-

About

- About Listly

- Community & Support

- Howto

- Chrome Extension

- Bookmarklet

- WordPress Plugin

- Listly Premium

- Privacy

- Terms

- DMCA Copyright

- © 2010-2025 Boomy Labs

Listly by shawnetta4

Accounting, bookkeeping, payroll, vat and taxation news.

One key to the successfully running of a business is being able to sense how your business is doing at a financial level.

Common Tax Traps to Avoid When Starting a Business It is a very common perception among the new entrepreneurs that the vast and sometimes ambiguous UK Tax rules are one of the reasons that impedes their growth. And sometimes it can even be a real problem for your business if you are unwary.

If you are searching for a self-assessment accountant, our qualified and experienced team are self-assessment tax specialists. They will complete your tax returns on time and file to HMRC. People across the UK want cheap tax returns, done without a hassle. Contact Us today!

Filing a self-assessment tax return is a daunting task, especially when left for the last minute. True tax planning and saving need time and preparation - and preparation here implies preparation in advance.

An Accountant plays a very important role in your Business and offers Business Accounting services that includes Accounts, Payroll, VAT, Bookkeeping, and Tax and business advice.

After the Coronavirus pandemic digital transformation and acceptance of latest technologies has accelerated years of change in a short span of time.

The first step towards proper risk management is getting a proper and updated view on your risk assessment so that you get a bird’s eye view of what risks the pandemic poses to the smooth flow of your business.

If you own a very small company or you are an expert in financial matters, it is always advisable to get the services of an qualified and experienced accounting firm which will provide you with many services such as Book-keeping, VAT, Tax, Payroll and Accounts.

Expenses for self-employed individuals are the certain costs of finishing your work or operating your business. When you are filling out your Self-Assessment tax return every year, they decrease the amount of income you end up paying tax on.

The virtual world has opened out like a Pandora’s box all thanks to Covid 19. Now it is not just getting the accounts right that matter, but how techno savvy you are also determines how well you are able to retain those clients.

Best accounting firm in UK offers tax accounting services for small businesses. Affordable Accounting, bookkeeping, Payroll, VAT and Tax Return Services. One of the top 100 accountancy firms in UK with more than 20 years of experience.

Corporation tax is a type of tax that must be paid by UK limited companies. It is based on the yearly corporate profits that a business or company generates.

Bookkeeping service is something which generally all the businesses in London opts for because it helps in analysing the business performance of companies.

Are you regularly making mistakes? Is your return showing no profit or less profit than expected for a long time? Is it dramatically different than other similar businesses? Are you a company director and your self-assessment tax return shows you earn less than your employee?

Affordable Accountancy services for small and medium sized businesses in the UK. Team of experienced and qualified accountants to help SMEs to stay compliant. We provide high-level accounting services in the UK from last 20 years. To know more give us a call or Email us today.

Self-Assessment is a system HM Revenue & Customs uses to collect Income Tax in the United Kingdom. You submit it to HM Revenue and Customs, which you can do web or through the mail.

If you own a personal or family company, you're likely familiar with the benefits of taking dividends as a tax-efficient way to extract profits.

Do You Need an Accountant When Starting Up a Business?. We have a team of dedicated and trained professionals who are passionate about accounts and there to assist you. Our innovative line of services includes all types of accounting services.

New residential property buyers can rejoice as VAT recovery presents significant savings opportunities. By reclaiming VAT paid on construction costs, purchasers can enjoy reduced purchase prices or additional financial flexibility.

Don't forget to file your self-assessment tax return by January 31st to steer clear of penalties. Take charge of your tax obligations and meet the deadline to avoid unnecessary fines. Ensure accurate reporting of your income, expenses, and deductions. Act promptly to stay compliant and maintain peace of mind.

Discover how an accurate payroll process can transform your organization. Avoid costly errors, ensure employee satisfaction, and comply with legal regulations. Learn the benefits of efficient payroll management for long-term growth and success.

Discover the significant advantages of hiring a tax accountant for your business finances. From optimizing deductions to ensuring compliance, explore the five ways a tax professional can enhance your financial management and contribute to the long-term success of your business.

Discover how tax advisory services play a vital role in driving the success of startups in the UK. Learn how expert guidance on tax planning, compliance, and incentives helps startups thrive and optimize their financial strategies. Stay ahead in the competitive landscape with tailored tax advice tailored for startup.

Looking for expert tax accountants and a reliable small business accountant in London, UK? Our top-rated accounting firm offers personalized financial solutions for small businesses. Trust us to handle your accounting needs while you focus on growing your business.

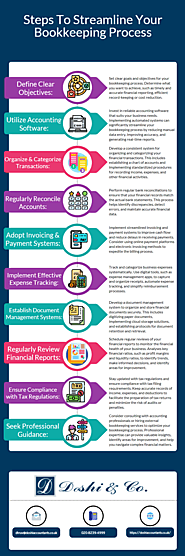

Transform your bookkeeping approach with our tried-and-tested methods. Learn how to streamline data entry, reconcile accounts, and make informed financial decisions. Start optimizing your bookkeeping process today!