-

About

- About Listly

- Community & Support

- Howto

- Chrome Extension

- Bookmarklet

- WordPress Plugin

- Listly Premium

- Privacy

- Terms

- DMCA Copyright

- © 2010-2025 Boomy Labs

Gordon McCallum

Gordon McCallum

Listly by Gordon McCallum

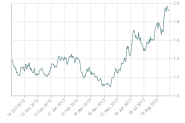

There has been a lot of volatility to the upside in Canadian mortgage rates - especially fixed rates - in the past few weeks. Here's why:

The Back to Work lending program is designed for families facing an economic event, which the FHA defines as “any occurrence beyond the borrower’s control that results in loss of employment, loss of income or a combination of both, which causes a reduction in the borrower’s household income of 20 percent or more for a period of at least six months.” This applies to everyone in the household, not only the borrower.

Federal Reserve Chairman Ben Bernanke. (Photo: Manuel Balce Ceneta, AP) President Obama let slip this week that he may not be inclined to dissuade Federal Reserve Chairman Ben Bernanke from stepping down when his term ends in January.

TORONTO--Canadian bond prices tumbled along with U.S. Treasurys on Wednesday after the U.S. Federal Reserve boosted its forecasts for the U.S. economy, suggesting to many that the reduction of its quantitative-easing program may not be that far off.

TORONTO - The Toronto stock market had a broad and deep decline Thursday on a disappointing read on Chinese manufacturing and the U.S. Federal Reserve's latest indication that it may be time to wind down economic stimulus. Many miners are already working on razor-thin margins, and if prices do not recover soon, they will be forced to make difficult decisions about their businesses.

The Bank of Canada is the nation's central bank. We are not a commercial bank and do not offer banking services to the public. Rather, we have responsibilities for Canada's monetary policy, bank notes, financial system, and funds management. Our principal role, as defined in the Bank of Canada Act, is "to promote the economic and financial welfare of Canada."

by Mike Moffatt, Canadian Business on Monday, June 17, 2013 6:05pm - This article appeared first on Canadian Business. Is the Canadian economy improving? If you had asked me last week, I would have said the signs look good. Today, I am less sure.