-

About

- About Listly

- Community & Support

- Howto

- Chrome Extension

- Bookmarklet

- WordPress Plugin

- Listly Premium

- Privacy

- Terms

- DMCA Copyright

- © 2010-2025 Boomy Labs

GOLDundercover

GOLDundercover

Listly by GOLDundercover

Source: http://goldundercover.com

Marc Faber, The Gloom, Boom & Doom Report, explains why the thinks the Fed's quantitative easing program is permanent and is likely to increase.

25 July 2013

From the blog Talking Numbers: A feud is breaking out between two of Wall Street's most followed commentators. Dennis Gartman responds to Art Cashin's comments on gold conspiracy theories. A feud is breaking out between two of Wall Street's most followed commentators. Art Cashin, UBS ... Cashin's hardly a gold conspiratorist...→

19 July 2013

Focus on 2Q Equity Earnings & 3Q Forecasts - not time for gold, yet.

From the blog Talking Numbers: David Darst, Morgan Stanley Wealth Management Chief Investment Strategist, on what's next for gold. Fed policy is one of the many factors currently affecting gold but what about the long-term?

16 July 2013

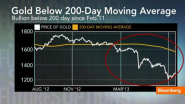

Gold spends longest time under 200-day MA since 2011...

Bloomberg senior market correspondent Julie Hyman and Dominic Chu focus on the recent ups and downs in the gold market and take a look at the latest market statistics in "On The Markets." They speak on Bloomberg Television's "In The Loop."

15 JUL 13

Marcus Grubb, World Gold Council, explains why pullbacks in the gold market are natural and provide a value buy for any investor.

27 June 2013

Another day another beating for gold. The yellow metal fell another 3.5% overnight bringing it to prices unseen for almost three years. The SPDR Gold Trust ETF (GLD) is now down over 25% year-to-date as retail investors find themselves on the wrong side of what is suddenly looking like one of the great boom-bust cycles.

From the blog Talking Numbers: Gold is down more almost 24% this year. Dennis Gartman, Founder and Publisher of the Gartman Letter, says the worst is yet to come. Dennis Gartman's three reasons why gold is going lower: No more easy monetary policy: Gartman says: ... Continue reading →

From the blog Talking Numbers: Gold dropped below $1,300 overnight. Here's why it may fall even more - down to $1,000. Gold bugs felt the heel of Fed tapering as prices of the yellow metal fell 4.5% overnight. Not only did it break below $1,300 ... Continue reading →

It's been exhausting trying to keep up with all the newsflow...anyone in any part of the world can post relevant gold videos here, please feel welcomed to add to the list.

7 June 2013

Roubini is not living on planet Earth, per Jim Rickards, author of Currency wars, rebuts Roubini's 6-pointer blast against gold.

21 May 2013

Gold and silver are eyeing the Federal Reserve's policy-making minutes due out Wednesday, Grafite Capital's Mihir Dange tells Joe Deaux.

Gold volatility increasing, go long $1,337.

21 May 2013

Just as the Beatles sent the world into a frenzy in the summer of '64, rockstar Prime Minister Shinzo Abe's latest hit "Abenomics," is taking Japan by storm. Since announcing his economic jumpstart policies back in November, the Nikkei (N225) has surged 70%, and now comes fresh evidence that the economy has improved as well, with GDP climbing higher due to strong exports and factory output.

I still own the US$ and I will buy more, what else is there?

21 May 2013

Arnab Das of Roubini Global Economics says, in an interview to CNBC-TV18, that the economic scenario is not ready for the US Fed to pull the plug on QE and expects gold to trend down on a stronger dollar environment.

21 May 2013

In recent years, the "growth vs. austerity" debate has been raging in academic and policy circles. In recent weeks the growth crowd have been claiming victory, citing: Research showing Carmen Reinhart and Kenneth Rogoff's seminal work on debt-to-GDP levels contained numerous errors and was not so conclusive as originally believed.

Kudlow repeats a mea culpa about U.S. monetary policy. “Bernanke was right,” he says. “He put the money in and those of us who expected inflation were wrong.”

In admitting as much (repeatedly), Kudlow shows he’s not doctrinaire about the best policy prescriptions or unwilling to let the facts get in the way of his opinions. In this regard, the conservative stalwart stands out from many others in the inflation camp.

21 May 2013

Which metal is the worst? The outlook for gold and silver, with CNBC's Jackie DeAngelis and the Futures Now Traders.

As other currencies debase, US$ will strengthen, gold will get crushed.

21 May 2013

Rotation from gold and other ETFs into equities to pick up.

Even with QE infinity, there is no kick left for gold. Expectations are that Bernanke will pull back.

Huge options player playing the gold market at key technical points.

The latest insight into the hot world of commodities and the companies that produce them, including interviews with mineral and mining entrepreneurs from Canada and around the globe.

21 May 2013

Gold prices decline; experts' outlook on commodities. Volatility is great for paper gold traders.

What should long-term investors pick, gold or silver? Retail space clearly shows gold is the clear choice.

21 May 2013

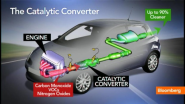

On today's "Futures In Focus," Bloomberg's Alix Steel examines how use in catalytic converters has lifted platinum and palladium prices as gold and silver have fallen into a bear market. She speaks on Bloomberg Television's "Market Makers."

20 May 2013

Gold prices are up about $19 right now, reports CNBC's Sharon Epperson. Gold prices were sharply lower earlier in the session.

20 May 2013

Pinaki Rath, managing director at Gold Matrix Resources, tells ET NOW he is bearish on gold in the short to medium term and sees the yellow metal reaching price levels of $1,200 per ounce.

20 May 2013

Silver continues its downward move as gold sinks and industrial production slows, RJO Futures's Phil Streible tells TheStreet's Joe Deaux.

21 May 2013

After cresting to highs, gold has been looking more earth-bound recently. Is this the end of the bull market or just a pause? Scott Colyer, chief executive at Advisors Asset Management, joins Money Beat. Photo: Getty Images.

21 May 2013

An ounce of gold, often represented by a single American Eagle coin, is a fairly easy thing to visualize. Even a 400 ounce gold bar, like the ones held at Fort Knox, is a fairly fathomable concept. But when you try to get your head around just how much of the metal an ETF like ike the SPRD Gold Shares (GLD) owns, it can get a little daunting. And the same is true when you try to track how much they've had to sell as the price of gold slips to a 2-1/2 year low.

"300 tons," says Tom Lydon, the editor of ETF Trends, in the attached video, calling the disposal of over 600,000 pounds of gold so far this year "amazing" and "incredible."

21 May 2013

South African National Union of Mine workers striking for minimum wages 7,000 CNY or US$750-850 for gold miners.