-

About

- About Listly

- Community & Support

- Howto

- Chrome Extension

- Bookmarklet

- WordPress Plugin

- Listly Premium

- Privacy

- Terms

- DMCA Copyright

- © 2010-2025 Boomy Labs

business loan broker

business loan broker

Listly by business loan broker

A Business loan broker is the one that acts as an agent between the lender and the party who is seeking financial assistance for their business. However, they are not responsible for providing the loans; they will only provide the services that are required in this process. The Business Loan Broker will provide you with all the required information you need to get the specified type of loans. Pop over to this web-site http://www.primefund.com/ for more information on Business Loan Broker.

While long-term financial analysis primarily concerns strategic planning, working capital management deals with day-to-day operations. By making sure that production lines do not stop due to lack of raw materials, that inventories do not build up because production continues unchanged when sales dip, that customers pay on time and that enough cash is on hand to make payments when they are due. Obviously without good startup business loans, no firm can be efficient and profitable. Check this link right here http://www.primefund.com/ for more information on startup business loans. follow us : https://goo.gl/XzjuNJ

https://goo.gl/Cqr9Ky

https://goo.gl/R12aF0

https://goo.gl/o8pRlx

https://goo.gl/SEoA5X

Commercial Property Loans involve close scrutiny by lenders who weigh the quality, equity and type of the hard collateral extremely heavily. The lenders try to provide the borrower with as much flexibility as they can, but they also charge the highest rates when they are compared to a bank loan. A lot of commercial loans are temporary bridge loans where the hither rate is an acceptable offer in exchange for the speed with which they can process the loan. Check this link right here http://www.primefund.com/commercial-lending/commercial-real-estate-loans/ for more information on Commercial Property Loans. follow us : https://goo.gl/vukLM6

https://goo.gl/7Hgyx1

https://goo.gl/IdaWYW

https://goo.gl/Axy07u

https://goo.gl/HtFKUS

Commercial Property Loans involve close scrutiny by lenders who weigh the quality, equity and type of the hard collateral extremely heavily. The lenders try to provide the borrower with as much flexibility as they can, but they also charge the highest rates when they are compared to a bank loan. A lot of commercial loans are temporary bridge loans where the hither rate is an acceptable offer in exchange for the speed with which they can process the loan. Check this link right here http://www.primefund.com/commercial-lending/commercial-real-estate-loans/ for more information on Commercial Property Loans. follow us : https://goo.gl/vukLM6

https://goo.gl/7Hgyx1

https://goo.gl/IdaWYW

https://goo.gl/Axy07u

https://goo.gl/HtFKUS

While long-term financial analysis primarily concerns strategic planning, inventory financet deals with day-to-day operations. By making sure that production lines do not stop due to lack of raw materials, that inventories do not build up because production continues unchanged when sales dip, that customers pay on time and that enough cash is on hand to make payments when they are due. Obviously without good inventory finance, no firm can be efficient and profitable. Check this link right here http://www.primefund.com/working-capital-management/understanding-working-capital-finance/ for more information on inventory finance. follow us : https://goo.gl/wB0Ln7

https://goo.gl/jufvHn

https://goo.gl/cR1Djk

https://goo.gl/hHfzmk

https://goo.gl/NjOewI

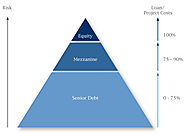

mezzanine loan involve close scrutiny by lenders who weigh the quality, equity and type of the hard collateral extremely heavily. The lenders try to provide the borrower with as much flexibility as they can, but they also charge the highest rates when they are compared to a bank loan. A lot of commercial loans are temporary bridge loans where the hither rate is an acceptable offer in exchange for the speed with which they can process the loan. Check this link right here http://www.primefund.com/commercial-lending/ for more information on mezzanine loan. follow us :https://goo.gl/1vS6DF

https://goo.gl/Kk9clx

https://goo.gl/tQKF1f

https://goo.gl/t11kXo

https://goo.gl/nvXdwI

While long-term financial analysis primarily concerns strategic planning, commercial loan brokerdeals with day-to-day operations. By making sure that production lines do not stop due to lack of raw materials, that inventories do not build up because production continues unchanged when sales dip, that customers pay on time and that enough cash is on hand to make payments when they are due. Obviously without good working capital management, no firm can be efficient and profitable. Check this link right here http://www.primefund.com/commercial-lending/commercial-real-estate-loans/ for more information on commercial loan broker. follow us : https://goo.gl/oAXXQN

https://goo.gl/FLxEDy

https://goo.gl/fxv046

https://goo.gl/vbg1QG

https://goo.gl/6oN7OD