving and saving for retirement (or financial independence), worrying about how much you should have invested in stocks or bonds or mutual funds or GICs, and if it's enough, but that what you do with your money after you reach that magical goal is a complete and utter mystery?

Ahem. Hi. (Is this thing on?) I'm Sandi. I'm thirty-four, married, with three kids, a house, and no pets. I drive a minivan. I like Dr. Who, Terry Pratchett, and butter. Lots of butter. I live in the very small town of Gravenhurst, Ontario, where I operate Spring Personal Finance, a fee only financial planning practice.

Raise your hand if you've spent any time thinking about what kind of money you're likely to get from the government when you retire. Now raise your hand if you don't really know how much money that will be, or how to figure it out. ...twenty-seven...twenty-eight...twenty-nine... almost everyone, then.

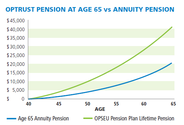

Can I tell you a story? It's a true one, and - unfortunately - it's happened more than once. Way more than once. It may even be your story. Here goes: Sam is leaving his job, and with it his defined benefit plan.

Untold sums of money have already been spent preparing for the birth of Prince George of Cambridge. The Duchess of Cambridge was seen buying a $500-white bassinet for the mini royal and a Bugaboo stroller, which can cost up to $1,200. (Even the BBC spent about 13,000 pounds or $20,000 to put cameramen on constant baby watch.)

On Jan. 1, Louise Wallace took her first step down the long road toward debt freedom: She drafted a budget. "Nothing fancy. Just a list of my revenue and my expenses so I can see where the money comes in and where the money goes out," she said in a post on her blog, which launched New Year's Day.

It's been eight months since Scotiabank closed the deal to buy ING Direct, snapping up the online bank for $3.1 billion. Scotia promised to keep its hands off ING's operations, opting to keep the bank as a separate, standalone entity and so far has been true to its word.

Brooke's Note: I looked up Sandi Martin's town. The burg is 100 miles north of Toronto and it has a population of about 12,000. That actually sounds pretty big (to this Mainer) until you consider that it is about 200 square miles in size and is the thriving metropolis of its immediate area.

Occupation Fee-only financial planner The portfolio TD e-Series index funds: Canadian Bond, Canadian Equity, U.S. Equity and International Equity. The investor For many years, Sandi Martin worked as a financial planner at a bank. But she found "it was a struggle to truly serve client needs," so she resigned to become a fee-only financial planner.

Hate him if you must, but let's be fair: that ripped guy at your gym probably didn't just wake up one morning looking like a Greek god. He probably got that body by exercising regularly. It's the same with most wealthy people.

Hi, I'm Sandi, and I'm new here. Here's what you need to know about me. Trying to read every personal finance post, article, and news item out there is probably last on your to-do list, after taking out the garbage. Why?

Most Canadians believe they are knowledgeable about tax-free savings accounts, but 89 per cent don't know what can go in the accounts and 81 per cent are unaware of the annual contribution limit, according to a Bank of Montreal study.

Imagine a world of total certainty - you know when you'll die, how many times your car will crap out on you, what the markets will do, and if your third kid will need braces. In that world.

We all want the best for our children. We want them to do even better than us. ("It's too late for me, but I want to one day live in my kid's mansion.") How better to prepare them for a successful future than to ensure they have some financial support for post-secondary education.

Procrastination is opportunity's natural assassin. Victor Kiam apparently said that. The late U.S. businessman was famous for appearing in ads for Remington, his electric-razor company. Many financial advisers also would probably like to say this to their clients when discussing RRSP contributions. Procrastinate now and watch your retirement goals fade later.

If your desk and drawers are looking like they appeared in an episode of Hoarders, it may be time to spring clean your paperwork. "At the end of [tax season], I clean out my filing cabinet," says Sandi Martin, a fee-based financial planner.

Someday, you're going to die. Thankfully, it probably won't be at the hands of some enormous gladiator with a mace and a pet lion, but no matter how you go, take a minute right now to imagine what will happen next if you leave a spouse behind.

Ermagherd, friend - I'm so thrilled to bring you the first post of my new Summer series - Money Smarts - on how to get your financial shit together as a freelancer or entrepreneur. I've recruited the help of the ever-clever Sandi Martin of Spring Personal Finance because who better to answer your questions than a banker-gone-rogue?

If you felt green with envy this long holiday weekend as friends packed up their cars for the journey to cottage country, you may be telling yourself it's finally time to take the plunge. Winter is too long, summer too short and the city too noisy and sticky to bear.

When it comes to bookkeeping and accounting, there are only four words you need to remember: Don't Cross The Streams Business expenses go through the business account and on the business credit card. Personal expenses go through the personal account and personal credit card. The end. If you're just starting out, start right.

Fee only/advice only financial planner at Spring Financial Planning, ex-banker, curmudgeon.

Co-host with the really loud laugh on Because Money