-

About

- About Listly

- Community & Support

- Howto

- Chrome Extension

- Bookmarklet

- WordPress Plugin

- Listly Premium

- Privacy

- Terms

- DMCA Copyright

- © 2010-2025 Boomy Labs

IndiaLends

IndiaLends

Listly by IndiaLends

Dream of every couple is to make their marriage a lavish one. If your dream is same, then apply for personal loan and live up to your dream of having a fairy tale marriage. Life is too small to fulfill all the dreams, but it is possible to live up to some of your dreams by applying for personal loan from IndiaLends. Visit- https://bit.ly/2kNoTU3

Personal loan offered by all the top banks and NBFCs. It is easy to avail as it comes up with the best affordable interest rates. Now one can easily go with the option of online personal loan as it will help in getting loan sanctioned within few hours. So now keep your all worries aside, go with the option of digital process to apply for personal loan. It will help you to deal with all types of financial cash crunch in a hassle-free manner.

In this era, nobody wants to wait for a long time to get dreams fulfilled. Now shortage of money can’t stop you from living your dreams apply Personal Loan.

One can apply for a personal loan online anytime and anywhere just with a click of a mouse. The online personal loan process is very quick and convenient and helps in getting instant approval. Being multipurpose and unsecured, Online Personal Loan becomes one of the best-selling credit products of the credit market. If you are in search to fill the gap between accumulated income and expenses, apply for personal loans available at affordable interest rates and easy repayment options.

FinTech with features such smooth documentation process and not having a stringent eligibility criterion made it possible to take online personal loans quickly. If you are looking to get an instant loan, then FinTech would be the most favorable option, as disbursal takes here in a matter of minutes.

A medical loan is an unsecured personal loan and as the name suggests health insurance is an insurance product. With a medical personal loan, you can go to any hospital of your choice and convenience, be it a non-cashless hospital as you can pay cash from the medical loan disbursed to you. IndiaLends helps you get the medical personal loan in the quickest way possible at an attractive rate of interest. Visit the IndiaLends website to know more.

CIBIL score plays an important role in the time taken for the loan approval. Better is your CIBIL Score higher is the chances of getting an instant personal loan approval. Good Credit or CIBIL score will help in gaining the trust of your potential lenders.

Apply for loans on marketplace lending platforms that have partnerships with multiple banks and financial institutions that might lend to your credit profile. These platforms provide fast personal loans and lend to a wider consumer segment than regular brick-and- mortar banks, at affordable interest rates.

Personal loans are a perfect credit instrument to deal with any form of financial emergency without pledging any collateral. Whether money is needed for home renovation, for planning a wedding, or for travel purposes or paying off any bills, apply for an online personal loan. Now online you can easily apply for a personal loan, upload scanned documents and after that quick verification will be done online, the disbursement will take place in a few hours.

It is available at an affordable interest rate along with an easy repayment option. But to get the best offers on a personal loan, be sure to compare the loan offers available with all financial lenders as per your eligibility criteria.

Get your Credit Report for free from IndiaLends. Learn how to check your Credit Score online and get the best-evaluated free credit report.

Best Personal Loan offers- Apply online personal loan to get lowest interest rates, instant approval, minimum documentation and disbursal of funds to your bank a/c in 42 hours of Loan Approval. Instant personal loans are a perfect solution for those emergency times as it is approved in a matter of just an hour.

There are multiple financial reasons due to which people felt in need to apply personal loan. The best part about a personal loan is that it is not backed with any kind of collateral and is unsecured. It made the processing of personal loans simplified. For the convenience of an applicant, NBFCs and financial institutions made a collaboration with aggregate sites which provided the facility of applying for an online personal loan.

Your credit report is the snapshot of your credit and repayment history during the past. It lists certain things like the number of loans and credit cards that you have applied to date. It also shows how disciplined you were in paying your loan EMIs and credit card bills on time based on which lender evaluates your eligibility and further decides whether to sanction you the loan or not. So, before you make any loan application make sure that you check your free credit score and download credit report from the official websites.

In the digital era, nobody is too much keen to wait for a long time to get dreams fulfilled. Dream can be of anything. Now shortage of money can’t stop you from living your dreams, as one stop solution to this problem comes in the form of Instant Personal Loan. Now one can easily fulfill his or her dream of foreign tour by applying for instant personal loan.

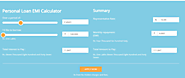

If you are planning to avail of a personal loan, always take into consideration your income and your current commitments. To ascertain the same, there is a personal loan EMI calculator is the perfect way to calculate your monthly EMIs as per your affordability. There is no need to wonder about how much EMI one needs to pay. With an online personal loan calculator, get an idea about the EMIs, interest rate, and tenure of making a loan repayment.

Personal loan among the loans is considered as the best, as a personal loan is an unsecured loan in which neither collateral nor any kind of security is required against your loan. The other advantage of having a personal loan is that you don’t need to submit any document showing the purpose of need as in other loans. So you can say that a personal loan is a multipurpose in nature it can be used according to wish and your needs.

Online you can get a fast-personal loan at reducing interest rates if you are looking for quick financing for your urgent requirements. You can apply for a personal loan via laptop or phone according to your convenience. Via phone you can use the mobile app of the lender, check your eligibility, choose the loan offer, upload the scanned documents, and after the verification of documents, loan disbursal will take place.

The days of waiting in line to file a personal loan application are long gone. Online you can compare and choose the loan offers that match perfectly with your eligibility, just in few taps. So, need not get worried about applying for a personal loan application online as it is very easy once you understand the process and eligibility criteria.

The concept of getting an online personal loan is getting popular among millennials due to the benefits it offers. If you are in dire need of cash, looking for Contactless and Touchless personal loans, then here we share all the benefits of applying for an instant personal loan online. With all these benefits, a personal loan has become the best financial weapon that is easy to avail of and is available with all the top lenders.

If you do not have a decent credit score and you want to apply for a car loan, then it is advisable for you to have a good credit score first to boost your eligibility. You should have a score of 750 or above to stand a good chance of being approved. The higher your score, the better your ability to get a loan. Check here all about car loans and the CIBIL score required for them.

When it comes to meeting emergencies, availing a loan online during such situations will help. Applying for a personal loan online will also help you save some extra bucks that will help you build a secure future. It will not only assist you to acquire the funds to meet emergencies, but it will also help you boost your credit score.

IDFC's first personal loan is here to overcome unexpected expenses be it is a wedding or a vacation or home renovation or higher education etc. With IDFC first, one can get a loan up to Rs 40 Lakh along with features such as a quick approval i.e. 2 minutes, if you are meeting the above eligibility criteria. All you need to do is submit the necessary documents. The tenure to repay IDFC First Bank personal loan varies from 12 to 60 months.

Employees can easily check their EPF claim status either online or offline as per convenience. If you are choosing an online mode, you need to log in to the UAN Member Portal or by visiting the official website of EPFO. Know here in the detailed procedure of EPF Claim status.

Now you can keep a track of the current status of your HDFC loan online just with a click of a mouse. All are required to enter the loan details to get the HDFC personal loan status by logging into the website of HDFC Bank. Apart from that, you can also make an easy comparison of various HDFC personal loan interest rates offer after checking your eligibility to arrive at a firm decision.

Are you dealing with any financial contingencies? You can apply for a loan with Bajaj FinServ up to 25 Lakhs online, sitting from the comfort of your home. Being an unsecured loan, it is a collateral-free loan with a flexible repayment tenure starting from 12 months and goes up to 84 months. Read here about the features and benefits associated with applying for an online personal loan with Bajaj FinServ subjected to meeting the eligibility criteria.

If you are already a customer with a particular bank, it would be a smart move to consider the same bank for opting for a personal loan. It will work in your favor if you have a healthy relationship with your bank. In this case, they may retain you and award a lower interest rate helping you pay lower EMIs.

IndiaLends is a digital lending and borrowing marketplace. It offers different types of loans like personal loans, unsecured loans, installment loans and oth...