-

About

- About Listly

- Community & Support

- Howto

- Chrome Extension

- Bookmarklet

- WordPress Plugin

- Listly Premium

- Privacy

- Terms

- DMCA Copyright

- © 2010-2025 Boomy Labs

Rajashri Venkatesh

Rajashri Venkatesh

Listly by Rajashri Venkatesh

We saw a significant dip in the indian economic since the ban of 500 and 1000 Rs notes. With the overall tightening of the regulatory environment, tax evaders and wilful defaulters may consider changing their game there was also an immense discomfort experienced by local vendors and common people. Here are few of the disadvantages of demonetisation.

An interesting side effect here of India's demonetization plan. As we know, the Rs 500 and Rs 1,000 notes have been cancelled as legal tender, to be replaced by other notes and designs. There are limits on how much cash can be changed for cash (Rs 4,000, soon to fall to 2,000) but no limits upon what can be deposited in bank accounts. Of course, large deposits are going to be subject to tax scrutiny, rather the point of the exercise in fact.

Everyone is aware about the demonetization policy of the government by banning Rs. 500 & Rs. 1000 currency notes. One can understand that it would have a pretty bad impact on SMEs, small traders, real estate, transport sector, consumer durable goods industry. Not only these sectors but it would major affect the rural areas business as over there, majority of the transactions are made in cash. The ban of Rs. 500 and Rs. 1000 currency notes will impact those industries where hardcore cash transactions are made. Demonetization will affect the liquidity, but for a short term.

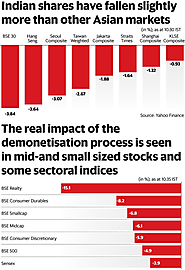

The government’s move to suck out 86% value of money in circulation by demonetizing Rs.500 and Rs.1,000 currency notes will adversely impact India’s economic growth, at least in the short run, fear some economists. Some others, however, maintain that the demonetization move, taken to weed out black money and counterfeit notes in circulation, will have little effect on the economy.

Indian Economy has far been a victim of black money and corruption. The Indian system looked incorrigible resulting in crores of unreported money flowing in and out from the country. The Modi Government, in order to curb the flow of black money came up with the Income Declaration Scheme (IDS), which gives holders of undeclared wealth…

The images on television are troubling. Harassed people queuing for hours. An elderly man, obviously quite sick, crying helplessly. The hospital wouldn’t admit him for the required surgery nor would the chemist sell him the drugs he needed because his money had ceased to be legal tender. A lady crying, her husband had just died because no hospital would admit him. The treatment money she had had suddenly become worthless.

The thrust of demonetization of Rs 500 and Rs 1,000 notes was to curb a parallel economy thriving on black money in the country. Ironically, the very move has birthed a new kind of parallel economy, especially in rural areas like Anekal, on the outskirts of Bengaluru.

As Indians struggle to come to grip with the second de-monetisation of currency since independence (the previous one was in 1978 and restricted to Rs1,000, Rs5,000 and Rs10,000 notes), the scale and scope of this action is significantly bigger. The demonetisation move seems to have widespread support from ordinary people; however there are pockets of hardship despite attempts by the government to exempt crucial needs such as hospitals, tolls, chemists, crematoria and petrol pumps.

The Indian government’s decision to demonetize currency notes of Rs500 and Rs1,000 was necessitated by the increase in difficult-to-tell counterfeit notes and a desire to curb black income generation as well as eliminating a part of existing unaccounted wealth held in these high-denomination notes. The authorities’ intent and action are indeed praiseworthy but need to be followed up with subsequent actions to remain effective.