-

About

- About Listly

- Community & Support

- Howto

- Chrome Extension

- Bookmarklet

- WordPress Plugin

- Listly Premium

- Privacy

- Terms

- DMCA Copyright

- © 2010-2025 Boomy Labs

Jackson Middleton

Jackson Middleton

Listly by Jackson Middleton

Here is a list of all the best news stories and blog posts in Canada released this month dealing with Personal Finance in Canada. Use #CDNFinance to search social sites for more conversation. If you would like to add something to the list, please go ahead! Also, consider letting us know which stories you have read by clicking "I've Read This". Moderated by Jackson Middleton & Sandi Martin

Source: http://www.firstfoundation.ca/blog/canadian-personal-finance-news-november-2013-list/

The passages that caught my eye in the first few pages of Deep Risk describe the couple's plight: "This story speaks volumes about risk. All investors experienced it during 2008-2009; if you did not lose sleep then, you're not human. But the outcomes varied greatly from investor to investor, depending on their individual level of discipline .

Hi, I'm Sandi, and I'm new here. Here's what you need to know about me. Trying to read every personal finance post, article, and news item out there is probably last on your to-do list, after taking out the garbage. Why?

You've switched banks. You've moved. You want to start do-it-yourselfing in a discount brokerage account. Whatever the reason, you need to transfer RRSP, TFSA, or RESP money from one institution to another (or sometimes, from one part of an institution to another), and you want to make sure that it stays tax-sheltered, tax free, or tax deferred while you're doing it.

Many of us suffer from financial inertia because we can't seem to find the time or desire to deal with our money problems. We put off decisions that, with some careful planning and research, could save us hundreds of dollars per year.

![What Does The Squawkfox Say? [Video] | First Foundation](http://media.list.ly/production/40198/337567/kerry_k-_taylor-1_185px.png)

Because Money Podcast | Ep03 Watch the Video on YouTube >> The secret of the fox, ancient mystery, somewhere deep in the woods, I know you are hiding, what is your sound? Will we ever know, will it always be a mystery? What do you say... So what does the Squawkfox say?

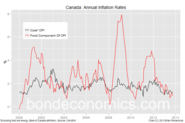

The Canadian Consumer Price Index (CPI) was released last Friday, and it continued the trend of remaining well below the Bank of Canada target of 2%. This was not too surprising, so I will instead examine the behaviour of food inflation. Although I will look at Canadian data in this post, the behaviour is similar in other developed countries.

Canadians might have to hit the books and brush up on their knowledge of investing. The Bridgehouse Investor Knowledge Index shows that participants scored an average of 39% in a survey that measured Canadian investors' understanding of investment terms and concepts.

Industry groups fight vigorously to protect the status quo By 2016, mutual fund firms and investment dealers will be required to tell their clients what they're paying and how they're doing. Our country's provincial regulators have also initiated discussions as to whether investment advisors should be held to a higher standard of fiduciary duty, rather than the current "best interests."

A majority of Canadians are in favour of expanding the Canada Pension Plan (CPP), according to a poll. A survey released exclusively to CARP by The Forum Poll shows that 53% want CPP contributions increased so benefits can be expanded, compared with 34% who disagree.

Canadians are carrying more debt now than a year ago, but it seems like many have a better handle on paying it back, says a newly-released study. Statistics from credit monitoring firm Equifax Canada show that consumer debt, excluding mortgages, rose 3.7 per cent in the third quarter to $507.1 billion from $489 billion a year earlier.

Most people have heard of the Rule of 72. It's a way to estimate how long it takes for your money to double at a given rate of return. Less well known is that this rule can be used to estimate how long it will take for investment fees to consume half your portfolio.

How do you spot a fraud? Financial analyst Harry Markopolos spotted fraudster money manager Bernie Madoff. So, he's got some ideas on the subject. "Bernie Madoff said his performance was roughly seven and half times better than the stock index he pretended to be benchmarking himself against," says Markopolos.

I don't believe the average person has any idea of what an imbedded commission is or how it affects them. As a matter of fact, I wouldn't be surprised if most investors of mutual funds had a better understanding of how a black hole works.

Tim Cestnick is president of WaterStreet Family Offices , and author of several tax and personal finance books. tcestnick@waterstreet.ca Beware that giving a Christmas gift can be a risky exercise - and even dangerous. Just ask Jonathan Cantu and Charles Kern, two men from California who gave presents to each other a few years ago and ended up injured and in jail.

Bloggers constantly strive for a unique idea or concept that gets people thinking, talking and even taking action. While I am not sure if my blog post on stress testing your death was unique or not (it was certainly morbid), it definitely seemed to strike a chord with many readers.

My job requires reading a lot of financial news. It's one of my favorite parts. But it gives me a front-row seat to the downside of financial journalism: gibberish, nonsense, garbage, and drivel. And let me tell you, there's a lot of it. Here are a few stupid things I hear a lot.

Loosely, a hedge fund is like a mutual fund with almost no regulation. They can blow up economies, or they can be conservative. The ones that get all the press tend to be the more aggressive ones. Alpha Dogs The world of hedge funds attracts the real killers of the financial world.

Since everyone is talking about stock market crashes this week, let's add some context here... Since the invention of the Dow Jones Industrial Average at the turn of the last century, there have been eleven instances in which stocks declined by more than 35% from peak to trough, or what you would term a market crash.

Employees: A company is really about its people, and that's worth keeping in mind as you invest in one When I meet a fellow stock picking investor, I always ask them what they invest in, and why. After having many such conversations, I noticed a pattern. Many people often choose...

IEF found that while 70% of investors believe that they are protected by a best interest standard, only 1% of them actually are

Of the CPP audits that I have conducted in the past six months, almost half of the clients were receiving less than they were entitled to. Sometimes these underpayments were less than $1 per month, but one client was being underpaid more than $50 per month.

This is our very first Canadian Personal Finance Hangout. Sandi wanted to call it Episode 4, however I told her no one would pick up on the movie reference.

A father's advice to his daughters about debt, saving and investing may just be the best financial literacy lesson you'll read this year. November is Financial Literacy Month, and that means a deluge of tips from banks, consumer groups and financial industry professional groups and regulators.

This belief that you can detect when someone is lying through non-verbal signals is transcontinental. A global study done in 2006 by The Global Deception Research Team reveals that across 82 nations, close to 75% of people believe that the biggest giveaway when someone is lying is through their eyes, specifically gaze aversion.

Where's the crisis? CPP expansion is supposedly required to save the Canadian middle class from retirement penury. "A large number of Canadians - particularly middle-income earners in the work force today - are at risk of seeing their living standards fall in the golden years," says a recent Globe and Mail editorial.