-

About

- About Listly

- Community & Support

- Howto

- Chrome Extension

- Bookmarklet

- WordPress Plugin

- Listly Premium

- Privacy

- Terms

- DMCA Copyright

- © 2010-2025 Boomy Labs

Ngulminthang Lhanghal

Ngulminthang Lhanghal

Listly by Ngulminthang Lhanghal

Here in this list of finance, banking, import, export, trade finance, letter of credit you can read financial guides and can understand the financial terms used in in international banking and financial business transactions. Know whatever you want to know about finance.

Follow me:- Ngulminthang

New Mountain Finance Corporation (NASDAQ: NMFC) (the "Company", "we", "us" or "our") today announced its financial results for the quarter and year ended December 31, 2020 and reported fourth quarter net investment income of $0.30 per weighted average share. At December 31, 2020, net asset value ("NAV") per share was $12.62, compared to $12.24 at September 30, 2020 and $13.26 at December 31, 2019. The Company also announced that its board of directors declared a first quarter distribution of $0.30 per share, which will be payable on March 31, 2021 to holders of record as of March 17, 2021.

Read more:- https://finance.yahoo.com/news/mountain-finance-corporation-announces-financial-213500358.html

A bank guarantee is a legal agreement between the Bank, the beneficiary, and the applicant ie. the borrower where the bank provides a guarantee to the beneficiary on the behalf of the borrower that the contractual obligations will be met in case the borrower is unable to do so. In other words, in a bank guarantee, the borrower/debtor appoints a lending institution ie. a bank to cover its losses if he defaults or fails to pay the loan. The bank assures the beneficiary through this bank guarantee that if the borrower does not perform his legal obligation or fails to settle the debts, then it will be taken care of by the bank.

Read more:- https://emeriobanque.weebly.com/blog/difference-between-bank-guarantee-and-corporate-guarantee

A Usance Letter Of Credit is a particular type of letter of credit where the buyer gets a predetermined credit period ie. These usance letters of credit are payable within a predetermined time only after the presentation of the confirming documents. These are also known as Time LC or Deferred Payment LC.

Read more:- https://emeriobanque.blogspot.com/2021/01/usance-letter-of-credit-definition-and.html

Personal finance is an essential term that consists of planning and managing money, savings as well as investments. It includes budgeting, banking, insurance, investments, mortgages, retirement planning, and tax planning. The concept of personal finance is all about determining your personal financial goals such as savings for short-term financial needs or planning for retirement etc. It depends on your income, expenses, and financial individual goals to fulfill those financial requirements.

Read more:- https://emeriobanque.weebly.com/blog/benefits-of-personal-finance

Are you seeking a personal loan to expand your business? Do you need finance for buying more equipment for your business? Well, applying for a personal loan can help you solve all your financial problems but how you convince a bank or a lending institution to give you a personal loan is totally up to your awareness of the essential criteria.Lending services can be a quick and effective way to cater to your every type of business needs whether it is for starting a new venture or consolidating debt. But getting personal finance from a bank involves a complex procedure with the significant steps of customer verification which conclude your overall result.

Read more:- https://emeriobanque.mystrikingly.com/blog/bank-checks-before-lending-money

TOKYO, Feb 24 (Reuters) - Japanese government bond yields rose on Wednesday as investors remained wary of buying ahead of a Bank of Japan policy review next month, amid speculation it could widen the 40 basis point band under which it allows 10-year yields to move around its 0% target.

Read more:- https://finance.yahoo.com/news/jgb-yields-rise-cautious-trade-074514494.html

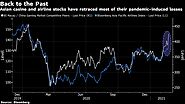

(Bloomberg) -- The recent surge in shares linked to leisure and tourism shows there is still plenty of money to to be made on the reopening trade.

Macau casino stocks jumped on Tuesday by their most in nearly two-and-a-half months after the gambling hub reopened its doors to quarantine-free travel from mainland China. U.K.’s travel and entertainment shares soared after Prime Minister Boris Johnson announced plans to reopen the economy.

Read more:- https://finance.yahoo.com/news/still-money-made-reopening-trade-071039024.html

BEIJING (AP) — China’s commerce minister appealed to Washington for “joint efforts” to revive trade but gave no indication Wednesday when tariff war talks might resume or whether Beijing might offer concessions.

“Cooperation is the only correct choice,” Wang Wentao said at a news conference.

President Joe Biden has yet to announce a strategy for dealing with Beijing but is widely expected to renew pressure on trade and technology complaints that prompted his predecessor, Donald Trump, to raise taxes on Chinese imports.

Read more:- https://finance.yahoo.com/news/chinese-official-calls-joint-efforts-093207061.html

Global transportation management software (TMS) provider BuyCo has landed an investment from French financial services group ODDO BHF that will also entail the two entities developing trade finance products for BuyCo’s shipper customers.

Terms of the investment were not disclosed, but BuyCo said the funding from ODDO, announced Monday, brings the total investment into the Marseille-based software provider to 6.5 million euros (US $7.9 million) since its founding in 2015.

Impello Global, a trade finance advisory group and trade credit insurance brokerage headquartered in Seattle, has hired Matthew Handwork as its new head of structured trade finance.

Starting with immediate effect, Handwork will work with lenders and manufacturers to grow the firm’s structured trade finance business globally. He will continue to be based in Columbus, Ohio.

Read more:- https://www.gtreview.com/news/on-the-move/impello-global-appoints-new-head-of-structured-trade-finance-2/

The research report on ' Non-Bank Trade Finance market' now available with Market Study Report, LLC, offers a detailed analysis of the factors influencing the global business sphere. This report also provides precise information pertaining to market size, commercialization aspects and revenue estimation of this business. The report further elucidates the status of leading industry players thriving in the competitive spectrum of the ' Non-Bank Trade Finance market'.

Mundi, a startup helping exporters and forwarders in Mexico get access to trade financing, this week landed a $7.8 million seed venture capital funding round to help grow Mexican export volumes.

The New York-based company is initially targeting the Mexican small and medium-sized enterprise (SME) market, with a product designed to free up working capital by letting them tap into a pool of trade finance. Those companies typically struggle to get such financing from banks, which perceive smaller exporters as too big a risk to back, CEO Martin Pustilnick told JOC.com.

HSBC and Qatar Islamic Bank (QIB) have closed an Islamic trade finance facility worth US$100mn. The financial institutions refinance trade facility is a new addition to HSBC’s Islamic product suite, according to a press statement by QIB.

Read more:- https://www.gtreview.com/news/mena/hsbc-and-qib-agree-us100mn-islamic-trade-finance-deal/

The publisher brings years of research experience to the 9th edition of this report. The 199-page report presents concise insights into how the pandemic has impacted production and the buy side for 2020 and 2021. A short-term phased recovery by key geography is also addressed.

Read more:- https://finance.yahoo.com/news/global-trade-finance-industry-2020-130300318.html

Greensill began to unravel last Monday when its main insurer stopped providing credit insurance on $4.1 billion of debt in portfolios it had created for clients including Swiss bank Credit Suisse.

The court document supporting Greensill’s insolvency application said without that insurance, Greensill was no longer able to sell notes backed by debts to investors, nor fund clients such as GFG in return.

Read more:- https://www.reuters.com/article/us-britain-greensill-idUSKBN2B01WB

DARIEN, Conn., March 08, 2021 (GLOBE NEWSWIRE) -- Old Hill recently provided an $8 million senior secured pre-export credit facility to a company in Latin America with whom it had a previous lending relationship. The company exports specialty agricultural products to top-tier global distributors. Old Hill’s financing allowed this exporter to lever its inventories during the harvesting and processing cycle resulting in working capital for its business. This is the second such facility Old Hill has provided to this exporter and reflects Old Hill’s interest and expertise in trade finance. Security for the facility consists of physical commodities pledged under warehouse receipts, as well assignment of export contracts and receivables.

HSBC has once again retained the top spot in Euromoney’s Trade Finance Survey for 2021. German lender Deutsche Bank maintains its second-placed ranking while Citi regained its third-place position from last year’s holder UniCredit.

The top 10 ranking had one new entrant, ING Group, with the Dutch bank moving from 15th place to seventh. Heading in the other direction was Commerzbank, which slipped from fifth place to ninth.

In recent years, financial institutions have been keen to stay ahead of the regulators and adopt a holistic approach to their own Environmental, Social and Corporate Governance (ESG) strategy to ensure they are well-placed to meet the financing and advisory needs of new and emerging sectors.

The result of this means that the market for financial products that pursue sustainability objectives has grown substantially in terms of volume and diversity. For corporates, this presents an exciting new opportunity.

One such product available is sustainability linked loans, which facilitate and promote sustainable economic activity and growth (without a specific use of proceeds requirement) by incentivising the borrower’s achievement of ambitious, predetermined ESG performance targets through the pricing of the loan. These loans can be applied to working capital facilities, term loans, revolving credit facilities, or more specialist trade finance. As well as being applied to new loans, sustainability linked targets can be integrated into existing facilities.

Read more:- https://www.lexology.com/library/detail.aspx?g=27413658-f964-4012-b784-6bafa4a4c338

LONDON, March 8, 2021 /PRNewswire/ -- Investment Banking boutique CFE Finance, specialised in niche credit strategies and trade finance, has been listed as one of the first 300 companies in the 2021 special ranking "FT 1000: Europe's Fastest Growing Companies".

The Financial Times report, compiled with the German research company Statista, analyses the performance of hundreds of companies and lists the ones that have achieved the highest compound annual growth rate in revenue in the last twelve months. The 2021 ranking has been published this week in the special report "FT 1000: Europe's fastest-growing companies".

India provides one of the biggest opportunities for investing in private credit or situations where borrowers are unable to raise money from usual sources such as the banking system and are under distress, according to experts from global and local institutions who convened to share their thoughts at Indian Private Equity and Venture Capital Association’s (IVCA) tenth conclave which is taking place virtually.

“There is a big vacuum in the MSME sector which is unable to raise money easily. Real estate is another sector that doesn’t have access to all available sources of funding such as bond markets. So there is a big opportunity to provide credit here for private players like ourselves”, said Nipun Sahni, Partner, Apollo Global Management, amongst the largest credit investors in the world with $320 billion under management.

More than 7 years of experience in the international trade finance and related business scene in South and South-East Asia, China and Australia.

Financial expert in international trade finance and related business areas with more than 7 years experience.

Technology provider dltledgers has received a $7 million funding injection in a Series A round led by Regis and Savoy Capital, Vittal, Walden International and various veteran industry leaders, it said in an announcement on Thursday.

At the same time, the company will migrate its blockchain-based solutions from the Hyperledger Fabric to Corda, R3’s enterprise blockchain platform, which will enable businesses in trade finance to streamline business operations, while reducing overheads.

Read more: https://www.finews.asia/finance/34104-singapore-fintech-to-grow-trade-finance-platform-dltledgers

Finastra today announced the integration of its Fusion Trade Innovation and Enigio’s trace:original for the development of a solution responsible for managing and handling digital original documents using DLT. The integration will be carried through Finastra’s FusionFabric.cloud open developer platform and is expected to offer benefits including straight-through processing and machine readability for faster turnaround times and shorter servicing lead times.

“The open integration of Enigio’s trace:original with Fusion Trade Innovation makes it incredibly easy for banks to generate traceable documents, with the significant benefits that this brings – including increased efficiency, reduced costs and increased fraud protection,” said Iain MacLennan, VP Trade and Supply Chain Finance at Finastra. “We look forward to welcoming customers into the era of digital trade, helping to make paperless trade finance a reality.”

Read more: https://ibsintelligence.com/ibsi-news/finastra-and-enigio-team-up-to-boost-paperless-trade-finance/

Drip Capital, the fintech firm that focuses on providing trade finance to exporters and importers announced its partnership with California-based East-West Bank (EWB) for a $40 million credit facility. The credit will be used by Drip Capital to offer its trade finance solutions to a wider range of small and medium-sized businesses (SMBs).

“In the past, we have engaged with a lot of family offices and funds but getting a strong bank partner is also an important milestone for the company. It helps to prove to the investor community that banks are interested in this asset and are wanting to finance these assets,” Pushkar Mukewar, Co-Founder and CEO, Drip Capital told Financial Express Online.