-

About

- About Listly

- Community & Support

- Howto

- Chrome Extension

- Bookmarklet

- WordPress Plugin

- Listly Premium

- Privacy

- Terms

- DMCA Copyright

- © 2010-2025 Boomy Labs

Listly by Shyam Subramanyan

A few of the most interesting posts, videos, and podcasts on crypto tokens from 2016 and 2017

In 2014, we wrote that “Bitcoin is more than money, and more than a protocol. It’s a model and platform for true crowdfunding — open, distributed, and liquid all the way.” That new model is here, and…

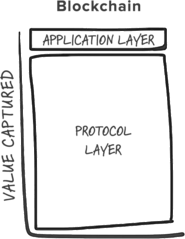

Here's one way to think about the differences between the Internet and the Blockchain. The previous generation of shared protocols (TCP/IP, HTTP, SMTP, etc.) produced immeasurable amounts of value, but most of it got captured and re-aggregated on top at the applications layer, largely in the form of data (think Google, Facebook and so on). The Internet stack, in terms of how value is distributed, is composed of "thin" protocols and "fat" applications. As the market developed, we learned that investing in applications produced high returns whereas investing directly in protocol technologies generally produced low returns.

Much has been discussed about blockchain-based tokens lately. We hosted the inaugural Token Summit in New York on May 25th. Prices of tokens have soared, startups are raising millions in token sales…

With the price momentum that Bitcoin, Ethereum and other digital assets have experienced over the past few weeks, I’ve recently heard from more people who want to get serious about learning about…

The most impactful technologies are polarizing and make people uncomfortable. The boom in blockchain-based tokens in the past year has certainly made a lot of people uncomfortable. On one side, you…

Writing his college thesis on Bitcoin in 2012 and becoming Coinbase's first employee in 2013, Olaf Carlson-Wee has been at the forefront of cryptocurrency for many years. Recently, he left Coinbase to start Polychain Capital, a hedge fund focused solely on investing in cryptocurrencies and protocol tokens. Olaf joined us to discuss his journey in the industry and the investment thesis behing Polychain.

Topics discussed in this episode:

How Olaf Carlson-Wee became Coinbase's first employee

The investment thesis behind Polychain Capital

Why protocol tokens represent a huge investment opportunity

The current state of tokensales

Why the blockchain crowdfunding campaigns will start resembling VC deal structure

His view on the state of the Bitcoin network and community

Links mentioned in this episode:

Polychain Capital: http://polychain.capital

Beyond Bitcoin: The future of cryptocurrencies - The Signal: https://blog.mixpanel.com/2016/07/27/blockchain-technology-olaf-carlson-wee/

Bitcoin Will Never Be a Currency—It's Something Way Weirder | WIRED: https://www.wired.com/2017/01/bitcoin-will-never-currency-something-way-weirder/

The Golden Age Of Open Protocols – AVC: http://avc.com/2016/07/the-golden-age-of-open-protocols/

Blockchain Tokens and the dawn of the Decentralized Business Model: https://blog.coinbase.com/app-coins-and-the-dawn-of-the-decentralized-business-model-8b8c951e734f#.rl4mv6p98

Fat Protocols | Union Square Ventures: http://www.usv.com/blog/fat-protocols

a16z and USV invest $10m in new digital asset hedge fund: https://www.forbes.com/sites/laurashin/2016/12/09/andreessen-horowitz-and-union-square-ventures-invest-10-million-in-new-digital-assets-hedge-fund/#2e6f5ce95e97

The future is a decentralized internet | TechCrunch: https://techcrunch.com/2017/01/08/the-future-is-a-decentralized-internet/

Ethereum (ETH) has exploded in the first half of 2017, with its dollar exchange rate going from $8.29 to $93.65, resulting in a current market cap of $8.6bn.

I currently look at the development of the blockchain ecosystem through the lens of creating a new decentralized application development stack. A good barometer is asking the question: “do we have…

Crypto Tokens and the Coming Age of Protocol Innovation HTTP as the underlying protocol of the web allows for decentralized publishing. Anyone can operate a web server and publish their own content....

It is a wonderful accident of history that the internet and web were created as open platforms that anyone — users, developers, organizations — could access equally. Among other things, this allowed…

Most of us have probably heard of bitcoin and ethereum -- but did you know there were 15 new cryptocurrencies launched this past month alone? How then do we know which protocols to invest in -- not just as a developer or user, but as an investor? Because, let's face it, open source software and services need resources not just to survive but thrive.

General partner Chris Dixon talks about this dynamic between open vs closed in this episode of the a16z Podcast with Olaf Carlson-Wee, founder of (a16z investment) Polychain, a new kind of hedge fund that invests directly in cryptocurrencies at the protocol layer. But what does that actually mean? Instead of investing in the companies that are building on top of these protocols, Polychain invests in the protocols themselves -- in much the same way that you could have invested in domain names instead of early internet companies like Amazon in the early days (which most people actually didn't have access to do). Imagine if you could have bought equity in Linux!

As people create application-specific tokens for these protocols (also known as “app coins”) to crowdfund and share equity in these networks, it's actually "bringing capitalism into open source" -- and could even one day lead to less centralized platforms and a web owned by users. It's also creating a whole new asset class... but whatever you do, do NOT try this at home!

Bitcoin quickly made its way from a whitepaper to a production network, which is pretty amazing when you think about it. But its scripting/ programming language was initially, intentionally, limited for a few reasons, which meant that building new apps on bitcoin wasn't always easy.

Enter ethereum in 2014 -- a public blockchain platform that moved away from the "Swiss-army knife" approach to a more general protocol approach. This would in turn allow endless (and entirely new) use cases to be built on top of the blockchain, whether smart contracts or "app coins" that allow decentralized crowdfunding and decentralized business models. The results, at first glance, may seem just like a new way of financing a company. But it actually goes much deeper than that: They're really software protocols that are almost replacing centralized companies or what those companies would do. The possibilities are endless...

In this episode of the a16z Podcast, Ethereum inventor and co-creator Vitalik Buterin joins Fred Ehrsam, co-founder of Coinbase (an a16z portfolio company) in conversation with Chris Dixon. The conversation covers everything from the politics of open source (and value of network effects even when those networks split) to the challenges of mainstreaming and scaling tech. And what happens next?

HEY!)

It is worth adding a very good site which can help and which is available to everyone who can go online, especially since it works in eight languages and is so simple that it can be used without fear of getting something wrong, so the https://starsmatic.com/ is a very suitable site for everyone as a pro and a beginner!!!