-

About

- About Listly

- Community & Support

- Howto

- Chrome Extension

- Bookmarklet

- WordPress Plugin

- Listly Premium

- Privacy

- Terms

- DMCA Copyright

- © 2010-2025 Boomy Labs

Salvatore Tirabassi

Salvatore Tirabassi

Listly by Salvatore Tirabassi

Financial and executive leader with 20+ years' diverse experience in high-growth environments. Expert in analytics and data science leadership, passionate about solving business problems at the intersection of technology, business, and data.

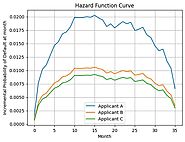

In the evolving landscape of consumer lending, fintech companies have revolutionized borrower experiences, introducing real-time approvals and swift fund transfers. While tree-based classification models like XGBoost currently dominate credit scoring, survival regression algorithms are an intriguing alternative.

You might see it in various places as CLV (Customer Lifetime Value) or LTV (Lifetime Value). Lifetime Customer Value, or LCV, is what I call this metric.

Excel’s powerful capabilities, integrations and flexibility make it a favored tool for all financial and accounting professionals. Like many middle market companies, we considered moving from an Excel dominated financial planning and reporting process to an “enterprise grade” solution.

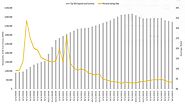

On January 22, I posted an article on consumer financial strength driven by the amount of cash consumers have in checkable deposits as reported by the Fed. If you look at the bottom 50% of households by wealth, they are sitting on an astounding 2.5x as much cash in their checking accounts as they had before the start of COVID. See the chart below.

Cracks in Consumer Credit Card Delinquency Despite High Cash Balances.pptx - Download as a PDF or view online for free

Since I spend my working hours in a business that is focused on consumer finance with particular focus on consumers who have excessive debt, many people often ask me what I think about the financial strength of the consumer and how consumer finances might contribute to a recession or "soft landing".

Predictive models underpin many trading systems. In this post, I discuss the application to the emerging world of crypto futures. Tradery LabsI recently had the pleasure of doing some advisory and coaching work with a startup called Tradery Labs. Tradery Labs is bringing futuristic predictive-modeling techniques into a highly honed system that will democratize the

Salvatore Tirabassi is a multi-faceted leader and strategist with expertise in business, finance, operations, marketing, credit risk, data science and technology.

In the consumer lending space, fintech companies have innovated many aspects of the consumer experience. One of the biggest innovations has been the real-time approval of consumers for installment loans with borrowed cash hitting consumer bank accounts in an expedited and highly satisfying way.

In a recent post on SaaS financial modeling, I covered some of the main drivers that play a role in the construction of financial forecasts for SaaS and related business models. One of the most important aspects of such financial forecasts is the build out of contracted revenues. In general contracted revenues can be quite