-

About

- About Listly

- Community & Support

- Howto

- Chrome Extension

- Bookmarklet

- WordPress Plugin

- Listly Premium

- Privacy

- Terms

- DMCA Copyright

- © 2010-2025 Boomy Labs

Dean Cooper

Dean Cooper

Listly by Dean Cooper

Want to learn about accounting. This list is all you need!

Ever wondered how big companies pay less tax?

Test your JavaScript, CSS, HTML or CoffeeScript online with JSFiddle code editor.

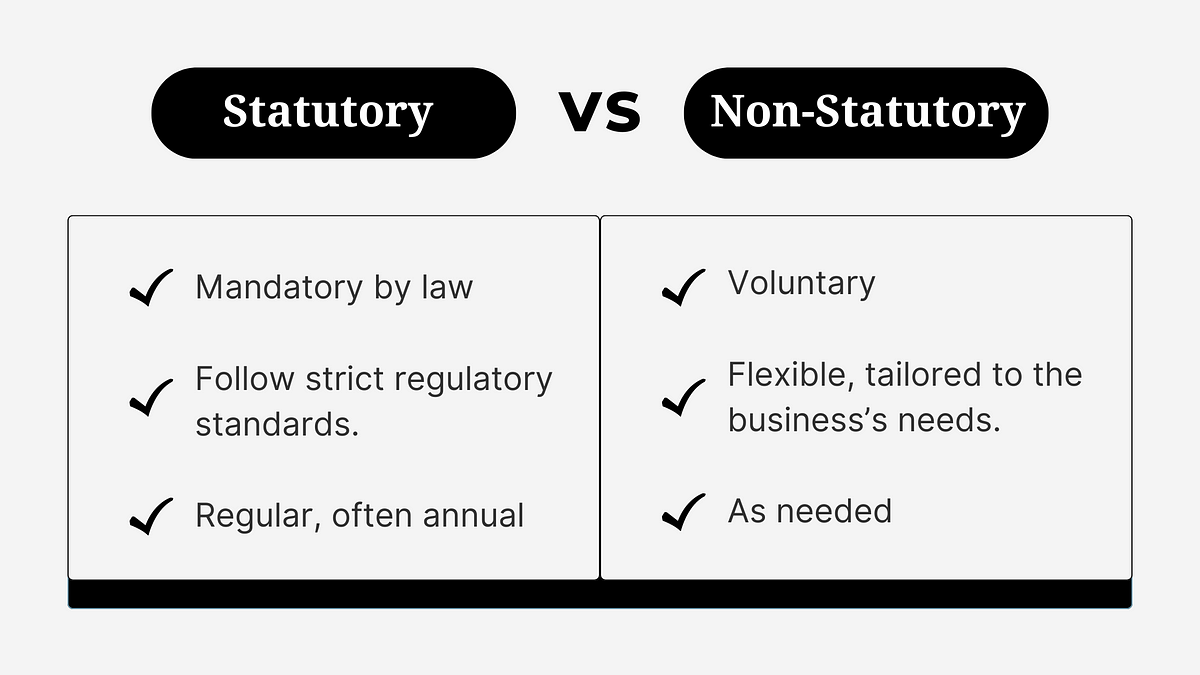

An audit checks your financial records to make sure everything’s accurate. Think of it like a health check-up for your business finances. Auditors look at your books and records to confirm that…

If you're an expat, offshore tax planning can save you a lot of money and headaches. Offshore tax planning involves legally reducing your tax burden by holding assets or money in another country. It might sound like a complicated process, but it’s really about using the tax la...

Cryptocurrency has taken the financial world by storm, offering exciting investment opportunities. However, along with these opportunities come tax responsibilities that are often misunderstood or overlooked. In this article, we'll look into some of the common mistakes UK investors make when it comes to crypto taxes and how to avoid them. Understanding Crypto Tax in…

Hey there! Taxes might not be the most exciting topic, but having a good tax advisor in London can save you loads of stress and money. Let's have a look at why tax planning is essential and how you can benefit from it.

Struggling with crypto taxes? You're not alone—let's make it easier with the right tools and help.Understanding Crypto Tax in the UKCryptocurrency has taken the world by storm, and many people in the

Tax Planning by , 2024, University of New York edition,

Struggling with your taxes? You're not alone. Key Takeaway: Personal taxes are complex, and professional advice can save you time and money. Look for qualifications and ask key questions to find the best advisor. Use strategies like income splitting and tax-efficient investments to lower your tax bill. Personalized tax planning and ongoing support are crucial…

Cryptocurrency investments are exciting, but dealing with capital gains tax can be tough. Understanding Cryptocurrency and Capital Gains Tax What is Cryptocurrency? Cryptocurrency

Hey there! If you're in the travel industry, you might have heard about ATOL reporting accountants.Takeaway SummariesATOL reporting accountants ensure compliance with ATOL regulations, protecting your

Ever wondered how travel companies stay afloat despite the financial risks they face? It's all thanks to ATOL reporting accountants. Takeaway Summaries ATOL reporting accountants e

ATOL, which stands for Air Travel Organiser’s Licence, is a UK financial protection scheme that protects travelers if a travel company goes under.

UK crypto investors, it's time to get serious about your accounting standards.TakeawaysLearn the basics of crypto accounting and its importanceUnderstand UK crypto accounting standards and compliance requirements

Proactive Personal Taxation Strategies: Tips from MMBA Experts Personal taxation include

Offshore tax planning means using international tax laws to handle your taxes better. It’s not about dodging taxes; it’s about managing them smartly. You take advantage of different tax laws around the world to reduce your tax bill legally.

Penzu is a free online diary and personal journal focused on privacy. Easily keep a secret diary or a private journal of notes and ideas securely on the web.

Discover Events in your city and buy tickets online instantly. You can also create your event and start selling tickets online within a minute.