-

About

- About Listly

- Community & Support

- Howto

- Chrome Extension

- Bookmarklet

- WordPress Plugin

- Listly Premium

- Privacy

- Terms

- DMCA Copyright

- © 2010-2025 Boomy Labs

Listly by 1031xchange-com

1031 Exchange: a way of Sharper Insights to Smarter Investments

Defer your capital gains taxes and upgrade your investment

1031 Exchange Rules 2020 - If you are planning to do a 1031 exchange than knowing these 1031 exchange rules is important for you. Contact today.

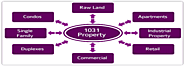

The demand for 1031 exchange property has increased over the years, and the reason is obvious more detail at 1031xchange.com/1031-exchange-properties/

According to Section 1031 of the IRC, it is mandatory for an exchanger to identify replacement properties. For more detail about at https://1031xchange.com/

Replacement property acquired in a 1031 tax-deferred exchange must be “like-kind” to the real estate being sold. Like-kind means “similar in nature or character, notwithstanding variations in grade or quality. For the 1031 exchange commercial properties to pass as “like-kind” they must be maintained for productive use in a trade or business or operated for investment purposes

Though both 1031 and 1033 exchanges let investors defer capital gains taxes, both sections are entirely different from each other. Read about in this article

1031 Exchange defer your capital gains taxes and upgrade your investment. Get Tax benefit, Diversification, Upgrading Undesirable Assets and many more benefits of doing 1031 exchange. Find more detail about 1031 exchange at 1031xchange.com

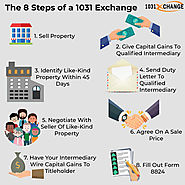

Looking for step-by-step instructions to help you through a 1031 exchange? We have created this 1031 exchange check list just for you.

Section 1031 of IRC or 1031 exchange, is an arrangement that allows investors to defer capital gains taxes on exchanging an investment property. Learn more.

There are different ways through which you can close your 1031 exchange. DST investment is one of them. As a 1031 exchange investor, you can buy DST shares as your 1031 exchange replacement property. When you purchase interests in a DST, you buy interests in the real estate and not in the

trust. That’s why DST investment is considered a real estate investment and qualifies for 1031 exchanges.

The Investor still needs to pay their capital gains tax eventually if they ever choose to sell their appreciated property without buying a new property of the same value.

1031 exchange commercial properties to pass as “like-kind”. they must be maintained for productive use in a trade or business or operated for investment purposes.

using a 1031 Exchange, an investor can defer capital gains taxes on exchanging like-kind properties, which otherwise they would be liable to pay. However, that’s not complete knowledge.

1031 exchange Louisiana - If you are looking for 1031 exchange services in Louisiana then get in touch today with 1031xchnage Experts.

Get answers from all 1031 exchange questions related to Arizona investment properties. In Arizona, property prices are skyrocketing. Interest rates are steady, and appreciation rates are increasing gradually.

Are you are looking for 1031 exchange properties in san-Francisco then 1031xchange is the right place for you. Due to San Francisco investment properties have high rental Income

Deferred capital gain Taxes- Sign up now to learn the ways to defer capital gains Tax in 1031 Exchange by connecting with our 1031xchange Experts .

Colorado housing market is the seventh fastest-growing in the country. It’s been underrated for a long time, but there has been a massive spike in newcomers in recent years. The Centennial accommodated nearly 80,000 new people last year, which is a population growth of 1.4%.

Interested in learning about how to do a tax deferred exchange? Simply give us a call for consultation and assistance on capital gains tax.