-

About

- About Listly

- Community & Support

- Howto

- Chrome Extension

- Bookmarklet

- WordPress Plugin

- Listly Premium

- Privacy

- Terms

- DMCA Copyright

- © 2010-2025 Boomy Labs

Sandi Martin

Sandi Martin

Listly by Sandi Martin

April's list of the best Canadian personal finance news, articles, and blog posts from around the internet, expertly curated for interest and relevance. You can follow this list right here in List.ly, by following me on Twitter (@sandimartinspf), or by keeping an eye on https://springplans.ca/news

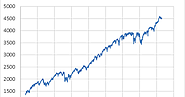

"The only conclusion my lizard brain can draw is that the stock market only goes up."

"Life is about more than financial optimization. Financial optimization frees you to make interesting, irrational choices about how to spend your time on Earth. One day I will lay upon my deathbed (hopefully in the air conditioned apartment with a good wifi signal supplied to me by those thoughtful lions). I will look back across my life and think of all the choices that I made."

"The advice for active management to improve its fortunes is simple. First, take more care when opening and closing funds. Throwing investments against the wall to see what sticks, and shutting down those funds that don’t take hold, impresses nobody. That harms active management’s brand. Second, less is more! The lower the expense hurdle, the less high that management must jump."

"Now put yourself in his place. He did his task. He got the grape. Clearly he is a wiz with the pebble. Who knows what Ginger is up to? Don’t tell Fred he doesn’t deserve his grape or that the grape was merely the result of luck on his part. No one wants to hear that.

Consider that 74% of members of parliament have lived a lifetime of getting grapes. Not to mention 98% of the top 100 CEOs in Canada. Add in three-quarters of all senior managers in the country.

This may go some way towards explaining why it is so very difficult to convince those with the power to do so to close the wage gap."

"The obvious financial benefit is that by adding modestly to your time in the workforce, you are increasing the number of years you are saving and deferring the point at which you begin withdrawing. That double-whammy can significantly increase either how long your money will last or how much you can spend on an annual basis without running out. "

![[PDF] When More is Less: Rethinking Financial Health | Sarah Newcomb](http://media.list.ly/production/351819/2132521/item2132521_185px.jpeg?ver=5627993901)

"A finance-only definition of well-being assumes that emotional well-being will automatically follow economic stability—our research at Morningstar shows otherwise"

"Your cash buffer belongs in your primary checking account. It acts as a level to mentally associate with a balance of zero. For example, if you cash buffer is $5,000 and you dip below that amount, you might consider exercising additional care with your expenses and payments."

"The same personality traits that facilitate saving for retirement become impediments when it is time to spend that money"

"If VC generates higher returns than large-cap public equities, it’s not because investors have to endure more risk. They just have to endure about the same amount of risk crammed into a much shorter period. Which is hard. There’s a cost to it. You pay for it, not with money but with worry and doubt."

"Bottom line: yes, interest rates are low and if they rise, bond index funds will lose value. But for most investors they should still be a permanent part of your portfolio."

March's list of the best Canadian personal finance news, articles, and blog posts from around the internet, expertly curated for interest and relevance

Fee only/advice only financial planner at Spring Financial Planning, ex-banker, curmudgeon.

Co-host with the really loud laugh on Because Money