-

About

- About Listly

- Community & Support

- Howto

- Chrome Extension

- Bookmarklet

- WordPress Plugin

- Listly Premium

- Privacy

- Terms

- DMCA Copyright

- © 2010-2025 Boomy Labs

IndiaLends

IndiaLends

Listly by IndiaLends

You can get the choice of your Citi Bank Credit Card with instant approval and hassle-free documentation.

Credit cards and loans have a great impact on your credit score. So, you need to stick to your credit limit which should not be more than 30% and try to adopt healthy credit habits like paying your loan EMIs and credit card bills always on time. Also, make sure whenever you apply for any loan or credit card, you should always check your credit score online with any of the credit bureaus. You can also download your free credit report once a year which will help you know where you stand on credit.

The features associated with online personal loans such as unsecured, easy availability, convenience, and multipurpose nature makes it the most popular choice of people nowadays in comparison to the offline personal loan. Learn more about an online personal loan here.

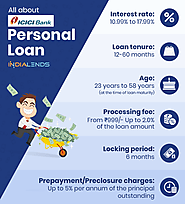

ICICI Bank is one of the top private lenders that offer unsecured loans at a competitive rate of interest. Personal Loans help them to meet their emergency needs. Applicants can easily apply for the loan online by following easy steps. Apart from this, applicants can also track their loan status by login into their net banking account to proceed further.

There are a plethora of credit cards available online nowadays. Some of the top lenders that offer best online credit card are SBI, HDFC, ICICI and Yes Bank among others. You can easily apply for credit card online to meet your immediate requirement when you are facing a severe cash crunch in your life. Make sure you don't forget to check your credit score and eligibility before applying for it.

Applying for the credit card online is the fastest and the most convenient method because you can do it any time, from anywhere. It also gives applicants the convenience to compare multiple credit card offers online, which you really need to do if you want to find the best deal. Learn here how you can apply for a credit card online?

If you are looking for a credit card that has features such as cashback, rewards, and discount offers on dining, shopping, and entertainment, then apply for ICICI Bank Credit cards. Online you can know about features, eligibility, ICICI credit card offers, apply for the card, and then check ICICI credit card status at any time just with a click of a mouse. Every time you make a purchase with the ICICI Bank Credit card, you will earn reward points that you can redeem against a host of gifts and merchandise.

If you are willing to enjoy incentives such as discounts, reward points, cash backs, and air miles then apply for an SBI Credit card. Here you can find the reasons to get an SBI Credit card that makes decision making easier for you.

If you are looking for credit cards with benefits such as lounge access, cashback, travel benefits, or lifestyle benefits. Here is the list of the best credit card offers to explore in 2020 including both free credit cards and premium credit cards.

Credit has become an indispensable part of our lives today. They help in making your online transactions much easier and reduce the need for carrying physical cash in your wallet. There are a plethora of best credit cards available nowadays. You need to select the card that matches your needs and lifestyle to get the most of your credit card. You can apply for a credit card online after checking your eligibility criteria.

If you are in search of a credit card that offers you travel in luxury, in that case, HDFC Regalia Credit card Or HDFC regalia First Credit card would be a wise option to consider. It is among the top tier of cards of HDFC bank which comes with the host of lifestyle and travel Rewards.

When you start searching for the best credit card in India, you will come across multiple credit cards having different types of features. So always choose the card that matches perfectly with your spending habits. Here is the list of top 10 credit cards of 2020.

Using a credit card has a direct influence on the most important factors that go into your credit score. So, getting a credit card and using it regularly and responsibly is one of the quickest and most effective ways to build your credit score. Here is how you can use your credit cards to build your credit score in no time.

American Express card is also known as Amex credit Card. It is known for its fabulous Amex credit card offers. You get one point on every pound you spend on purchases. You can make use of those reward points the way you want with a range of travel, shopping, and entertainment partners. American Express has a range of flexible credit card options to suit your individual needs. Compare and choose the best one.

The use of the credit cards allows you to borrow money up to a certain limit, which must be repaid to meet any form of immediate financial need. On the other hand, it works best in building up your credit scores, if you are practicing positive payment activity. Each of the bank or card is having a different parameter for approving a credit card application.

American Express card is also known as Amex credit Card. It is known for its fabulous Amex credit card offers. You get one point on every pound you spend on purchases. You can make use of those reward points the way you want with a range of travel, shopping, and entertainment partners. American Express has a range of flexible credit card options to suit your individual needs. Compare and choose the best one.

Credit cards have become one of the most popular financial tools nowadays. They have made shopping easier, convenient, and safer. To become eligible for a credit card, you need to meet the specific eligibility criteria. Here you can check the basic eligibility criteria to secure a credit card in India and some tips to boost your credit card eligibility.

If you are starting your credit journey, opting for a lifetime free credit card would be a sensible option. If you meet the eligibility, you can easily apply for a lifetime credit card from any bank of your choice after going through their detailed terms and conditions online. Here have a look at some of the best lifetime free credit cards to make a better choice and the perks of applying for such cards.

Choosing the perfect card for you can make all the difference between enjoying benefits that are perfect for you or getting benefits that make no sense to you. Here we have come up with various points that you need to consider before choosing the right card that suits best as per your lifestyle requirements.

Getting a first credit card can be a daunting task if you are not aware of the right approach. Here, in this guide, we have discussed in detail about how you can apply for your new credit card and what important things you need to know before filing your application.

SBI offers a wide range of credit cards with unmatched benefits, discounts, and deals. You can apply for an SBI credit card online or offline at your convenience. You can use them for doing your online shopping, save on dining, travel, or movies. All SBI credit cards provide excellent benefits to the users in the form of rewards, cashback, complimentary airport lounge access, and a lot more. Let us have a look at everything you need to know regarding SBI credit cards.

IndiaLends is a digital lending and borrowing marketplace. It offers different types of loans like personal loans, unsecured loans, installment loans and oth...