-

About

- About Listly

- Community & Support

- Howto

- Chrome Extension

- Bookmarklet

- WordPress Plugin

- Listly Premium

- Privacy

- Terms

- DMCA Copyright

- © 2010-2025 Boomy Labs

business loan broker

business loan broker

Listly by business loan broker

Browse this site http://www.primefund.com/corporate-funding/ for more information on Acquisition Financing. follow us : https://goo.gl/gUacJP

https://goo.gl/hrg9U2

https://goo.gl/mQnrLx

Acquisition Financing is a common term used within the industry lingo when it comes to the financial aspect of acquiring a company. Acquisition means to acquire or to take something into your possession. This is the layman’s definition of acquisition but in business terms it means when a party acquires enough shares of a company for it to be considered owned by that party. Acquisitions are made as part of a company’s growth plan when it is more advantageous to take over an existing operation than it is to expand. Browse this site http://www.primefund.com/corporate-funding/ for more information on Acquisition Financing. follow us : https://goo.gl/gUacJP

https://goo.gl/hrg9U2

https://goo.gl/mQnrLx

https://goo.gl/Q2GbfD

https://goo.gl/mQnrLx

Startup Business Loans are provided to a business owner to start a business which has no or minimum business history. The financial assistance that is provided may be in different forms i.e. in the form of cash, loan or something else. However, there are a lot of people who does not know where to go when it comes to getting the financial assistance. There are also some entrepreneurs that are provided by a lot of options and they find it difficult to decide between them. Visit this site http://www.primefund.com/corporate-funding/ for more information on Startup Business Loans. follow us : https://goo.gl/tD6ae6

https://goo.gl/k9lVbE

https://goo.gl/IAqhTC

https://goo.gl/9GguxM

https://goo.gl/wSzmDc

The commercial lending loan is viewed more conservatively and those business with less than three years, the personal credit of principals will be evaluated and may hold true for longer period of time, this is for the tightly held companies and for the corporation companies, the business performance and credit ratings will be evaluated with proven track records. Most of the commercial lending loans are from the commercial banks although there are also some banks that offer commercial lending loans to small business entrepreneurs. Browse this site http://www.primefund.com for more information on Commercial Lending. follow us : https://goo.gl/zJ2K4b

https://goo.gl/XqIOFK

https://goo.gl/36Z7vF

https://goo.gl/M2AvXG

https://goo.gl/by4Zlc

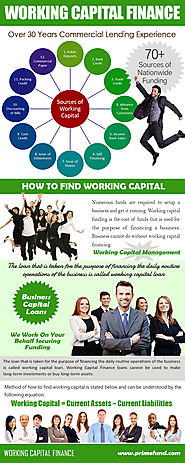

Capital finance addresses cyclical or seasonal capital needs of businesses. In fact, it builds up short-term assets required to revive operation and generate revenue, but which can be accessed only after giving cash payment. business acquisition loan allows companies to invest in short-term assets that helps it operating successfully. It helps raising capital for prepaid business expenditure, like security deposits, licenses, insurance policies, and many more. Click this site http://www.primefund.com/corporate-funding/ for more information on business acquisition loan. follow us : https://goo.gl/G2HS3m

https://goo.gl/m615xI

https://goo.gl/ecXUY7

https://goo.gl/PJC5l5

https://goo.gl/XqnJL5

Capital finance addresses cyclical or seasonal capital needs of businesses. In fact, it builds up short-term assets required to revive operation and generate revenue, but which can be accessed only after giving cash payment. Working Capital Finance allows companies to invest in short-term assets that helps it operating successfully. It helps raising capital for prepaid business expenditure, like security deposits, licenses, insurance policies, and many more. Click this site http://www.primefund.com/working-capital-management/understanding-working-capital-finance/ for more information on Working Capital Finance. follow us : https://goo.gl/ujAQYN

https://goo.gl/XsnbaS

https://goo.gl/drWp3o

https://goo.gl/IcwJWP

https://goo.gl/n9PrzC

The business capital loans is viewed more conservatively and those business with less than three years, the personal credit of principals will be evaluated and may hold true for longer period of time, this is for the tightly held companies and for the corporation companies, the business performance and credit ratings will be evaluated with proven track records. Most of the commercial lending loans are from the commercial banks although there are also some banks that offer commercial lending loans to small business entrepreneurs. Browse this site http://www.primefund.com/working-capital-management/understanding-working-capital-finance/ for more information on business capital loans. follow us : https://goo.gl/oaJrOj

https://goo.gl/vrJ3v9

https://goo.gl/Wf6g1u

https://goo.gl/UgFSZy

https://goo.gl/siJlCv

Commercial Real Estate Loans can be broadly categorized into two types, namely, long term and short term loans. While long term loans are mostly availed for purchasing commercial real estate properties, and are meant to be paid over a very long time, short term loans are usually acquired for smooth running of businesses without having to face any kind of financial problems. The short term loans are also called bridge loans. Browse this site http://www.primefund.com/commercial-lending/ for more information on Commercial Real Estate Loans. follow us :https://goo.gl/7ppT13

https://goo.gl/2TdBBm

https://goo.gl/H6o3oz

https://goo.gl/1JU5pN

https://goo.gl/TJR6Go

There are many reasons precisely why a business may wish to obtain another organization or combine by using it. To be able to acquire another organization, company mezzanine finance providers is usually required. The organization might want to expand through obtaining an additional corporation's company as well as providers. This will increase the client base. Try this site http://www.primefund.com/commercial-lending/ for more information on mezzanine finance providers. follow us : https://goo.gl/vmzpvd

https://goo.gl/Y987qC

https://goo.gl/ZtGevS

https://goo.gl/m4wZEI

https://goo.gl/yqg2S8

franchise loan can be broadly categorized into two types, namely, long term and short term loans. While long term loans are mostly availed for purchasing commercial real estate properties, and are meant to be paid over a very long time, short term loans are usually acquired for smooth running of businesses without having to face any kind of financial problems. The short term loans are also called bridge loans. Browse this site http://www.primefund.com/corporate-funding/ for more information on franchise loan. follow us : https://goo.gl/ziBPTT

https://goo.gl/eMfNVb

https://goo.gl/eMfNVb

https://goo.gl/9awaJg

https://goo.gl/Ns0v2w