-

About

- About Listly

- Community & Support

- Howto

- Chrome Extension

- Bookmarklet

- WordPress Plugin

- Listly Premium

- Privacy

- Terms

- DMCA Copyright

- © 2010-2025 Boomy Labs

Listly by ineerajgupta321

How can you read that line and not feel all warm and fuzzy. In one succinct sentence he was able to wrap national pride with positive views on the economy. J.P. Morgan was an amazing businessman and…

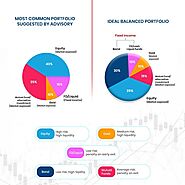

Why Bonds is important in your Portfolio and What role do bonds play in a portfolio in India as well How to have a diversified portfolio with bonds.

Debt securities issued by the India Treasury, the Indian government bonds, sponsored enterprises, the India government agencies, and the India government enterprises are one of the world’s most…

Companies are able to raise money in the market in one of two ways, issue stock or issue the debt instrument also known as a bond. Stock transfers some ownership of the company to stockholders, while…

You may be thinking about investing your money into bonds. These are viewed as being less risky than the share market, as companies or governments guarantee them. Government bonds in India are seen…

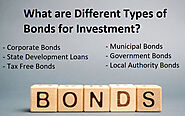

There are various type of government bonds india which are sold by the corporations, federal government, state and local governments, and foreign governments. Getting your bonds for investment in india back is one of the great things about bond investing. This is considered to be a good investment in bonds for those who are just starting out in investing and those with…

Retirement income planning means starting now, regardless if you're 21 or hitting retirement age already, in order to prosper as a retiree.

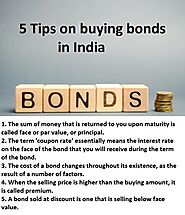

Investing in bonds is very safe, and the returns are usually very good. There are four basic types of bonds available and they are sold through the Government, through corporations, state and local governments, and foreign governments. The greatest thing about bonds investment in India is that you will get your initial investment back. This makes bonds the perfect investment option in india as well best fixed income securities in india vehicle for those who are new to investing, or for those who

To understand high yield bonds, let's define what a bonds in India. A bonds is an interest-bearing investment that obliges the borrower to pay a specific amount of interest for a specific period of time and then at maturity to repay the investor the original amount of the loan. High yield bonds in India are bonds issued by corporations. These companies pay interest rates higher than those of top quality investment in government bonds in India or investment in corporate bonds in India to attract investors.

Investing in bonds are one of the most efficient ways of protecting your investments, and they also can be a great way to keep up with the ever-changing economy. Savings bonds are a way for you to get money for investing in the Bonds market. This is because they come backed by a collateral asset such as a property. In order to use these bonds, it is essential that you have an account with a credit institution.

Buy RBI Bonds in India through RBI floating-rate bond. You can buy or sale online RBI Bonds nowdays. RBI Bonds is offered by Government of India as well reserve banks of India.

2 Ways to earn Fixed Income without heavy investment. Invest in stocks, equity, government Bonds, corporate bonds and tax free bonds in India now and earn maximum interest rate.

Put your money in Bonds (bonds investment), invest in Fixed Income Securities including IPO, Equity and mutual Fund.

There are so many moments in life when we wish we could be more articulate to say things our minds so wonderfully conjure, so we can put our points across more clearly and express without having to miscommunicate. The demand for one thing gives rise to ideas and alternatives.

Bonds Investment are essentially a way to leverage your money by borrowing it in the hope that you will be able to make a profit when you sell the bond back. There are many ways to go about getting this type of bond but the biggest way is through an investment club. Investment option in India are essentially like stockbrokers and are a great way to get involved.

Because bonds are low-risk fixed investment option in India. It offer diversity to your investment portfolio and generate a secondary source of income.

The clue as to what a perpetual bonds in India actually is lies in its name. Invest in Perpetual online in India means ongoing, and that is exactly what this bond does. It has no date by which it m...

Perpetual securities are fixed income securities in India with no fixed maturity date. Investment in Perpetual bonds issuances are done by credits from the investment grade space, preferably with Sovereign-Owned Entity (SOE) background. Issuances from stable sectors get good reception from investors.

Bonds are simply a loan, an investor owned utility (IOU) in which an investor loans money to government agency or to a company for a period of more than one year. In return, the agency or company issues bonds that promise to pay original principal along with interest on a specified date called…

A great way to make investments is by purchasing bonds. This will give details on what is invest in bonds. People are always interested in making extra money on their savings. Buy Bonds Online accrue better interest than their savings account. They both do use compound interest to reward their customer.

Corporate bonds in India are issued by both public and private companies. When an investor purchases a Secondary market for Bonds in India, in effect, the investor is lending money to the company. Com...

Invest in bonds on the bonds market in India as they are a safe investment option in India with a steady amount of profit. This could be good advice for someone who likes to use a low risk strategy…

What are Sovereign Gold Bonds? To be aware of the value placed on gold one needs to take a step back in history to realize why Sovereign gold bonds investment in India has been loo

In today's times when markets are as turbulent as they are unpredictable, it is sometimes difficult for many to even get positive returns on their investment...