-

About

- About Listly

- Community & Support

- Howto

- Chrome Extension

- Bookmarklet

- WordPress Plugin

- Listly Premium

- Privacy

- Terms

- DMCA Copyright

- © 2010-2025 Boomy Labs

IndiaLends

IndiaLends

Listly by IndiaLends

Instant Personal loans are designed for the well being of customers and is being used based on preferences and needs.

Apply for a personal loan online, it comes with the feature of instant approval and quick disbursal in comparison to other forms of credits. Apart from that, there is no need to give any collateral against the loan. It is the best way to cope up with your financial needs be it any medical emergency, planning a dream wedding or a vacation or any other kind of emergency. Instant Personal loans are designed for the well being of customers and is being used based on preferences and needs.

Online you can get a fast-personal loan at reducing interest rates if you are looking for quick financing for your urgent needs. You can apply for a personal loan via laptop or phone according to your convenience. Via phone you can use the mobile app of the lender, check your eligibility, choose the loan offer, upload the scanned documents and after the verification of documents, loan disbursal will take place.

An online personal loan helps an individual to bear any urgent expenses be it is a wedding or a home renovation or any kind of emergency expenses. When you apply for a personal loan unlike others there is no restriction on the loan amount as you can make use of the money for any purpose. The loan processing time is also very fast as compared to other forms of credit. Apart from that, when you apply for a personal loan online, you also get a chance to make comparisons of various loan offers. | Apply for Personal Loans Online

Online get personal loan approved quickly with limited documentation. When you apply for a personal loan online there are no hidden fee charges and there are zero-part prepayment fees. Now you can apply for a loan online just with a click of a mouse and make comparisons of various loan offers available with the banks and NBFCs sitting in one place. All you need to do is check your eligibility to get instant approval and avail of the benefits of the online personal loan.

If you are thinking of buying a health insurance policy, stop thinking, and purchase one right away. As a result, health insurance companies charge a higher premium for insuring people beyond a certain age. Read ahead to know more about buying health insurance plans and the documentation required for it.

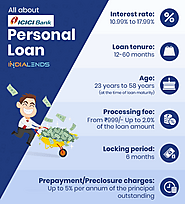

A personal loan is a type of unsecured loan and helps you meet your current financial needs. If you are looking for an instant e-approval, then go for ICICI personal loan apply online. It is a very quick and easy process to get a low- interest rate loans requiring minimal documentation. ICICI personal loan works best when you want to meet your immediate expenses. Here you can get a personal loan up to 20 lakhs if you have a required document to apply for a personal and meeting all the eligibility criteria.

Bajaj Finserv offers personal loans to its customers at an affordable interest rate starting from 12%. Bajaj Finserv with its lowest personal loan interest rates ensures to reduce your overall loan burden. If you are not satisfied with the personal loan interest rates offered by your existing lender, switch to Bajaj Finserv, and enjoy the lower rates. Apply Bajaj Finserv Personal Loan Instantly Online at a low-Interest Rate and calculate your EMI with IndiaLends. Check the Documents required.

HDFC Personal Loan offers highly competitive interest rates and has special offers and interest rates for HDFC Bank account holders. The personal loan is available on the basis of a person’s credit history like his repayment history on other loans and credit cards. The interest rate offered for the HDFC Personal loan top-up is between 9.15 % p.a. to 9.65 % p.a. and the tenure is subject to that of the existing loan.

Bajaj Finserv offers customized personal loan interest rates and schemes for special categories of borrowers, including borrowers working in reputed companies, banks, or government employees, etc. As of today, Bajaj Finserv Personal loan interest rates are in the range of 12.99% to 15.50%, with the lowest rates offered to existing customers of the bank with a strong CIBIL Score and for those working with reputed corporate with a stable employment history.

Personal loans are one of the most popular financing options available today. It can be used for a variety of purposes such as a wedding, higher education, house renovation, debt consolidation, and lots more. The best part is you can get instant approval if you meet the eligibility criteria and have a good credit score. Check here the top reasons for which you can avail of a personal loan.

Getting a loan for emergency requirements is not a tough task these days as you have the option to get an instant loan. An instant loan is basically the updated version of personal loan which is available online. An instant loan provides you instant access to money and requires minimum or no documentation which makes it convenient for the borrowers.

EPF scheme aims at promoting savings to be used post-retirement by various employees all over the country. The Employees Provident Fund Organization (EPFO) assists this board in its activities. It is a statutory body constituted by the Government of India that promotes employees to save funds for retirement. Know here in detail regarding its structure and functions.

HDFC Bank is one of the top private lenders in India. Borrowers can avail of a low rate of interest HDFC Personal Loan online with quick and hassle-free approval. The loan will help you to meet your instant financial needs for a variety of purposes like higher education, wedding expenses, debt consolidation, travel expenses, etc. Borrowers can easily apply online and track their personal loan status by login into their net banking or internet banking.

Now you can keep a track of the current status of your HDFC loan online just with a click of a mouse. All are required to enter the loan details to get the HDFC personal loan status by logging into the website of HDFC Bank. Apart from that, you can also make an easy comparison of various HDFC personal loan interest rate offers after checking your eligibility to arrive at a firm decision.

The HDFC bank is known for offering a wide variety of services and products, among all, one of the key offerings is HDFC Bank Personal Loan. In the past 21 years, Bank has won the trust of customers and become the most preferred financial service provides especially when it comes to providing personal loans. Read here the benefits of applying for a personal loan with HDFC Bank.

Now you can keep a track of the current status of your HDFC loan online just with a click of a mouse. All are required to enter the loan details to get the HDFC personal loan status by logging into the website of HDFC Bank. Apart from that, you can also make an easy comparison of various HDFC personal loan interest rate offers after checking your eligibility to arrive at a firm decision.

HDFC Bank is one of the top private lenders in India. Borrowers can avail of a low rate of interest HDFC Personal Loan online with quick and hassle-free approval. The loan will help you to meet your instant financial needs for a variety of purposes like higher education, wedding expenses, debt consolidation, travel expenses, etc. Borrowers can easily apply online and track their personal loan status by login into their net banking or internet banking.

When you are going to apply for a personal loan, at that time lender always checks your borrowing power. As you enter the loan amount, personal loan interest rate, and loan tenure, the calculator instantly displays your EMI. If you are having a good credit history, it will strongly improve your borrowing power and helps you to get personal loan approval in the future easily. Learn about the factors that will help in knowing your borrowing power.

IndiaLends is one of the best digital lending platforms to get the low-interest rate personal loan of the top banks and NBFCs. It is a collateral-free loan and the interest rate offered to the applicant is based on their credit profile. When you are accepting any loan offer, there are certain factors to keep in mind. This will be a key to get a low interest rate personal loan offer.

IndiaLends is a digital lending and borrowing marketplace. It offers different types of loans like personal loans, unsecured loans, installment loans and oth...