-

About

- About Listly

- Community & Support

- Howto

- Chrome Extension

- Bookmarklet

- WordPress Plugin

- Listly Premium

- Privacy

- Terms

- DMCA Copyright

- © 2010-2025 Boomy Labs

Sandi Martin

Sandi Martin

Listly by Sandi Martin

May's list of the best Canadian personal finance news, articles, and blog posts from around the internet, expertly curated for interest and relevance. You can follow this list right here in List.ly, by following me on Twitter (@sandimartinspf), or by keeping an eye on https://springplans.ca/news

Dan Hallett is no stranger to those who keep their fingers on the pulse of the financial services in Canada. We often exchange ideas and thoughts over email on industry developments, and I think we’ve both decided that these topics make for good conversations to have to make public on the podcast. In this episode, Dan shares his thoughts and questions about robo-advisors, helps explain the new cost and performance reports many Canadian investors are slated to receive this year as part of a regulatory initiative known as CRM2, and also discusses some of the things you should look for when choosing a financial advisor.

"But turning $1,000 in 1997 into $4,128 in 2017 was a brutal experience. That 313% return was paid for with many sleepless nights. The chart below shows the difference between the map and the terrain; all the white space between the red and the black line is where the unforced errors occur."

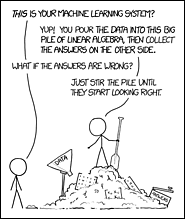

"Odds are, many of them will turn out to be nothing more than patterns that appear to have worked in the past that have no predictive power for the future."

Kees has several TFSA, RRSP and LIRA accounts where he manages ETF passive portfolios. What's the best way to rebalance them?

Millennials don't exist and the entire idea of "generations" is unscientific. (https://www.youtube.com/watch?v=-HFwok9SlQQ&feature=youtu.be)

"Remember that picking something and getting enrolled is far preferable to picking nothing while you try to research to identify the “optimal” fund (or mix of funds)."

"I’m older and wiser now (I hope), and no longer impressed with who can fling the most spaghetti at the wall, from the most randomly selected sources, and then point to it, screaming like a chimpanzee."

"Like most worthwhile pursuits, gradual change’s cost is additional patience. Your perceived progress will be slower than somebody who makes quick, drastic changes, but I believe your odds of actually improving, in a lasting way, are far better.".

" the simple personal finance principles such as avoiding credit card debt, paying down our mortgage debt, living below our means, having a good credit score, etc. didn’t seem to matter until they really mattered. This stuff seems boring but it can be extremely helpful when you really need it."

When it comes to personal bankruptcy, Canadians have a lot of mistaken beliefs that need clearing up.

"I got tons of advice when I moved into my first apartment. Some friend or family member gifted me with the tiny toolbox I called Baby’s First Toolbox. It was the size of a slim binder and probably cost them $20.

And that $20 toolbox has saved me thousands of dollars over the last decade."

"If we can’t tell the difference between someone flipping a coin at their desk and actual stock returns, then those stock returns must be pretty random. If it looks like a duck and quacks like a duck, it’s probably a duck.

Paying attention to daily returns won’t do anything besides give you an ulcer. Since these daily returns are bouncing all over the place, you’re adding a lot of stress to your day that you just don’t need."

"But the real issue with bad habits is while they scratch the itch, they don’t fix the underlying problem. Being worried about your bills might lead you to check Facebook, but that doesn’t make Mark Zuckerberg pay your mortgage."

April's list of the best Canadian personal finance news, articles, and blog posts from around the internet, expertly curated for interest and relevance

Fee only/advice only financial planner at Spring Financial Planning, ex-banker, curmudgeon.

Co-host with the really loud laugh on Because Money