-

About

- About Listly

- Community & Support

- Howto

- Chrome Extension

- Bookmarklet

- WordPress Plugin

- Listly Premium

- Privacy

- Terms

- DMCA Copyright

- © 2010-2025 Boomy Labs

O’Connor Associates

O’Connor Associates

Listly by O’Connor Associates

O’Connor saved clients over $215 million in property taxes in 2023 and has already saved clients over $212 million in 2024!

"Looking to lower your business or personal property tax?

O'Connor offers expert services to help you maximize tax savings and minimize liabilities. With extensive experience and data-backed strategies, their team ensures accurate tax assessments and provides effective solutions for both businesses and individuals.

Ready to cut down your property tax? Contact O'Connor today for a consultation and start saving. Visit O'Connor Property Tax Services to learn more at https://www.poconnor.com/business-personal-property-tax-services/."

If your property was impacted by a disaster, you may qualify for the 2024 Disaster Exemption to reduce your property taxes. O'Connor offers expert guidance to help you navigate the process and ensure you receive the maximum exemption possible, easing the financial burden on affected property owners. Visit:- O'Connor’s 2024 Disaster Exemption Page to find out how you can apply! https://www.poconnor.com/2024-disaster-exemption/

If your property was damaged by a recent disaster, you may be eligible for a Temporary Disaster Exemption, reducing your tax burden. O'Connor offers services to help you apply and understand your eligibility, ensuring you benefit from the available tax relief for temporary damages. Discover your eligibility by visiting O'Connor's Temporary Disaster Exemption page at https://www.poconnor.com/temporary-disaster-exemption/.

Are you overpaying on property taxes? Discover the benefits of a tailored Property Tax Protection Program designed to lower your annual tax burden. Whether you're a homeowner or a business owner, these programs ensure you're not paying more than you should. Let seasoned professionals review your property tax valuation and guide you through the property tax appeal process. To Learn more about protecting your property today with O'Connor Residential property tax protection program visit:https://www.poconnor.com/property-tax-protection-programs/.

"Is your business paying too much in property taxes? The Commercial Property Tax Program offers solutions to reduce your tax liability, ensuring you're not overpaying. With expert guidance, the program helps you navigate the complex tax appeal process, protecting your bottom line and enhancing profitability.

Get started today and explore your options for reducing commercial property taxes!

Discover more and Reduce your commercial property tax with O'Connor Commercial tax protection program. Click here for more information https://www.poconnor.com/commercial-property-tax-program/"

"If your home has been damaged by a disaster, you may be eligible for significant tax relief. The Disaster Exemption can reduce your property taxes, helping ease the financial strain in difficult times. Learn how to apply and take advantage of this valuable program to protect your home and finances.

Apply for relief today and explore how the disaster exemption can benefit you. Learn more about disaster exemptions for homeowners Visit O'Connor Tax Reduction Expert at https://www.poconnor.com/how-the-disaster-exemption-can-ease-the-financial-burden-for-homeowners/"

In 2024, commercial property owners in Smith County faced an average tax increase of 18%, with many businesses choosing to challenge these steep assessments. Hotel properties saw the most dramatic rise, with values jumping by 46.7%, while landowners experienced a smaller 4.4% increase. These significant tax hikes are prompting businesses to reassess their strategies and consider property tax appeals. To learn more about how these changes could affect your property, visit our detailed report on the latest reassessment.

Is your business facing a steep rise in property taxes? Get expert guidance on how to manage or appeal your 2024 reassessment by visiting our website today https://www.poconnor.com/the-2024-smith-county-reassessment-reveals-that-commercial-property-values-surged-significantly-more-than-residential-values/.

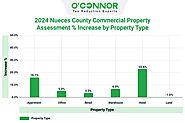

During the 2024 property tax assessments, commercial property values in Nueces County showed varied changes, with hotel properties experiencing a sharp 22.6% rise in value—from $629 million to $772 million. Meanwhile, landowners saw a slight 1% decline in property values. In response, many business owners have chosen to challenge their tax assessments, seeking relief from the increasing tax burden. For a full breakdown of these changes and guidance on how to manage your property taxes, read our comprehensive assessment report.

Facing higher commercial property taxes in Nueces County? Discover expert strategies to challenge your 2024 reassessment. Visit our website https://www.poconnor.com/the-2024-nueces-county-reassessment-shows-residential-property-values-up-7-9-and-commercial-values-up-3-2/ for more details.

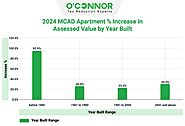

The 2024 property tax assessments in Montgomery County revealed a sharp increase in apartment property values, with an overall rise of over 30%. Apartments built before 1960 saw the most dramatic surge, with values skyrocketing by more than 93%. Even newer apartment buildings, especially those constructed after 2001, experienced significant value hikes of around 30%. Property owners facing these substantial increases are exploring options to challenge their assessments. For more insights on how these changes may affect your property, explore our detailed report.

Concerned about rising apartment property taxes in Montgomery County? Visit our website for expert guidance on challenging your 2024 reassessment and reducing your tax burden.

"1) Texas Property Tax appeals can lower assessed values when records are outdated, market shifts aren’t reflected, or similar homes are valued lower.

2) File by May 15 (or 30 days after notice), cite market value and unequal appraisal, and review the appraisal district record card for errors that affect Property Tax Value.

3) Use accepted methods: sales comparison, income, and cost; pair with unequal appraisal when comps indicate disparities.

4) Progression: informal meeting with a staff appraiser; if needed, present evidence at the ARB hearing; some cases continue to district court after ARB.

5) Protesting is free, can’t raise your value at ARB, and often succeeds when evidence is well documented; annual appeals help Lower Property Tax Bills over time.

6) A Property Tax Consultant can help assemble data and manage deadlines; O’Connor’s Tax Reduction Experts support homeowners statewide.

Click here to know more information on reason's to appeal Texas property tax: https://www.poconnor.com/twenty-plus-reasons-texans-should-protest-property-taxes-annually/"

#TexasPropertyTax

#PropertyTaxConsultant

#PropertyTaxRelief

#PropertyTaxAppealExperts

#LowerPropertyTaxBills

#OConnor

#TaxReductionExperts

"The Dekalb County Tax Assessor issues annual Dekalb County Tax Assessment notices that influence Dekalb County Property Tax values. O’Connor’s Tax Reduction Experts check values, prepare documentation, and and file a Tax Appeal when justified to adjust the assessment.

Service has no upfront cost; fees are only a portion of savings when a reduction is achieved, and no fee if there’s no change. Enrollment provides yearly assistance for as long as the home is owned, managing timelines and submissions. Designed for owners who want help organizing evidence for Dekalb County Tax Appraisal reviews and presenting materials clearly for efficient processing. See your potential savings & get your free enrollment today by visiting:- https://www.poconnor.com/georgia/dekalb-county-property-tax-reduction"

"Property taxes in Fulton County, GA can often rise faster than expected, placing a burden on homeowners and commercial property owners alike. Many property owners end up paying more than necessary simply because they aren’t aware of their appeal options or the true assessed value of their property.

That’s where O’Connor, the tax reduction experts, make a difference. With decades of experience handling property tax matters across Georgia, O’Connor helps you review your property’s assessed value and identify opportunities for a potential tax reduction. Our team evaluates every detail from comparable sales and property data to market trends ensuring your case is supported with accurate and up-to-date information. Whether you’re dealing with a residential or commercial property, O’Connor assists you in managing the entire tax appeal process from begining to the end. You don’t need to stress about forms, meetings, or deadlines our professionals handle it all efficiently while keeping you informed every step of the way.

Our Mission:- Its simple, To help Fulton County property owners pay only their fair share & not more. By combining strong analytical insights with local market knowledge, we become a trusted choice among property owners seeking to reduce their annual tax load and improve their financial standing. If your Fulton County Tax Assessor valuation seems higher than expected, this could be the right time to have an expert review it. Even a small percentage reduction can lead to meaningful yearly savings and long-term benefits. Learn how O’Connor can help you file a proper tax appeal and potentially reduce your yearly tax expense. Visit:- https://www.poconnor.com/georgia/fulton-county-property-tax-reduction/ O’Connor’s Fulton County Property Tax Reduction to get started now."

"1) Business Personal Property refers to tangible assets like equipment, furniture, and inventory used by businesses to generate income.

2) Personal Property Tax is assessed annually based on January 1 market value, with valuation supporting accurate tax obligations through the Property Tax Valuation process.

3) Appraisal districts use the Cost, Market, or Income Method to determine fair value, adjusting for depreciation and excluding intangible assets.

4) Businesses must file a rendition by April 15 (extendable to May 15) listing all assets; failure can trigger penalties up to 50% of tax due.

5) Removing ghost assets—non-existent or obsolete items—helps prevent overpayment and streamlines compliance.

6) A Tax Reduction Service can assist in identifying eligible exemptions, such as the $500 small business relief, and support appeals if overvaluation occurs.

7) The right to appeal a Business Personal Property Tax assessment runs to May 15 or 30 days after notice, whichever is later.

8) O’Connor helps organize asset data, submit renditions, and handle annual reviews to ensure current records and fair valuations.

For more information on Texas Business Personal Property Tax valuation visit:- https://www.poconnor.com/business-personal-property-tax-valuation/"

#BusinessPersonalProperty

#PersonalPropertyTax

#BusinessPersonalPropertyTax

#PropertyTaxValuation

#TaxReductionService

#OConnor

"1) Business Property Tax applies to tangible assets used in operations, such as equipment, furniture, machinery, inventory, and vehicles.

2) Personal Property Tax is based on market value, with appraisal districts assessing these items annually as of January 1.

3) Tangible personal property includes physical items that can be seen, moved, and touched—excluding real estate, intangibles, or financial instruments.

4) Valuation considers quality, condition, and utility, and extracting tangible value from total cost, especially with tech-integrated assets, can be challenging.

5) Over time, the line between tangible and intangible has blurred, making accurate Business Personal Property Tax evaluation more complex.

6) The process mirrors real estate appraisal in theory, but relies on different data sources and industry-specific methods.

7) Tax Reduction Experts can help identify excluded intangibles, remove ghost assets, and ensure proper reporting to avoid overpayment.

8) O’Connor supports businesses with filing deadlines, classification, and documentation to maintain accurate records and fair valuations.

Click here to learn how to appeal your Business personal property tax overvaluation with O'Connor property tax reduction expert:- https://www.poconnor.com/business-personal-property-tax-101/"

#BusinessPropertyTax

#PersonalPropertyTax

#PersonalProperty

#BusinessPersonalPropertyTax

#PersonalTangibleProperty

#OConnor

#TaxReductionExperts

"1) Business Personal Property Tax applies to movable assets like office equipment, machinery, inventory, and vehicles used to generate income.

2) Personal Property includes both tangible and intangible forms, but only tangible personal property items that can be seen, touched, and moved is taxed.

3) Personal Tangible Property such as furniture, tools, and supplies is assessed annually, with valuation based on condition, utility, and market trends.

4) The line between tangible and intangible value has blurred over time, making accurate Business Property Tax assessment more complex, especially with tech-integrated assets.

5) Tax Reduction Experts can help identify overvaluations, remove ghost assets, and ensure only taxable items are reported.

6) Filing a rendition by April 15 is a key step, and O’Connor assists with documentation, classification, and deadlines to support fair valuations.

8) Understanding what counts as Personal Property helps avoid overpayment and ensures compliance with local requirements.

Ensure your business isn’t overpaying on equipment, inventory, or office assets connect with O’Connor’s Tax Reduction Experts today to review your personal property tax listing, identify eligible exclusions, and help secure a fair valuation for the upcoming tax year. https://www.poconnor.com/business-personal-property-tax-101/"

#BusinessPropertyTax

#PersonalPropertyTax

#PersonalProperty

#BusinessPersonalPropertyTax

#PersonalTangibleProperty

#OConnor

#TaxReductionExperts

"1) Business Personal Property includes tangible assets like equipment, machinery, furniture, inventory, and tools used in business operations.

2) Personal Property Tax is assessed annually based on January 1 market value, with appraisal districts using the Cost, Market, or Income Method to determine fair value.

3) The Property Tax Valuation process considers original cost, depreciation, and current market conditions to ensure accurate assessments.

4) Intangible assets like software or patents are not taxed only tangible, movable items count toward Business Personal Property Tax.

5) Removing ghost assets:- non-existent or outdated items helps prevent overpayment and keeps filings compliant.

6) A Tax Reduction Service can assist in identifying exclusions, such as the $500 small business exemption, and support appeals if values are too high.

7) Renditions are due by April 15 (extendable to May 15), and timely, accurate reporting supports fair valuations.

8) O’Connor helps businesses organize asset data, file on time, and ensure only taxable property is reported.

Don’t let overvalued equipment, outdated records, or missed exemptions increase your tax burden. Enroll now with O’Connor’s Tax Reduction Service today to ensure your Business Personal Property Tax is based on accurate valuations, proper depreciation, and only the tangible assets you currently own."

#BusinessPersonalProperty

#PersonalPropertyTax

#BusinessPersonalPropertyTax

#PropertyTaxValuation

#TaxReduction

Every business owns assets: furniture, equipment, computers, and other essentials that keep operations running. These items form part of what’s known as Business Personal Property. While they’re vital to productivity, they’re also subject to Personal Property Tax each year. Many companies, however, unknowingly overpay because their assets are not properly valued or reported.

That’s where O’Connor brings in experience and precision. Our Business Personal Property Tax Valuation services are designed to ensure that your taxable assets are accurately assessed nothing more, nothing less. By reviewing asset listings, depreciation schedules, and current market conditions, O’Connor helps identify opportunities where a Tax Reduction Service could make a measurable difference for your business.

Whether you manage a manufacturing facility, retail operation, or service company, O’Connor’s specialized team ensures your Property Tax Valuation aligns with real-world asset values. Their process includes:

1) Accurate asset categorization:- separating taxable items from non-taxable assets.

2) Depreciation and obsolescence review:- ensuring fair valuation for older or unused equipment.

3) Timely filing assistance:- reducing errors that could increase assessments.

4) Appeal support:- helping your business present a strong case for fair value when assessments exceed expectations.

Instead of treating property tax as just another annual obligation, O’Connor helps turn it into an opportunity for savings and efficiency. Our comprehensive analysis and commitment to fair assessment have helped thousands of businesses manage their Business Personal Property Tax with clarity and confidence. Ready to lower your Business Personal Property Tax and ensure your valuation reflects only qualifying assets? Connect with O’Connor to explore their Business Personal Property Tax Valuation Service and start maximizing your property tax savings today.

#BusinessPersonalProperty

#PersonalPropertyTax

#BusinessPersonalPropertyTax

#PropertyTaxValuation

#TaxReductionService

#OConnor

For every business, Personal Property such as computers, furniture, machinery, and equipment plays an essential role in daily operations. What many business owners may not realize is that these assets are also subject to Business Personal Property Tax. This annual assessment can directly impact your operating costs if your assets are not properly valued.

O’Connor, one of the leading Property Tax Reduction Experts, helps businesses take a clear, informed approach to managing their Personal Property Tax responsibilities. Our depth knowledge and detailed valuation process make it easier for organizations to stay compliant while minimizing overpayment.

Through the Business Personal Property Tax 101 information, O’Connor breaks down the entire process from identifying taxable Personal Tangible Property to understanding depreciation and preparing accurate filings. Businesses often overlook opportunities for tax savings simply because assets are listed incorrectly or valued above their actual worth. O’Connor’s expertise helps bridge that gap with a thorough review and fair assessment.

Here’s what O’Connor’s service brings to your business:

1) Transparent valuation process for all tangible business assets

2) Professional guidance in asset listing, depreciation, and documentation

3) Assistance with timely filings to avoid costly errors

4) Support from experienced tax professionals who understand local and regional variations.

Whether your company operates a small office or a large industrial setup, ensuring your Business Property Tax filings are accurate can create meaningful cost advantages. O’Connor helps simplify the process so you can focus on running your business not managing tax paperwork.

Learn how to effectively manage your Business Personal Property Tax and avoid overvalued assessments with guidance from O’Connor. Visit O’Connor’s Business Personal Property Tax 101:- https://www.poconnor.com/business-personal-property-tax-101/ to understand your options and take the first step toward accurate, fair property tax management.

#BusinessPropertyTax

#PersonalPropertyTax

#PersonalProperty

#BusinessPersonalPropertyTax

#PersonalTangibleProperty

#OConnor

#TaxReductionExperts

"Understanding Business Personal Property Tax is essential for any company managing tangible assets like equipment, machinery, furniture, and inventory. These items are valued annually as of January 1 using the Cost, Market, or Income Method, with depreciation and current market conditions factored into the Property Tax Valuation process. Accurate reporting helps businesses avoid penalties, manage budgets, and maintain compliance.

O'Connor's Tax Reduction Service supports companies by organizing asset data, identifying items that should not be taxed (such as intangibles like patents or software), and removing ghost assets outdated or non-existent entries that inflate tax bills. Businesses must file renditions by April 15, with possible extensions to May 15, and timely, accurate submissions can prevent penalties of up to 50% of the tax due.

Enrollment is simple and risk-free no upfront cost, and fees apply only when actual tax savings are achieved. Annual service ensures your Personal Property Tax filings remain accurate, compliant, and optimized for savings year after year.

Ready to ensure your Business Personal Property Tax reflects only qualifying assets? Connect with O'Connor to explore their Business Personal Property Tax Valuation Service:- https://www.poconnor.com/business-personal-property-tax-valuation/ and start maximizing your property tax savings today."

#BusinessPersonalProperty

#PersonalPropertyTax

#BusinessPersonalPropertyTax

#PropertyTaxValuation

#TaxReductionService

#OConnor

"For many business owners, the annual Business Property Tax can be a source of questions. A primary component of this is the assessment of your Personal Property. This category covers all the tangible assets your company utilizes. Think of items you can see, touch, and move, such as office furniture, machinery, computers, equipment, and even inventory. Properly identifying what falls under Personal Tangible Property is the foundational step.

The valuation of these assets is a critical part of the tax process. Determining the correct value isn't always a simple calculation. For example, the purchase price of a piece of modern technology often includes both tangible value (the physical hardware) and intangible value (the software, patents, and brand name). Separating the value of the physical asset from these non-physical elements is essential for an accurate assessment.

The tangible value of your business property is influenced by several key factors. These include the quality of its construction, its current physical condition, its functionality for your operations, and the existing supply and demand for similar items in the market. An appraisal should take these variables into account to arrive at a fair value. As technology and business assets continue to evolve, so do the methods for their valuation.

Ensuring your assets are valued correctly is key to managing your tax responsibilities fairly. If you have questions about your property assessment, the team at O'Connor provides resources to help. As experienced Tax Reduction Experts, they focus on providing clarity on property tax matters. o build a stronger understanding of how your business assets are valued and what it means for your taxes, it's beneficial to consult the dedicated professionals. You can explore a detailed guide on the fundamentals of Business Personal Property Tax:- https://www.poconnor.com/business-personal-property-tax-101/"

#BusinessPropertyTax

#PersonalPropertyTax

#PersonalProperty

#BusinessPersonalPropertyTax

#PersonalTangibleProperty

#OConnor

#TaxReductionExperts

"Business Property Tax is an annual tax on tangible, movable assets that a company uses to produce income. This includes items like office furniture, machinery, equipment, vehicles, and inventory. While the broader category of Personal Property also includes intangible assets like software, patents, and contracts, only the Personal Tangible Property is subject to taxation. These are physical items that can be seen, touched, and moved, which excludes real estate and financial instruments.

Understanding the difference between tangible and intangible value is crucial for accurate Business Personal Property Tax filings. In today's tech-driven environment, many assets have both physical and non-physical components (e.g., a smartphone's hardware vs. its operating system). Separating this value is key to ensuring a fair assessment, as only the tangible portion is taxable.

O'Connor's Tax Reduction Experts assist businesses in properly classifying their assets, identifying non-taxable intangibles, and ensuring valuations are accurate. The appraisal process is similar to real estate valuation but uses business-specific data sources and considers factors like an asset's condition, functionality, and market demand. Timely filing of renditions by April 15 is also essential to avoid penalties.

With a risk-free enrollment and a fee based only on achieved savings, O'Connor provides ongoing support to help manage asset records and annual filings. This ensures your Personal Property Tax is based on fair, accurate, and compliant valuations.

Ready to make sure your tax filings correctly distinguish between tangible and intangible assets? Explore O'Connor's Business Personal Property Tax 101:- https://www.poconnor.com/business-personal-property-tax-101/ Guide for more details on optimizing your filings."

#BusinessPropertyTax

#PersonalPropertyTax

#PersonalProperty

#BusinessPersonalPropertyTax

#PersonalTangibleProperty

#OConnor

#TaxReductionExperts

Business Personal Property includes all tangible assets a company uses to generate income, such as equipment, furniture, machinery, and inventory. Each year, these assets are subject to a Personal Property Tax based on their market value as of January 1. Local appraisal districts perform a Property Tax Valuation using standard methods like the Cost, Market, or Income approaches, while also considering depreciation. Accurate valuation is key to ensuring your business meets its tax obligations without overpaying.

To facilitate this process, businesses must file an annual rendition by April 15, detailing all taxable assets. This filing is a critical opportunity to ensure accuracy by removing ""ghost assets"" items that are no longer in use and properly separating taxable tangible assets from non-taxable intangible assets like software or patents. Failing to file on time can lead to significant penalties.

If you believe your property has been overvalued, you have the right to appeal the assessment. A professional Tax Reduction Service can provide valuable support in this area. O'Connor assists businesses by organizing asset data, identifying all available exemptions such as the $500 small business exemption in Texas and managing the entire appeals process. With no upfront fees, O'Connor offers expert guidance for your Business Personal Property Tax and only charges a fee if they successfully lower your tax bill.

Ready to ensure your Business Personal Property Tax is both accurate and fair? Connect with O'Connor to learn more about their Business Personal Property Tax Valuation service:- https://www.poconnor.com/business-personal-property-tax-valuation/ and how they can help you effectively manage your tax responsibilities.

#BusinessPersonalProperty

#PersonalPropertyTax

#BusinessPersonalPropertyTax

#PropertyTaxValuation

#TaxReductionService

#OConnor

"Business Personal Property (BPP) tax valuation is the process of determining the market value of a business's tangible assets, such as equipment, furniture, and inventory. This valuation directly influences a company's tax obligations. An accurate assessment is crucial for both compliance and effective financial planning, ensuring that a business pays taxes based on the true value of its assets.

The process of valuing BPP supports a fair distribution of tax responsibilities among businesses and provides funding for public services. Proper valuation can also lead to tax optimization by identifying potential exemptions and reducing the risk of audits or disputes with appraisal districts. It encourages businesses to maintain updated asset records, which improves overall operational efficiency.

Appraisal districts use several methods to estimate the value of business personal property :

Rendition Analysis: Businesses report their assets, including costs and descriptions.

Depreciation Adjustments: Asset values are adjusted based on age, condition, and market trends.

Market-Based Assessments: Values are aligned with real-world market conditions as of January 1.

Key methods for measuring BPP include the cost, market, and income approaches. It's also important to separate intangible assets and remove ""ghost assets"" (outdated or non-existent items) from records to avoid overpayment. In Texas, businesses can receive a $500 exemption for BPP, with some counties offering more. For expert assistance with your Business Personal Property Tax:- https://www.poconnor.com/business-personal-property-tax-valuation/ needs, consider the tax reduction services offered by O'Connor."

#BusinessPersonalProperty

#PersonalPropertyTax

#BusinessPersonalPropertyTax

#PropertyTaxValuation

#TaxReductionService

#OConnor

"Business property tax applies to the tangible assets a company owns and uses. This category, known as tangible personal property, includes items you can physically touch and move, such as office furniture, machinery, equipment, inventory, and computers. It is distinct from real estate. Understanding what qualifies as tangible personal property is the first step in the assessment process.

A key aspect of valuation is separating tangible property from intangible property. Intangible assets, like patents, software, brand value, and proprietary processes, are not typically included in this tax calculation. For example, the total cost of a modern piece of technology, such as a smartwatch, includes both its physical components and its embedded software and brand recognition. The valuation process aims to isolate the value of just the physical item.

The nature of personal property has changed greatly over time. Decades ago, most assets were purely physical. Today, many items have significant intangible value intertwined with their tangible value, which makes accurate assessment a more detailed process. The core principles of valuation, however, remain focused on determining an asset's worth based on its construction, condition, and functionality. Getting this valuation right is important for any business's financial planning. If you have questions about your business's personal property tax, the experienced team at O'Connor can provide assistance. For more information on BPP visit:- https://www.poconnor.com/business-personal-property-tax-101/"

#BusinessPropertyTax

#PersonalPropertyTax

#PersonalProperty

#BusinessPersonalPropertyTax

#PersonalTangibleProperty

#OConnor

#TaxReductionExperts