-

About

- About Listly

- Community & Support

- Howto

- Chrome Extension

- Bookmarklet

- WordPress Plugin

- Listly Premium

- Privacy

- Terms

- DMCA Copyright

- © 2010-2025 Boomy Labs

eatemad khatib

eatemad khatib

Listly by eatemad khatib

**Forex Trading Secrets

business services

https://eatemadkhatib.com/

Forex / Currency Basics

Synopsis

Basically banks, insurance companies, large corporations and

financial institutions are the players in the forex market exchange.

However of late, individual investors either working for themselves or

for a small group also seem to make quite an impact on the forex

trading platform. All these transactions are done through the buying

and selling exercise which is done according to real time market rates

available.

The Basics

The value of each currency involved in the transaction is expressed

in terms of the other paired one. This enables the investor to

actually view the value as it is depicted through the exchange.

There are usually only two currencies involved in each transaction

where one is bought and the other is sold according to the agreed

market dictated rate. The base currency is considered the first

currency in the pairing and the investor’s account is denominated

as this currency. The second currency in the paring is depicted as

the terms currency.

The transactions can be done by placing orders through dealer

intervention or they can also be done without dealer intervention

but through automation execution. This would mean that there

are some softwares available where the investor can set it up to

function on his or her behalf rather that opting to use the services

of an individual who would also charge the corresponding

commissions for such actions. However there have been

documented cases of the software chosen not being able to

function as it was designed to due to external disruptions thus

creating eventual losses instead of profits.

Markets The Forex Taps Into

Synopsis

Being the type of market that has the highest trading volume at any

given time encourages the further participation of the various

different countries. The high volume and liquidity makes the

currency market a very attractive and viable platform for investment.

The forex trading is also open to all such as traders, banking

institutions, trading companies, financial and non financial

institutions, companies and governments.

The Markets

One of the markets the forex often taps into is the tourists industry

where the exchange of money is needed in order for the visiting

tourists to make purchases and also cover all expenses during the stay

at the foreign destination.

Therefore the exchange of currency would be processed via a currency

broker and the said transaction would become part of the currency

market. As this form of currency trading is not really suitable or

viable for professional traders there are other forms of currency

trading that are used for these types of transactions. And these would

include currency futures markets and forex markets.

The forex markets exist for most of the major market currencies

where the exchange of rates is between the two countries all of which

is done in a twenty four circle, globally.

All of this is done directly as opposed to trading in contracts. Futures

markets are currency futures provided by an exchange. This would

mean that there is a centralized controlling system that keeps tabs on

the pricing which is the same no matter where the trader is trading

form globally.

In the past the forex has been used for negative reason of causing

problems in other countries financials. This has brought quite a few

economies to their lowest thus there are new legislations in place to

prevent such conditions from reoccurring. There are also controls and

“pegs” on currencies to curb such detrimental speculations.

Exchange Rate Regime And Exchange Rate Flexibility

Synopsis

The flexible exchange rate system is where the exchange rate is

decided and maintained on platforms that dictate the permanent

fixed ration or the completely flexible ratio.

However this has different implication for the extent in which the

relevant authorities are willing to participate in based on the foreign

exchange market stability. The degree of flexibility dictates the

category in which the transaction bodies determine which would

include currency unions, dollarized regimens and currency boards.

The conventional currency pegs are also designed to be under fixed

rates. The managed and independent “floats” are considered flexible

regimens and are exposed to time inconsistency problems and

exchange rates that are rather volatile even at best in different

degrees.

The Rates

The exchange rate regime is basically how a country manages their

currency issues in connection to that of other currencies and the

foreign exchange market. The monetary policy designed and adopted

is generally dependant on the factors that are also dictated to by the

monetary policy in place. Actively playing a part in keeping the rates

fairly stable by having a pegged float, the central bank is able to keep

the rates from deviating too much, either high or low.

Over time some countries have opted to shift away from the fixed rate

regime and move towards a more flexible rate which is mainly based

on the supply and demand of the said currency. However too much

volatility in the global markets can cause challenges for countries

adopting this over time, as shown in the globalization platform that

can amplify the costs of incorporating inappropriate policies which

results in trading looses.

Most governing bodies are not trying to determine which policy works

best and is to their advantage in relation to the global sentiments.

Many are considering the decision to make the transition from fixed

to floating currencies.

Fixed Exchange Rate Measured Against Floating Exchange

Rate

Synopsis

Making the right choice between the two options will dramatically

dictate the survival of the currency stability and the trading platforms

tagged to the movements caused by the said currencies. Therefore

most governing powers are constantly exploring the suitability of the

adoption of either of these two fairly opposing styles of currency

rates.

Fixed and Floating

The smaller and more open the particular country’s economy, the

more apparent choice would be that of the fixed exchange rate.

This is mainly dictated to by the fact that a lot of the stability issues

for trading are connected in some way to the dependency on

exports and imports.

Here the best regime choice would be based on the ideally

stabilizers for the macroeconomic performance that will help to

minimize the fluctuation on output, consumption and domestic

pricing levels or other variables. However in most countries the

usage of both styles is incorporated in varying degrees of flexibility.

The usage of the fixed exchange rate would be preferable if the

country’s economy is faced with challenges that are mostly

monetarily connected.

The flexible rate is preferable if the fluctuations apparent condition

is volatile and is usually caused by other issues such as changes in

the demands for the domestic goods, exports and imports.

There are some quarters that are of the opinion that having a fixed

regime where the adoption of the pegged exchange rate is in place

would ensure the inflation rates are kept low or at the very least

controllable.

However this is not a complete ideal situation to be in, particularly

if there is a need to increase borrowing as the interest rates can

pressure the exchange rate pegged due to the fixed regime.

A floating rate however provider room to maneuver around a lot of

these problems. However it also contributes in some ways to the

rise in inflation but for the governing body this constitutes the

possibility of increasing the tax revenues.

Who Are The Participants In The Market

Synopsis

As in any platform, there are always a variety of players involved in

the correlation of its makeup. The same concept applies to the

workings within the participants of the forex markets.

The following is a breakdown of some of the more prominent

participants usually featured within this platform:.

The Participants

Hedger or hedge fund managers – being one of the primary

participants in the forex trading platform this participation in the

currency exchange market consists of businesses and other

organizations that actively participate in the international trading

arena.

Charging performance fees these entities are designed to minimize

the exposure to unwanted business risks while at the same time

creating profits from its investments which consists of futures,

derivative and swap contracts.

Banks are the other players on this platform and they function mainly

as investment entities for the country. The style used contributes to

the huge disparity between the bid and asking prices in this sector

thus attributing to the majority turnover and speculative trading

scenario.

Commercial companies are also important participants in the forex

market, though as comparatively smaller players however none the

less just as important in ensuring the long term trading flows, which

is pivotal to the currency’s exchange rates.

The central bank of a country – this entity is crucial to the smooth

functioning of the entire financial engine as it controls the money

supply, interest rates and inflation of the country. Ideally having

considerable amounts of foreign exchange reserves it can ensure the

market is kept relatively stable. With the control percentage it yields

the central banks will more often than not intervene in the forex

market should such an act be called for. However is has been evident

over time that some central banks have not been able to achieve the

target rates due to some reason or another.

How Economic, Political And Market Psychology Dictates

Forex Temperament

Synopsis

As with all money making entities, there are several factors that

dictate the success of failure of the exercise. The forex markets often

experience such effects though some level of check and balance

features help to keep this in control.

The following are some of the areas that typically contribute to the

forex temperament and movements:

Great Info

Economy – a country’s economy is dictates the currency value tagged.

An ideally growing economy will bring forth a very stable currency

showing and is highly value in comparison with other lesser

performing countries.

There are positive and negative effects to this movement which is

evident in terms of inflation. The inflation reduces the purchasing

power of the currency thus less can be bought with the said currency.

Healthy GDP growth will constitute an active economy thus it is likely

that the currency values will also rise. The purchasing power and the

interest rates are also factors that affect the overall movement of the

forex.

Governments create and sustain the elements connected to the

economy by ensuring all the beneficial economic policies are in place

and by correction those that are causing any imbalances to the either

discontinued or redesigned. Through the monetary policies and the

fiscal policies which have a nearing on the forex such elements are

maneuvered or controlled to a certain extent. Monetary policies will

influence the various component of the financial status which

sustains the economy, whereas the fiscal policies will dictate the

spending capabilities available for the governing platform.

International trade – trading between countries will be a good

indicator to the value of each country’s currency value especially if the

transactions are done without using a currency from a country not

connected to the trading needs of either party.

Wrapping Up

Understanding the fundamentals of forex trading will help to limit the

chances of making poor decisions that will eventually result in losses.

The processes and techniques can be effectively maneuvered, to the

advantage of the player if there is a complete and sound knowledge

about forex exchange dealings.

The following are some of the risks that one should be aware of, when

it comes to forex trading:

Amplification of losses – although leverage is considered the big

money making factor that makes the forex such an attractive

money making tool, this same leverage can work negatively too

causing massive losses when the actual price fluctuation value

of the currency takes a downward turn.

Constant fluctuations – this is a very dangerous ever present

element in this style of trading as there is very little possibility

of being able to constantly monitor the currency movements

and the trading globally. This is mainly due to the fact that forex

markets run on a 24 hour cycle as opposed to human

participation that is limited to a potion of this cycle. Therefore

trading at different levels and pricings will not keep the players

consistent in the earnings projected, if there is no constant hand

on involvement and monitoring exercises that function on a

global platform.

Lack of accurate information – when decision are made on one

country’s economic situation without the relevant accurate

knowledge of all the encompassing factors available, it can

cause disastrous results in the forex. Elements such as the

political situation, the geographical limitations or advantages

and any other contributing factors that may constitute a

particular scenario should play a role in deciding the forex

movement and none should be considered only individually.

Absence of global regulatory bodies – due to the various

possibilities the maneuvering of transaction and currency

manipulation presents, risks can be quite high as there are no

effective bodies in place to be answerable to

Are you ready to start earning a 50% recurring commission EVERY single month for each and every customer you acquire that stays active?! **

.https://bit.ly/3sDSONg

Source: https://list.ly/list/6sKt-forex-trading-secrets

**An Introduction To Trading Forex Without Indicators

You have probably heard about trading Forex without indicators. There is much being written about it these days, but it is actually nothing new. Trading without indicators is also called trading “price action”. This means simply trading based upon the price itself and nothing else.

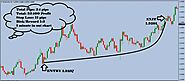

Figure 1.16 Daily EURUSD Data

What follows will be an example of trading without indicators. In the chart above you will see series of blue dots on prices bars and red dots on price bars. Although this is an example of trading without indicators the dots will help with the explanation. The blue dots represent when the high price has moved higher than the highest high of the previous 10 days. The red dots represent when a day’s low price has moved lower than the lowest low of the previous 10 days. The red and blue arrows represent a sell (short) entry and a buy (long) entry respectively.

The chart below shows entries and exits based upon using a 10-day breakout system. The system is called a breakout system because the trade is taken when the price “breaks out” of a certain range. In this case we buy on a breakout of the highest high of the last 10 days and sell on a breakout of the lowest low of the last 10 days.

Figure 1.17 Daily EURUSD Data

Test Period: 1/20/2003-1/20/2008

Stop Loss Amount = $1000 (100pips)

14 Day and 8 Day Breakout System Net Profit = ~ $36,000

This is another system where we have used different parameters for the buy entry and the sell entry.

We have run a few tests and found the following:

22 Day and 8 Day Breakout System Net Profit = ~ $42,000

Once again we see that testing different parameters pays off.

We have just gone over a few examples of how we can use a simple Forex chart with or without indicators to create a basic trading system. As we have stated before the parameters in the examples are not meant to be recommendations or suggestions for entering and exiting trades. They are here to illustrate the power that a few simple changes can have on a trading system’s overall performance results.

Determining Your Strategy - It takes successful traders a while to develop and perfect the strategies that they use. Some prefer to use one particular study or formula while others use a variety of other strategies. Some experts would probably recommend that you try to find a good combination of both fundamental and technical analysis to make long-term predictions and to help you identify entry and exit points. Ultimately the decision is up to you.

It is also recommended that when you start in the FOREX market you should start by opening a demo account and paper trade as a way to practice making a profit on a regular basis. Usually individuals who get into the FOREX market too quickly and without practicing to gain experience tend to lose money and ultimately aren’t successful. So before investing your money into anything, it’s always a good idea to get your feet wet before jumping in.

You will also have to learn to trade while keeping your emotions in check. It would be impossible to track the stop-loss points if you aren’t able to execute them when you need to. It is highly recommended that you set your stop-loss and take-profit points to execute automatically and never change them unless it’s a necessity. Trust your decisions and stand by them or you will end up driving you and your broker crazy.

It’s also important to follow the trends. Going against a trend is a pretty big gamble because statistically the FOREX market has tended to stick to trends so odds are you will be more successful if you don’t go against the grain.

The FOREX market is the world’s biggest market and people are drawn to it on a daily basis. But before you jump into the market, make sure you have a broker you trust and really put some effort into finding a strategy that will help you be successful.

**

Are you ready to start earning a 50% recurring commission EVERY single month for each and every customer you acquire that stays active?! **

.https://bit.ly/3sDSONg

The Fastest Way to Calculate Lot Size and Open a Trade on Your MT4 Platform is by using the Trader On Chart MT4 trade panel.

https://bit.ly/3Bpaz7e

The Fastest Way to Calculate Lot Size and Open a Trade on Your MT4 Desktop Platform

Auto-calculate position size

Trader On Chart will calculate the exact lot size for your trade according to the stop loss size and your available account equity. If you chose to risk 1% per trade, it means TOC will set the exact lot size so that in case your trade hits stop loss you lose no more than 1%.

Trading the 1 minute

chart requires the skill to master. Eddie Clark, trainer and trader,

has mastered trading the 1 minute In Out Forex Trading

System. With Kung-fu skills, Clark is able to show you how to trade

forex, analyze the chart and present to you a strategy that you trade only on

the 1 minute chart.

https://bit.ly/3uIlJ5F

Learn how to trade Forex with Tradeonix Pro. We've helped thousands of people learn to trade over the past 20 years.

https://bit.ly/3LsHDjm

Find the best online forex guides and softwares.

https://bit.ly/3sxz5yV

Bob is the lead trader behind 1000pip Builder. He worked for one of the leading financial services institutions in London and has over 10 years of experience as a skilled Forex trader and mentor. He now wants to bring his expertise to a wider audience and help home traders make a success of Forex trading. This is a unique opportunity to learn from an seasoned trader and follow the trades taken on Bob’s own trading account.

https://bit.ly/3GWTLpn

Bob is highly proficient in fundamental and technical analysis and uses his sound judgement to identify key trading opportunities. He believes that a deep understanding of market forces is critical to successful Forex trading. By joining Bob’s Forex signal service you will be given the opportunity to tap into that knowledge and learn from his vast experience.

Primarily a trend trader, Bob likes to focus on maximising returns from flowing price movement and considers it essential to focus on high probability opportunities. Bob’s key strength is his ability to interpret price movements and discern what is really happening behind the scenes. The aim is then to successfully translate this information into winning trades.

Bob is committed to providing the best Forex signals and helping you achieve your Forex trading goals. Become a member of 1000 pip Builder and take your trading to the next level.

100% rule based Forex system. Become a successful trader with this system for Forex. Automatic trade detection with entry, stop loss and take profit values. The Forex system for easy, stress free trading.

https://bit.ly/3uRe8S6

Trusted Forex Signals

Your Success Starts Here

Accurate Forex signals, independently

verified results and much more

This is one of the best Forex System available for MetaTrader-4

Powered by the most advanced, adaptive, and profitable trading

(turning-point detection) algorithms on the market,

using Secrete Strategies.

https://bit.ly/34QD80S

Some Trader use the FOREX Market as his Personal ATM Machine With ForexShark Trading Indicator!

OPTIMIZED for Maximum Profits, the ForexShark Generates Money on ANY PAIR!

This is one of the best Forex System available for MetaTrader-4 Powered by the most advanced, adaptive, and profitable trading (turning-point detection) algorithms on the market,

using Secrete Strategies.

Why Do Most Forex Traders Lose Money?

Here are some of the most common "symptoms" to watch out for.......

1. Getting out of positions too early - sign of fear

2. Staying in positions too long - sign of greed

3. Closing a position for a loss - sign of fear

4. Not closing a losing position - sign of greed

5. Jumping into a trend late - sign of greed

6. And jumping in too early - sign of greed

The main reason for losing money in Forex Trading is, not having control over your emotions.

That is why you need some technical indicators to guide you and hence, overcome the human emotion issues.

This product will give you everything you need to overcome losses and gain profits in forex trading

The Display on the Chart gives you Trend Analysis of M1 to H4 Time Frames and the Entry Signals for profitable Trading And also the BUY/SELL Indicators as shown in the picture below

Copy FxLifestyle's VIP Forex signals and start making profit. Our Profitable VIP Forex signals make profit around 91.3% of the time.

https://bit.ly/3BnaaC7

Earn a guaranteed profit within 3 days or 100% money back

Copy Trades Live From Successful Forex Trader 24hrs/ Day

250+ Forex Gifts Included: Forex Strategies, Indicators, Education, Software...... and more

Extremely simple to use (even for complete beginners)

24hr Live help & support

I Guarantee That The Video Below Will

Change Everything You Have Heard,

Seen Or Tried In Forex Automatic

Robot Trading...

See MAGIC Unfolding In Front Of Your Eyes

Trade Command Center is the latest Forex trading signal created by full time professional traders.

https://bit.ly/3LuVaXk

In case you were doing the math, that’s $86,949.15 in monthly income. I’ve got the actual live trading statement, and am going to prove to you that you could throw away your signal service AND your trading system and harness this insane earning power for yourself.

Hi, it’s Jessie with Tradeology. And today you can probably tell, is going to be different...

And I don’t just mean that I’m about to show you something amazing...

Something that has created $173,898.30 in wealth in less than eight weeks... And ANOTHER $166K in gross profit in only 12 short days...

**

Forex Trading Fortunes

Introductory

Forex trading is about currency trading on Forex market. The basic

principle that operates on every market, applies here as well: in

order to make money, you have to buy low then sell high. That's the

whole philosophy.

Working non-stop with uncountable amounts of dollars, Forex is the greatest

liquid financial market worldwide. You can now trade currency whenever you

want, wherever you are, whoever you are. Until the 90's this kind of trading

was only allowed for banks, big corporations or great dealers due to the

strict regulations imposed by this market. Individuals or small businesses

could not trade here.

Towards the end of the 90's, this situation changed as a consequence of the

technological development in communications. The Internet opened the road

to anybody, and Forex trading has become the most popular way of making

money while being at home.

As attractive as it may look, this type of trade is nevertheless risky. Quite a

number of people lost considerable sums of money in this business. If you

are a beginner it is important to have some knowledge about how to conduct

your trades on Forex market. You can get your education by accessing any

of the thousands of websites on Forex trading. Some of them actually give

you models of Forex trades, allowing you to practice this trading using fake

money.

Experts agree that you need to trade on this replica market to fully

understand the way actual Forex works. Therefore, it is advisable you create

an account on this model sites and start trading. You don't use real money.

You practice and improve your Forex trading skills.

Once you consider your training done, you can try your skills on the real

market. You just need a computer connected to high speed Internet, a

trading system and a Forex account.

You should never forget that there is always a risk of losing your money. To

minimize this risk, you must have basic knowledge about charting. Most of

the systems for Forex trading have charts which can guide you in your

Forex Trading Fortunes

trading. These charts virtually represent currency exchange rates and it is

here that you stop to make your decisions on buying or selling currency. To

be able to decide favorably, you need to acknowledge the way you should

read various Forex charts.

There are no two charts alike, even though they mirror the same

fluctuations. The daily charts can provide you information on the market

trend for the last 24 hours, while the hourly one can help you make an idea

of the trend of the day. There is a 15-minute chart which shows the

fluctuation of a currency for a time interval of 15 minutes. A 5-minute chart

might also be available sometimes.

Although there is a strong potential of earnings on Forex market, you should

keep in mind that there are risks as well. Knowing the basics only would not

be enough. A correct plan of investment and a strategy for it are strongly

recommended.

Forex Trading Fortunes

Invest

To trade successfully in Forex, you must be able to understand the

trading signals that can contribute greatly to your profits.

Select a chart that describes these trading indicators and rationally opt for a

trading system that can optimize the benefit of these trading indicators.

These signals can help in making important decisions regarding market entry

and exit or to make any adjustments in currency exchange.

Technical indicators describe the trading facts and figures by making certain

mathematical calculations and state the time period that was selected for

reckoning these indicators. Charts in Forex display continually updated

exchange rates of various currencies, the upward or downward trends and

the technical indicators. Every chart is being updated after a specified time

period. You must be acquainted with these charts and the technical

indicators before making an investment.

It is a sensible norm to consult the charts before making an entry to Foreign

exchange market. You can even consult multiple charts to figure out the best

time of entry. After mastering at entry signals' evaluation, you must pay

attention to the exit signals. Consider many options from trailing stops, fixed

stops and limit exits that you can use for your exit.

If you intend to make short trade, try concentrating on 'turning points' by

understanding any short-term pattern which can recur in long run. Monitor

the currency pairs to figure out any such swing. Usually traders prefer to set

a higher percentage for a short period, opting for the limit exit.

You can also consult exit signals that are based on real time transactions, to

make a decision regarding your exit.

In addition to consulting the technical indicators carefully, you must use a

signal that best suits your conditions. Instead of making a decision randomly

you must stick to a logical mechanism. Try using multiple signals in

accordance with many parameters that will lead you to risk aversion.

Forex Trading Fortunes

Assess the Right Time to Invest

Evaluating various Forex signals along with technical indicators allows you to

control your investment and anticipate the possible fluctuations in market.

Trading in Forex requires rigorous attention and observation and any

negligence can cause big losses. Technological advancements have made it

possible to analyze foreign exchange market 24 hours a day through

internet. You can even buy and sell currency on phone, because the need of

physical presence has been eliminated in Modern Forex trading.

Now-a-days if the Forex trading indicators meet the defined parameters,

you'll receive an alert to invest or sell your stock. To ensure the maximum

possible gain from your investment, decide on following the trading signal of

an experienced service provider's signals.

You must find out the best trading system that suits you. Logical evaluation

of figures and signals allow you to grab the right opportunity. You must

conduct a thorough research before making a transaction and don't just rely

on one source.

Read reviews, online trading forums, business newspapers and magazines

on foreign exchange to deeply understand the underlying system of Foreign

exchange trading. Use software to evaluate signals or a method developed

by any foreign exchange expert. Make notes and find out the right trading

system that works for you.

Forex Trading Fortunes

Education with Forex Trading

Forex is not a sophisticated market, but you must take into

consideration certain aspects if you want your trades to be

successful. You can really earn great amounts of money, the way

many people have done it and got rich overnight.

Foreign Exchange, also known as Forex has become the largest liquid

financial market worldwide. It has no particular location, as exchanges are

made by means of electronic network, getting thus the entire world involved

in it.

Forex is not a sophisticated market, but you must take into consideration

certain aspects if you want your trades to be successful. You can really earn

great amounts of money, the way many people have done it and got rich

overnight. At the same time, you should always keep in mind that risks are

involved too. It is necessary to get properly educated and have the adequate

knowledge about Forex trade before starting actual trading.

Many of the business school across the United States have courses on

financial trading and markets. Attending such courses will only benefit you,

as they provide you with the required knowledge and skill to enter Forex

market and trade successfully in there.

A good business school will teach you about properly reading the charts and

correctly spotting the trends. Reading a chart allows you to have an

overview on the direction a certain currency is heading to. Thus, you will be

able to decide on the currency you will trade. Reading a chart correctly is the

skill that you need most on Forex market. It helps you lower the risks of

losing your money and increase your earning chances.

When deciding on a particular school, you should consider those providing

real-time trading on model and even real accounts. It is a fact that the best

learning comes out of experience. Therefore, you should be required to

create both accounts. You need a dummy one for practice and a real one to

actually trade. Your real account should not be large, so that you don't lose

much money if you make mistakes. While practicing you get experience. You

will better know the way Forex works, which will help you when you decide

to become a real trader on the market.

Forex Trading Fortunes

Various trading systems should be available in these schools, so that you

can try them and decide which is easier for you to use. Even more

important, you get acquainted with the way these systems work and are

used, for the same purpose of avoiding mistakes on the real market.

Due to the fact that it is largely based on speculating, Forex is indeed a risky

market. You must have knowledge of the market, and skills to trade on it.

You can earn money very easy, but at the same time you can lose it

instantly. It is necessary to get properly educated before starting to trade on

this market.

Nowadays anyone owning a computer and having an internet connection can

trade on Forex. You should keep in mind the fact that Forex cannot

guarantee winning for everybody. The better knowledge you have, the

better your chances are to get profit on Forex trading. You'd better not step

in if you only think you can do it. Get educated first.

Forex Trading Fortunes

Importance of Learning Forex

Trading Basics

Are you looking for the place to invest your capital? Don't worry

now. There is the financial market where you can invest in a

profitable way.

There are many large companies which are trading in this most liquid and

volatile market and gaining profit with both hands.

If you like to adopt a trading career, do to forex trading. It is the best place

to invest. Unlike many other stock markets forex trading is most appropriate

place to invest because it operates 24 hours a day. It is present globally and

you can also trade through electronic media such as internet or even with

your mobile.

For those who are new to forex trading it is simply buying and selling of

currency. It is not as simple as it seems. It involves lot of technicality. You

need to learn a lot about forex trading before entry. In this article we

emphasis on learning forex trading.

Nowadays accessing forex trading market is not a challenge any more. You

do not need to go to real foreign exchange market. you can access forex

trading on internet. There are many software programs available online that

will provide you with timely market updates, currency quotes, rise and fall in

currency value and so on. Software will analyze and tell you when to buy or

sell a currency.

It is recommended to gather maximum information before starting trade in

foreign exchange market. You should be known trade tricks for earning more

profit. You can learn forex trading through experience and practice. To

invest in forex trading and rule over it is not a child's play. As much you get

in to forex market, more you will be expert player in this market.

Although forex trading is a big place to make money but on the contrary,

you it becomes very expensive with one wrong move.

The last thing is when you have to trade in the Forex market. Since the

Forex market is open 24/7 you can trade whatever time suits you best and

Forex Trading Fortunes

you can get out of it whenever you like. You just have to anticipate the trend

of the market.

As compared to bonds and stock, forex trading is riskier. But it is more

volatile you can make billions of dollars in few seconds.

Forex trading is not only for large firm and organization. This market is open

for everyone. The only conditions are that you should have sufficient capital

and an account to deal in forex trading. You can opt forex trading as a part

time task. You can trade any time you want.

You should have right system to trade. Take free version trails of system

before getting it. Analyze system by clients' blogs and testimonials about

system working.

Last but not least is the selection of an experience and well reputed forex

broker. He can provide you with lot of advises to deal in forex market and

how you maximize your profit with increasing risk.

Forex Trading Fortunes

Strategies for Forex Trading

Forex Trading is a place where potential investment players deal in

business and financial activities.

Forex is the modern name of Foreign Exchange Market, which is one of the

largest world market with estimated turnover of $1.5 trillion a day. In order

to deal in Forex and make it big, certain strategies should be adopted to

ensure triumph victory.

In Forex companies come with highly liquid assets. Companies prefer to be

involved in foreign exchange business than in any other trading business

because of its speedy transactions.

First and foremost, strategy is to acquire complete knowledge about Forex.

You should know all the tactics to maximize profit and minimize loss. It can

be done when you completely familiarize yourself with market systems and

players in the market. Major players in foreign exchange market are broker

companies, central bank of the country, commercial banks, and investment

funds.

Individuals with large capital are also trading in foreign exchange market.

The main forex trading market is Paris. Top trading currencies are Us dollar,

Japanese yen, Euro, Australian dollar, British pound and Swiss Franc. Forex

is a speculative market. It means that, there is no trading of really goods in

this market. Everything is virtual at forex trading.

Most of the companies buy one currency against another currency having

greater value today or tomorrow. Let's take an example, your speculative

experience tells you that price of Euro will be higher than US dollar in future.

Then you will go and get Euros against US dollars. When the value of Euro

will rise you can sell them to earn profit.

To learn the forex trading language is essential. You cannot survive in

foreign market if you do not learn its language. Like, increase in one

hundredth percent ($ 10 or $1) increase in trading currency value is

represented by PIP. Volume means the quantity or amount of currency you

are trading. Buying refers to acquisition of currency. Selling refers to

Forex Trading Fortunes

putting the currency into market because of the possibility of decrease in

currency value in near future.

Develop your trading strategy according to your trade type. Identify that

which kind of foreign market trader you are. Sound trading strategy

minimizes risk. Apply the policies of proper money management. Do not

invest all capital in one large transaction.

You should diversify your portfolio of transactions in order to minimize loss.

By allocating capital in many small transactions instead of large transaction

is beneficial as if your loss in one transaction you will loss only a fraction of

your capital.

Paper trading is the most beneficial tool for practicing trade in foreign

exchange market. It helps you to learn the forex trading working, it

familiarizes you with all the tools and software used in market. It allows you

to get enough knowledge and practice to deal in foreign exchange market

before dealing with real money.

Another strategy is the right selection of broker in foreign market. Select the

one who has complete forex trading knowledge. He should be familiar with

all the rules and regulation of foreign market.

Forex Trading Fortunes

Options to Learn Forex

Trading

It is commonly assumed that Forex trading is only for commercial

banks, state bank, investment companies or in short for large

governing bodies.

This is not true; any common individual can trade in foreign exchange

market. They just need sufficient capital to invest and an account in foreign

exchange market.

In foreign trading there are seven major trading currencies in FX market. In

foreign trading you can not only buy and sell currencies in pair but can also

trade single currency like US $ or Euro. It is common practice in forex

trading to buy the currency at lower price and sale it at relatively higher

price. This is the basic and précised forex market system. If you want to put

your hands in foreign exchange market, you cannot win the war with the

basic knowledge alone.

You need to have complete knowledge to become the sovereign of the

market.

Forex trading takes place 24 hours a day six day a week, which shows that

trading is going on when you are busy in your office or sleeping. Here you

need the knowledge of internet forex trading system. This system allows you

to set the currency price at your desired level; your currency will be sold

automatically at set price when value of currency will reach at desired level.

Do not afraid of large giants like commercial banks and professional

speculators in forex market. There are brokers in the market who work for

individuals and give you proper guidance.

It is necessary to learn forex trading procedure first. It is your primary

obligation to learn rule and regulation of forex trading. This will help you to

minimize risk, so it is advised to have proper knowledge about the market

before entering into it.

It is essential to learn psychology of forex trading. You should know how to

diversify your capital investment portfolio in order to reduce jeopardy. It is

Forex Trading Fortunes

advised do not make huge capital investment in one currency alone; instead

make investments in many small units. It will not only minimize risk factor

but also help you to compensate the loss in one investment unit by making

profit in other.

If being a new in this speculation game and you make a lot of profit in start,

then do not overestimate yourself. You should be more cautious that it is not

the same all the time. Do not neglect risk factor. Keep your ears and eyes

open in this game. Do not consider yourself an expert speculator but indulge

yourself in continuous learning process. Continuous learning is the only key

to success in forex market.

If you entered in forex market with the aim of getting success, then take the

help of experts in this field. Learn the strategies and tactics to deal in forex

market. Take free trials before investing hard money in the FX market that

will make you an expert.

There is a facility of forex trading classes also, where makes you to learn a

lot about the market trends. You can also work with brokers to enhance your

learning. Anyway, you learn the tactics be trained in forex trading. All the

above efforts will result in ultimate profit.

Forex Trading Fortunes

Chapter 6: Successfully Forex Trading

Having knowledge on Forex trading and the necessary skills to

actually trade on this market are a must to become a Forex trader.

Still, having only that much is not enough. There are other various aspects

you need to be aware of if you want success to be granted and really earn

money. Being informed about the main currencies traded and the trends

they follow is part of the basics.

Choosing the proper currency and the most favorable moment adds to the

requirements for success, as well. This is part of a trading strategy you

should have. There are several strategies which can be used while trading on

Forex, and if correctly used, they can shortly bring you serious amounts of

money. As Forex differs from stock trading, the strategies also differ.

The leverage strategy on Forex trading allows the investor to borrow money

for the purpose of increasing the potential of earning. It is among the

frequently used strategies for profit maximization on Forex market. But

there is a high level of risk that can be involved. To minimize it stop loss

orders are available. You can make use of them to reduce both risk and loss.

The strategy based on stop loss orders starts from a predetermined point,

which once reached will alert the investor and he will stop trading. It is

mainly used for risk and loss lowering. Making use of it can track you down

as well, as you might stop trading when currency value goes upper than

thought.

As Forex works 24 hours a day, everywhere around the world, you can trade

whenever you think the market is at the proper parameters for you to get

profit. Being such a liquid market, you can join it and leave it at any time.

You may want to have some tips on how to make money on Forex and how

to do it well. It is necessary for you to know that the golden rule of most of

the traders is to get in late and out early. This is due to the fact that the

most expensive ticks are the first and last ones.

Forex Trading Fortunes

If you lose, you should not add money. You would want to reduce the risks

instead of mounting them. Another way of doing reducing risk is to go with

the trend.

Among the tools you can work with on Forex, charts are the most important,

allowing you to make an idea of the trends, and forecast a certain currency

value. Being able to read various charts is also a necessity. You should know

that charts are daily, hourly, for a 15-minute period or even for 5-minute

timing. If you can compare the data you can spot the trends and thus

reduce the risks.

As a good Forex trader, you have to be aware of the fact that money can

also be lost, which will sometimes happen. You need not discourage nor

despair. Review your faults, find a way to eliminate them and keep on

trading.

Forex Trading Fortunes

Online Forex Day Trading

Tactics

Forex trading, also known as foreign exchange market, is the place

where buying and selling of currencies takes place.

Trading at forex trading continues day and night, six days a week with many

prospects for traders to make profit.

If you want to trade only during day time than you need not to exert

yourself to learn forex trading deeply. One thing that will make you a perfect

and successful trader is PRACTICE. Practice makes you a perfect and

superior trader in foreign exchange market. It should be remembering that

practice need determination and dedication to cope with tough foreign

exchange market conditions.

In this article we tried to discuss all possible ways that a daytime trader

should adopt to guarantee profit.

There are many online paper trading trials offered at several websites. It is

advised to practice paper trading before using hard cash in forex trading.

In forex trading you can minimize risk but cannot eliminate it. If you are

new in FX market, do not afraid losses. Losses will make you to learn unique

ways of earning profit. So, it is recommended to learn from mistakes and do

not repeat these mistakes in future.

Discipline is the foremost rule for trading in foreign exchange market.

Discipline will help you to make wise decisions about what strategies and

tactics should be adopted to multiply profit.

You should create and maintain trading chart for evaluation of results. The

chart will tell you what necessary adjustments should be made for better

performance in future.

Do not panic with failure; remember that failure is the first stair towards

victory. Learn from failure and do not repeat mistakes in future.

Forex Trading Fortunes

If you see the currency value that you want to sell goes down, and you did

not sale currency in the hope of rise in price again. Do not make such

mistakes; sell the currency at the first time when its value decline as there

are more bright chances of further decrease in currency value. That is how

you would be able to lessen more loss.

If you are truly a day trader, then trading software and hardware can

facilitate you to trade at home or office.

As forex trading is fastest trading market, so for daytime online trader’s

internet speed should be fast too. It will facilitate you to respond timely to

quotes and trading updates.

For quicker online responses for execution and confirmation of quotes there

is speedier online system called EDAT. EDAT has an additional feature

through which traders can acquire and contact directly with trade specialists

for captivating recommendation to solve unwelcomed market threat.

Moreover, another facility for day traders is that if they want to sell specific

currency at desired price level, then they can set specific price for that

currency.

When the value of currency will reach at their desired level than it is could

be sold automatically when you are away or sleeping.

In short, if you want to be a successful day trader you need discipline,

dedication and immense effort. All these factors collectively ensure profit.

Forex Trading Fortunes

Useful Considerations of

Forex Trading

If you are convinced with the veiled opportunity of Foreign exchange

investment that can boost your financial condition within days and

have decided to jump in this vast financial ocean, just think for a

second 'Are you prepared?'

In a hope to turn thousands into millions can possibly indulge you in loss.

So, make sure that you have got the necessary training and exposure to

enter Forex, which means understanding the basic concepts to the most

intricate tactics of currency trade.

Online forums, articles and tutorials can provide a fair understanding even to

beginners. For advance learning you can join a foreign exchange institute

that have trained and experienced instructors who actually deal in currency

exchange. These instructors have real-time market knowledge and can

familiarize you with the valuable insights of Forex.

Following are some useful tips regarding foreign currency exchange market:

Making a place in huge investment giants, require enough confidence and

capability to assess ongoing market changes. You can't always earn profits

by following anyone blindly, no matter how successful that investor is in

Forex. It is your own intuition and decision-making ability to buy or sell right

type of currency at right time. Beginners are often called 'turtles' because of

their inadequate experience regarding currency trade.

Your approach toward currency exchange matters a lot. If you're a keen

observer and have monitored past trends and patterns regarding exchange

of any currency, you are in a better position to avoid any possible loss. To

unveil long term trends, use breakout method that is still the most effective

way to do so.

Trends in exchange rates of currencies of developed economies tend to be

more stable. There are now a number of sophisticated software’s available

that can analyze past and current exchange rates and can anticipate future

trends. You must be able to read Forex charts and running figures.

Forex Trading Fortunes

Entry to Forex means, sustainable attitude toward currency exchange. This

means that you must act sensibly even when you bear a loss. Instead of

buying or selling haphazardly, make your moves logically by considering

long-term tendencies. Besides relying on Breakout method, you must hold

your morale high even during down periods. Revenues cannot be generated

endlessly in Forex without ever bearing loss so you must be mentally

prepared for any such failure.

Aside from advantages gained from reasonable measures of risk aversion,

low risk can actually restrict profits at Forex. There's a rule in foreign

exchange market, the greater the risk, the greater the profits. You must

decide what suits you best and must anticipate the right opportunity to

invest or sell.

Just like 'too many cooks spoil the broth', a consensus on a certain move in

Forex can end up in nothing. Use your intuition, technical details, and

analysis techniques and decide rationally rather than just relying on rumors.

By acquiring sufficient knowledge before entry to Forex and learning from

real life instances, you can nail this enormous opportunity to earn millions of

dollars. Just be a persistent trader, good observer and keen learner, you'll

reap the benefits from this international platform.

Forex Trading Fortunes

Automated Forex Trading

Long gone is the time when only banks and private institutions could

trade the Forex market.

Now, individuals have access to trade their own money, and lots of it. The

exchange of foreign currencies has since been open to private investors,

central banks like Bank of America, and several countries. But now with the

introduction of the Expert Advisor trading systems, the smaller trader can

now automate their trades like the big companies do.

The systems allow the user to set their own parameters and trading

guidelines. The program consists of software that has been developed for a

specific type of trading style, not everyone trades the same. Some spot

trade, some trade big, some hedge and so on and so forth. The developers

of these types of software take into consideration any nuances of Forex

trading as well as being aware that the market is trading 24 hours a day,

even during weekends.

Without these types of systems in place, the trader would have to monitor

the pair that is being trades on a constant basis along with monitoring

opening and closing times which is almost impossible to keep up with. By

using the Expert advisors, a trader can setup trading signals to make life a

bit easier such as a type of order, stop loss, trade entry, news tickers etc.

Some of the key benefits of using an automated trading system is that it

gives the trader full control, but cuts out the emotional bond a trader has

with his money... making the temptation to trade on a whim a lot less likely.

This takes the guesswork out of trading if the trader implements the right

trading signals for this trading style.

The EA is a mathematical algorithm and it performs solely on formulas, so if

the EA doesn’t perform like it should it can be changed, augmented and

tweaked until the trader finds the recipe for success that they are looking

for. Then, this process is repeated constantly to achieve a money-making

strategy.

Forex Trading Fortunes

Trading also involves the trends of the market, be it long-term or shortterm. These trends play a big role in the amount of trades that a trader is

involved in. The EA, if setup correctly, will take these trends in-stride and

make the trades accordingly, minimizing the drawdown or losing trades.

Using historical data, traders can analyze and test their trading theories and

strategies, some EA's have a built-in function to record such data.

Almost every expert advisor system being developed now is made using the

MetaTrader 4 platform since it provides reliable historical data that you can

download from their site or any other, Multilanguage support, solid and userfriendly interface.

Automated expert advisors are becoming the tool of choice for many traders

and companies around the globe, most are free, but the ones that really

rake in the money you have to pay for. You get what you pay for.**

Are you ready to start earning a 50% recurring commission EVERY single month for each and every customer you acquire that stays active?! **

.https://bit.ly/3sDSONg

**High-quality Forex robots that deliver constant results at low price. Demo versions of all Forex Robots are available. Automated Forex Tools is specialized in developing Forex robots (expert advisors).

https://bit.ly/3Jnqx4i

Automated Forex Tools specializes in developing Forex Robots (also known as Expert Advisors or EAs). These robots are used by traders as tools for buying and selling currencies in the popular Forex market. The Forex market offers infinite opportunities. Our team's main goal is to help forex traders achieve incredible results with the help of our forex robots.

FOREX EXPERT ADVISORS (FOREX ROBOTS)

Our team has developed several Forex Robots that can be used in different situations depending on the market conditions. We continue to develop new robots and refine the existing ones. Below you will find some of our most popular Forex Robots**

**

The Basics of FOREX Trading

What exactly is FOREX trading? Put simply, FOREX trading is the buying and selling of international currencies. Traditionally, participation in the FOREX market was confined to major banking and trading institutions. But in recent years, technological developments have opened up this once exclusive arena to smaller companies and even individuals by allowing them to trade currencies online.

The world’s currency rates are not fixed. They follow a floating exchange rate and are always traded in pairs— EuroDollar, Dollar/Yen, etc. Most international transactions are exchanges of the world’s major currencies.

When it comes to Forex trading, there are a number of major currency pairs. : Euro v. US dollar, US dollar v. Japanese yen, British pound v. US dollar, and US dollar v. Swiss franc. These currency pairs are considered major in comparison to the other currency pairs because of their trading volume.

In the FOREX market, these relationships are shortened: EUR/USD, USD/JPY, GBP/USD, and USD/CHF. They may also be listed as follows (without the slash): EURUSD, USDJPY, GBPUSD, and USDCHF

Below is a chart of 4 currency pairs clearly illustrating their relationship to each other.

Figure 1.0 Major Currency Pairs - Daily Data

It is also important to remember that there are no dividends paid on currencies. If you are a trader in the FOREX market, you look to see whether one currency’s value will appreciate against another currency. When this is the case, you exchange the latter for the first. Ideally, you will be able to exchange the first currency for the other at a later time and collect a profit from the trade.

FOREX transactions are typically conducted by professionals at major banks and brokerage firms. FOREX trading has long been an important feature of the international market. At all hours of the day, currencies are being traded by brokers around the world. In fact, the FOREX market operates virtually twenty- four hours a day and five days a week with traders at international banking institutions working a number of separate shifts.

The FOREX market is different from the normal stock market in the fact that price shifts are much smoother and do not result in significant gaps. Each day the FOREX market turns over trillions of dollars, allowing traders to enter and exit certain position very easily. As you can see, the FOREX market is a dynamic and continuous system that basically never sleeps. To be sure, even on September 11 in 2001 it was still possible to obtain currency quotes.

Also known as the foreign exchange market, or FX, it is the oldest and most expansive financial market in the world. In comparison, the currency futures market is a mere one percent the size of the FOREX market.

Trades are brokered between major banking groups and circulate around the globe, from America to Australia, to Asia, to Europe, and back to the U.S. For a long time, financial prerequisites and hefty minimum transaction amounts put the FOREX market out of reach of small traders. Consequently, at one time major banks and financial institutions were the only parties that could benefit from participation in the FOREX market’s fluidness and strong exchange rates.

Today is a different story. FOREX market dealers can divide large units within the market, allowing smaller corporations and even individuals the ability to trade these smaller units. Even though it is the oldest financial market in the world, the FOREX market has evolved a great deal in a short amount of time. High-speed internet connections and sophisticated online Forex trading platforms has definitely made it easier for individual traders to get involved in Forex trading and possibly be very successful at it. This basic guide is your first step towards a successful future in trading in the extremely lucrative FOREX market.

Are you ready to start earning a 50% recurring commission EVERY single month for each and every customer you acquire that stays active?! **

.https://bit.ly/3sDSONg

**

ADOBE FLASH PLAYER

You are either missing or need to update your ADOBE Flash Player in order to see this video .

Download Now

http://forex-megadroid.com/index.php

AFTER 21 YEARS:

WE FINALLY SETTLED THE SCORE

“Forex Megadroid™ Indisputably Proves A

Robot Can Trade With 95.82% Accuracy In

EVERY SINGLE Market Condition And

Quadruple Every Single Dollar YOU Deposit”

IMPORTANT: EVERY SINGLE MARKET CONDITION:

**Reasons To Trade In The FOREX Market

If you asked Forex traders the number one reason they traded Forex most of them would say, “profit potential”

Figure 1.1 Daily GBPUSD Data

The chart above shows the daily GBPUSD (British Pound/US Dollar) currency pair. This chart shows the “BUY”

entry where the blue arrow is (the bottom left of the chart). This represents where a particular Forex trading system went long (bought).

The profit so far in this trade is approximately $24,000 per Forex contract. This is from just one simple trade in the Forex market! So as you can see the profit potential is there and opportunities such as these exist in all Forex currency pairs.

There is a unique and potentially very profitable opportunity offered through cash/spot FOREX markets regardless of the condition of the market.

The advantages of FOREX trading are:

Around the clock market: A trader can trade anytime that they think market conditions are favorable; Forex offers a 24-hour market. This is particularly convenient for those who wish to trade Forex on a part-time basis. You could easily find markets to trade that will not conflict with your work schedule. There is basically no schedule that the Forex market’s trading hours can’t accommodate.

Easy in-Easy out: A trader can enter or exit the market almost totally at will; no other market offers as much liquidity. There are very few execution barriers and no limits are placed on daily trading. The leverage available in Forex is much higher than equity markets: A leverage ratio of up to 400:1 in comparison to 2:1 in the equity markets.

Although the risk of using greater leverage can be higher in FOREX trading, the potential for profit is there as well!

A low-cost transaction: Compared to other markets the Forex market has some of the lowest transaction costs available.

Always An Opportunity To Profit: FOREX trading actually consists of buying or selling one currency against another, and there is always a profit opportunity for one currency pair or another.

Global market: With no organized exchanges like the New York Stock Exchange, trading is facilitated by electronic communication and telephones.

No market monopoly: Because of the size of the FOREX market, no single trader or bank can control the market price for any length of time. Because of the ineffectiveness of bank interventions to manipulate prices, they have diminished.

It is basically unregulated: There are no specific FOREX regulations for daily operations. Of course, banks are always regulated through banking laws.

There are many different advantages to trading FOREX instead of futures or stocks, such as:

There is much profit in trading on margin, but you need to be fully aware of the very high risks too. Be sure you understand the ins and outs of your margin account and that you have read the margin agreement between you and the clearing firm. If you still have things you are not sure about, discuss these issues beforehand with your account representative.

If you allow your account to fall below an amount set in your agreement, you could experience the partial or complete liquidation of your positions. It may be done before you even get a margin call, so be sure you review your margin balance regularly.

Take advantage of stop-loss orders on each open position; this is a must in order to reduce risk and preserve valuable working capital.

2. There are No Exchange Fees and NO Commission - You pay exchange and brokerage fees in the futures market, but FOREX trading is commission free with most Forex brokers. You benefit from free access to this worldwide network where buyers and sellers are matched almost instantly. Although the trading is commission free, the spread (difference between the asking price and the bidding price) is larger than futures.

You are able to plan ahead to limit risk to some degree in the FOREX trading market. An example of this would be losses sustained in the futures market due to Mad Cow Disease.

Trade Rollover In FOREX trading, you need to rollover each trade every two days just to keep your position. In futures, you must plan ahead to rollover when a contract expires.

Open Around the Clock - In the futures market your trading is limited during the window of time that each market is open. If current events make getting out of a position important, you still must wait until the market reopens. That could be hours, creating financial disaster for you. But, the FOREX market is open around the clock, five days a week. It actually follows the sun! From the United States, to Europe, Asia, Australia, and back again to the States, it allows you to trade at any time you desire.

A Market place of Free Trade On a daily basis, the foreign exchange is a $1.4 trillion (and growing) dollar market! This is 46 times larger than all the futures markets combined. Governments around the world struggle to control their own currency because of the massive number of people trading FOREX worldwide.

FOREX trading is a tremendous opportunity and an alternative to futures and commodities trading. As is true with all trading, there are certainly risks involved. To reduce your risk, the services of a Broker are important and advised. This comprehensive guide will help you learn what is necessary to achieve success in the FOREX market. Let’s get started!

**

Are you ready to start earning a 50% recurring commission EVERY single month for each and every customer you acquire that stays active?! **

.https://bit.ly/3sDSONg

**We provide comprehensive Forex training for beginners and advanced traders. You will learn all about Forex, master our trading strategy and can even follow our trade signals. We want to you become a Forex success.

https://bit.ly/33gh0wL

Comprehensive and structured learning

Everything you need to conquer Forex !

We provide comprehensive Forex training for beginners and advanced traders. You will learn all about Forex, master our trading strategy and can even follow our trade signals. We want to you become a Forex success.

Forex Mentor

By joining us, you will be mentored by a highly experienced Forex trader. You can have the support and knowledge you need to thrive at Forex trading

Forex Guide + Strategy

Our Forex trading guide will teach you everything you need to know about Forex. Most importantly you will learn our powerful Forex trading strategy

Leading Forex Signals

The best ways to learn how our Forex strategy works is to follow us trading with it! With our Forex signals you can follow every trade we take

High Performance

We are proud of the strong trading results that we have achieved and we want give you the skills to you need to succeed at Forex

Everything you need

Our aim is to provide you with comprehensive Forex training and personal support so that you can truly prosper in the Forex markets

Highly Recommended

Members highly recommend our structured approach to Forex training and many have greatly benefited from our help.**

**

Getting Started In The Exciting World Of Forex Trading

Learning to trade with Forex is not unnecessarily difficult; however, there are definitely a few items you must

be aware of and instructions to follow. Before beginning any trading, obviously you need to locate and forge a relationship with a broker to execute the trades. Just as with doctors, lawyers and other professions, there are a multitude of Forex brokers from which you can select.

To help you choose, here are some factors to consider:

Minimal Spreads - Unlike standard stock trading brokers, Forex brokers do not charge any commissions on the trades. They earn their income from what is called a spread. The spread is simply the difference between the buy and sell price of currency at a particular point in time. As you locate and investigate the brokers, you should inquire as to the spreads they charge. The lower the spread, the less it will cost you to trade in Forex. This is the same rule as with traditional brokers. The higher their commission on the trades, the lower your profit at the conclusion of the buy and sell transaction. It is in your best interest to choose a Forex broker offering a low spread.

Compliance and Reputation - Traditional stock trading brokers generally operate through their own brokerage houses. Forex brokers, however, are most often affiliated with a large bank or other financial institution. This is due to the substantial sums of capital required. In addition, you should confirm that the Forex broker you choose is properly licensed and registered. Forex brokers should be registered with the Futures Commission Merchant (FCM). IN addition, they are regulated by the Commodity Futures Trading Commission (CFTC).

You can locate and verify the registration as well as other facts and background information at the CFTC website at http://www.cftc.gov .Without a doubt, you want to retain and trade through a broker who is affiliated with a reputable bank or financial institution.

Available Research Tools and Information - Like traditional stock and commodity brokers, Forex brokers maintain various types of websites, trading platforms and underlying research and information portals. The sites should provide you with real time information, current charts, technical information and comparison ability and other relevant data. A good Forex trader will also sustain the ability to trade on different systems. As with any major financial endeavor of this type, ask for free trials to you can evaluate the Forex broker’s various trading platforms. Forex brokers should offer a wide array of information, schedules, tools and other support functions and records.

The bottom line is to locate a broker who will provide you with all the tools and services you require to be successful.

A Variety Of Leverage Options - To succeed in Forex trading you Leverage the price spreads on your trades. The price differentials are minute down to the small percentages of a penny. You are, however, using more than your actual capital borrowed from the broker to make the trades which is how you Leverage larger amounts for your trades than you actually have in cash. This allows you to earn money on the small price deviations. As an example, if you are leveraging at a ration of 100 to 1, this means that for every one of your dollars with which you are trading, you are borrowing 100 from the broker. A wide majority of brokers will allow you to leverage up to a 250 to 1 ratio.

You need to be careful, however, because the leverage ratio is directly related to risk. The higher the ratio, the more you are effectively borrowing from the broker. While you can earn more profit from the trades, you can also lose more if the price fluctuation is not in your favor. This risk reward evaluation is based on your own capital amounts and your tolerance level for profits and losses on the trades. If you are flush with capital, leveraging a higher amount is not as much of a concern. Nevertheless, brokers offer a large number of leveraging ratios and you will certainly find one or more to fit your desires and financial constraints. Even if you have a good amount of capital and can accept a certain amount of risk, you may not want to leverage a high amount if the market becomes volatile such as with exotic currency pairs.

Types of Accounts - You will need to open an account with a broker to execute trades. There are a variety of types of accounts which you can maintain. The lowest account is referred to as a mini account. It has a low minimum opening balance requirement of approximately $300.00. A mini account provides you with the highest ratio of leverage since you are using a small amount of capital with which to execute larger sums in your trades. Aside from the mini account is a standard account. That type of account provides a multitude of various leverage ratios. It has a higher minimum balance to open of approximately $2000.00. Finally, another type of account which brokers offer is a premium account. These require substantially higher minimums to open. They also offer you multiple ratios of leverage as well as give you access to additional platforms, tools and services. As you evaluate and pick a broker, find one that has the right mix of accounts, leverage, information and services for your requirements and financial circumstances.

Stay Away From Disreputable Brokers - Just like in any profession, there are good and bad representatives. Brokers are no different. Some are reputable and others are the ones you just need to avoid. These are the brokers who do not have your best interest in hand and simply buy prematurely or sell near a preset price point to increase their own profits.

These brokers will pick up a fraction of a penny always against on your trades. None of the brokers you evaluate will ever admit to such trading, but there are methods to determine if you are considering a broker who engages in this practice. You can speak with other brokers to get their opinion on the one or more that you are considering. You can ask if they are aware of the brokers trading proclivity in terns of the buying and selling near the price points.

There is no organization that tracks this type of activity. You can try to look on the Internet for discussion boards or messages that might disclose certain brokers and their trading activity.

Margin Calls and Requirements - Obviously since leveraging is all about borrowing money from the broker you need to understand exactly how much risk your broker is going to allow you to take on trades. Once you establish that together and discuss it, the broker will know the prices and differentials in the fluctuations within which to trade by buying or selling. This can, however, adversely impact you if the broker has that discretion and trades at losses.

For example, assume you maintain a margin account and your positions dramatically fall before turning around and rising substantially even exceeding the beginning price. Whether or not you have sufficient capital, a broker might have traded out your position during the fall to lessen the broker’s risk and potential loss. That trade could have been at or near the bottom of the price fluctuation. That would result in a margin call to you and you could be liable for substantial sums of money even though the price rebounded after the broker liquidated your position.