-

About

- About Listly

- Community & Support

- Howto

- Chrome Extension

- Bookmarklet

- WordPress Plugin

- Listly Premium

- Privacy

- Terms

- DMCA Copyright

- © 2010-2025 Boomy Labs

Hubbe Business

Hubbe Business

Listly by Hubbe Business

Hubbe is a leading marketplace for small business owners to get funding assistance through different types of business loans.

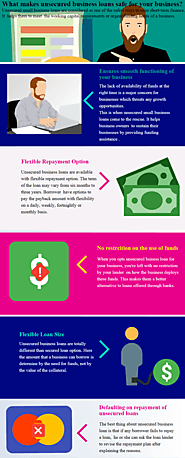

Unsecured business loans are undoubtedly the best option for small business owners to get funding assistance they need to grow their business. It is safe for all types of business owners and does have several benefits like flexible repayment option, fast approval and quick access to funds.

For small businesses and start-ups small business loans emerge as an effecitve medium for removing business hurdles. Checkout how small business lending helped John to overcome his financial hurdles.

Getting instants funds for business expansion is challenging for a business owner if he had bad credit history. Discover how business loans with bad credit through alternative lenders helped a retail business owner in this situation.

Getting loans for business is very hectic and full of lengthy paperwork which may affect your business growth if you didn't get funding at the right time. You…

Getting a business loan is very challenging for small business owners especially when they fail to meet the lender's qualification criteria. To meet the funding requirement, unsecured business loans will be an ideal option.

Hubbe is a name you can rely upon for flexible funding solutions that can help your business to grow. We strive to help small businesses with the much-needed funds they need to grow their business.

Getting loans for business is very hectic and full of lengthy paperwork which may affect your business growth if you didn't get funding at the right time.

You can use external sources like small business loans for funding assistance to develop effective marketing strategies for your business.

Enquire more at : https://hubbe.com.au/

For businesses who sell to other businesses on credit terms, Hubbe's Invoice Finance could be the solution to your cash flow requirements.

What’s great about it is that property security is not usually required. Access to funding is scalable, growing as sales grow.

Thanks for watching it. If you found this content helpful please take a second and like, share and comment. Also, make sure to follow us for more great content.

For more information on invoice finance visit https://hubbe.com.au/small-business-loans/invoice-finance/.

Hubbe offers the best-unsecured loans in Australia for small businesses with the easiest application process and fast approval which allows you to get the fund within 24 hours.

Thanks for watching it. If you found this content helpful please take a second and like, share and comment. Also, make sure to follow us for more great content.

Funding is the major roadblock to different stages of business growth. Discover how unsecured business loans offers perfect funding solutions for various stages of business growth.

An unsecured business loan as its name implies is a type of business loan which you can avail without keeping any asset as security. It is an amazing funding options for small business owners related to different industries. A borrower with a poor credit history can easily apply for such loans.

Are you suffering from capital fluctuations in your import business and thinking of funding your import business through a business line of credit? Checkout how business line of credit can help you to get rid of capital fluctuations.

For small businesses, it is merely a challenge to maintain the business and make it profitable. Checkout how Fast unsecured business loans from alternative lenders helps as a savior for them.

Acquiring a small business loan in Australia is very challenging for small business owners due to several factors. Here’s what should you do when you can't get access to funds you need to grow your business.

The end-of-year (EOY) bring struggles, with unpaid invoices and seasonal peaks to some business owners. But the celebratory season also brings plenty of business opportunities. Discover them here.

Worried for the payment of unpaid invoices? Learn the best strategies to overcome financial challenges and meet invoice needs through alternative financing with EOY offer.

For every business, financial fluctuations are predictable. Checkout how small business loans can help to overcome all the cash-flow challenges with proper planning and techniques,