-

About

- About Listly

- Community & Support

- Howto

- Chrome Extension

- Bookmarklet

- WordPress Plugin

- Listly Premium

- Privacy

- Terms

- DMCA Copyright

- © 2010-2025 Boomy Labs

mollyharris002

mollyharris002

Listly by mollyharris002

Shine Mortgages are a leading mortgage broker and adviser in the UK. Our expert will help and guide to give you the best rates and get an instant quote.

Source: https://www.shinemortgages.co.uk/

Shine Mortgages offers special mortgages on special offers with no upfront fee and hidden charges. Get loan up to 80% on income on lower rates. Fast procedures and timely disbursement.

ShineMortgage offers affordable mortgage deals with flexibility on credit score status. Get more value on debt-to-income ratio and supple repayment plans.

Shine Mortgage is providing a proper assistance for the first time buyers. You must understand the concept so that you can manage your deal in better way.

Shine Mortgages provides the solution for the mortgage issues and assist the clients in mitigating their burden. This blog explains all the insights of it.

As an independent commercial mortgage provider, we provide you with mortgages for your business aspirations at the best rates with a hassle-free process.

Are you a first-time-buyer? Use ShineMortgages tips and tricks to help you get on the property ladder with info on Help to Buy.

Shine Mortgages give assistance with affordable mortgages for the moving home on lower rates. Best possible price on customization and friendly treatment of borrowers beyond credit score status.

Getting a mortgage with a bad credit history might be difficult, but it is not impossible. Here are some tips that can help you get the deal within your budget.

Get those pending business plans in action and give a boost to your business. Grow with the world; apply for a commercial mortgage today!

Ulster Bank mortgage calculator is one of the most reliable online tools to get estimate of mortgage rates, and repayments. This blog gives you rough estimation of it and suggests you to make a wise decision.

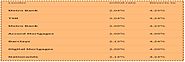

The UK mortgage lending market is known throughout the world for its innovative and competitive concepts introduced to attract more and more borrowers. The major share of mortgage borrowing is contributed by mutual organizations, building societies, credit...

Getting a mortgage for first-time buyers is not complicated. Lenders have reduced interest rates so that people can buy their dream home.

If shifting to a new home also brings the situation of shifting of mortgage, certain conditions are necessary to bring in consideration. Keep the prime focus to make sure that the whole deal remains affordable, as the feel of the new home does not face the interference of stressful experience.

Mortgage loans come equipped with attractive and personalized features for all types of applicants. For every property related financial need of yours, mortgages are your way to the shore.