-

About

- About Listly

- Community & Support

- Howto

- Chrome Extension

- Bookmarklet

- WordPress Plugin

- Listly Premium

- Privacy

- Terms

- DMCA Copyright

- © 2010-2025 Boomy Labs

Angela M. Smith

Angela M. Smith

Listly by Angela M. Smith

Invoicera is the online invoicing software offers you all the invoicing features

Invoicera, a web-based invoicing software and accounts payable & receivable system, is happy to announce that its annual and monthly subscription plans are available at 60% off for a limited time. This offer applies to all types of customized solutions too (i.e., Business Cloud, Professional Subscription etc.)

Digital agencies face a unique set of challenges, not least of which is ensuring that everyone in your agency is paid on time. On top of invoicing, you need to be able to manage and track expenses, ensure that tax and insurance obligations are met, and handle contract payments when a client outsources work. Invoicera can help.

In our opinion, an #onlineinvoicingsoftware is just as important as any other business tool you can have at your disposal. We’re here to tell you why. Read on and we’ll start off with a number of important benefits online invoicing software has to offer. If you’re still not convinced that using an online invoicing software is something you should be doing in your business.

keep reading! Why do you need an online invoicing software?

When using subscription billing software, companies no longer have to rely on paper or email reminders—or even phone calls—to collect what they’re owed. In addition to streamlining collections efforts, these programs also come with features designed to improve workflows throughout an organization. This means users can track potential customers, monitor orders placed and ensure faster delivery times—all from one location.

Find Out the Six trend Set to Transform Account Receivables in 2022

There are numerous reasons why your invoices may go unpaid, but to many business owners, there is one constant: late payments. If your business depends on timely payment for services rendered and products sold, you know how frustrating it can be when clients fall behind on their payments. But what are they really thinking?

Here’s a look at some of the most common excuses businesses give when it comes to paying bills on time, along with ways to get them paid up faster.

What Is The Best Online Invoicing Software For My Business?

In business, you have to do everything with a little bit of finesse.

To avoid these types of problems, it’s best to choose an invoicing software that suits your needs perfectly. Keep reading to learn more about five different types of online invoicing software, as well as which ones are worth taking a look at.

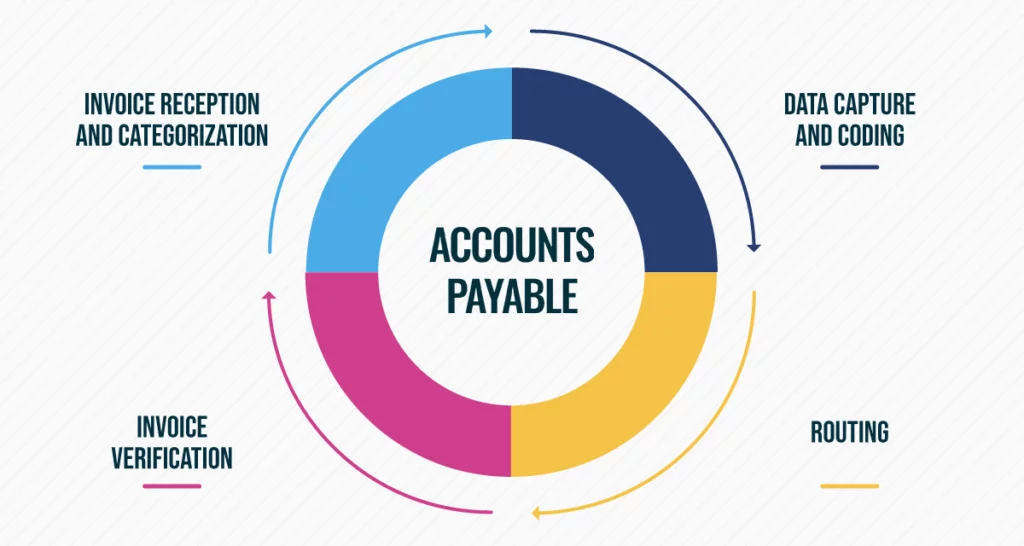

Managing your AR and AP in a systematic manner is one of the prime concerns for all business types.Here are tips to manage Accounts payable and receivable.

An online invoice software helps small businesses and startups with their accounts payable and receivable, helps them manage subscription billing management, and also provides them an easy way to send professional invoices directly from their website. This is not a paid advertisement but simply informative about how beneficial having an online invoice software can be for your company.

We’ve all been there: an invoice is paid to a vendor—but it turns out, a mistake was made, and now you need to reverse that payment. All too often, errors occur when manually paying invoices. This can be costly and inefficient. Automating your accounts payable process can reduce these mistakes so they don’t get through to final payment processing. Here are eight tips for using online invoice software to reduce errors in accounts payable.

In this guide, we’re going to take you through the top 10 challenges that companies face in regards to accounts payable and how accounts payable departments can deal with them, no matter what size or industry they fall into.

The terms you set on your invoices when sending them out may influence your company’s success. Let’s discuss the most critical invoicing and payment terms, Here’s 10 payment and invoice terms every entrepreneur should know:

Preparing a cash flow forecast can seem like an intimidating task, but it’s really quite simple once you learn the step-by-step process. This guide will teach you how to prepare a cash flow forecast in Microsoft Excel, allowing you to accurately plan out your business finances and use them to make more informed decisions about the future of your company.

If you want your business to accept recurring payments, but don’t know where to start, no worries—it’s easier than you think. With a bit of planning and research upfront, there are a few things you can do right now that will give you access to recurring payments in minutes! We outline them here. If you already accept recurring payments or if running an invoice management system just isn't your thing, click here for some alternative options.

If you’re a small business owner, it’s probably more than once. Unpaid invoices are one of small business owners’ most daunting challenges. Here are eight mistakes people make when billing clients, and how to correct them. Avoiding these mishaps can help you get paid faster—and bring in new customers.

Struggling to avoid late payments? Check out these 10 tips to avoid overdue payments. Know more about subscription billing software for customers.

How does your organization conduct procure-to-pay processes?

This procurement to pay process guide will help simplify the process and give you all the information you need to create an efficient P2P strategy for your organization by detailing the most important components.

Mobile payment apps can be integrated into your cash flow model to improve the efficiency of your business and help you build trust with customers by offering fast and convenient service just with the tap of a button.

Here are seven ways mobile payment apps can benefit businesses that operate on a cash flow model.