-

About

- About Listly

- Community & Support

- Howto

- Chrome Extension

- Bookmarklet

- WordPress Plugin

- Listly Premium

- Privacy

- Terms

- DMCA Copyright

- © 2010-2025 Boomy Labs

Sandi Martin

Sandi Martin

Listly by Sandi Martin

December's list of the best Canadian personal finance news, articles, and blog posts from around the internet, expertly curated for interest and relevance. You can follow this list right here in List.ly, by following me on Twitter (@sandimartinspf), or by signing up for Spring in your inbox here: https://springpersonalfinance.com/contact/

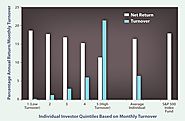

“What is the average investor to do if spending 10,000 hours or more “practicing” will not necessarily make you perform better?"

![Income Annuities in a Low-Rate Environment? You Bet! | Scott Stolz [may have to register]](http://media.list.ly/production/314239/1931798/item1931798_185px.jpeg?ver=4019197135)

Now, one might wonder why someone would buy an immediate annuity that is expected to payout less over time than the amount invested. After all, that 75-year-old male with a life expectancy of just under 11 years would have to live 12.67 years just to get his money back. First and foremost, immediate annuities are not about expected return. If they were, no one would buy them.

"fret less about getting any particular decision precisely right, and instead worry about whether you’re tackling the right range of issues"

"So I decided to make an RRSP infographic (hold the applause please) that ignores a lot of the little rules that you really don’t need to know about right now and boils RRSPs down to a few fundamental things.

If you don’t know what an RRSP is, here’s a place to start…."

"Knowing that something worked out, we argue that it wasn’t that risky after all. But what if, in reality, we were simply fortunate? This is the Fooled by Randomness effect.

The way to think about it is the following: The worst thing that can happen to a young gambler is that he wins the first time he goes to the casino. He might convince himself he can beat the system."

"This is not another call to write down everything you spend in a notebook. But it is a reminder that if you don’t like what you see when you glance at the credit or debit card statement or the pile of receipts, then it’s time to reconsider a few things. My colleague Carl Richards has offered short courses here recently on spending awareness and aligning spending with values."

" Time management gurus rarely stop to ask whether the task of merely staying afloat in the modern economy – holding down a job, paying the mortgage, being a good-enough parent – really ought to require rendering ourselves inhumanly efficient in the first place"

"It is up to us – indeed, it is our obligation – to maximise our productivity. This is a convenient ideology from the point of view of those who stand to profit from our working harder, and our increased capacity for consumer spending. But it also functions as a form of psychological avoidance. The more you can convince yourself that you need never make difficult choices – because there will be enough time for everything – the less you will feel obliged to ask yourself whether the life you are choosing is the right one."

"I don’t think becoming financially independent in the traditional sense is actually going to make you dramatically happier than being almost financially independent. If it does, it likely means you are currently leading a terrible life"

"Consider the maturity guarantee: the odds of a balanced portfolio showing a significantly negative return after 10 years is very low and not worth insuring. All of the other benefits of seg funds can be obtained in other, much cheaper ways, too."

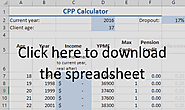

This Excel spreadsheet will help you calculate how much CPP you will get in retirement, and includes the 2016 CPP Enhancements.

November's list of the best Canadian personal finance news, articles, and blog posts from around the internet, expertly curated for interest and relevance

Fee only/advice only financial planner at Spring Financial Planning, ex-banker, curmudgeon.

Co-host with the really loud laugh on Because Money