-

About

- About Listly

- Community & Support

- Howto

- Chrome Extension

- Bookmarklet

- WordPress Plugin

- Listly Premium

- Privacy

- Terms

- DMCA Copyright

- © 2010-2025 Boomy Labs

Kathy Waite

Kathy Waite

Listly by Kathy Waite

Highly curated list of articles you should know to increase your wealth in 2016

Do you even know there is a difference?

Since most people are unaware or ill-informed about the fiduciary guidelines, here are a few simple questions to ask of your current or prospective financial advisor to see how transparent they are with their conflicts:

How are you paid?

Who else is paying you?

Do you earn commissions or bonuses based on the products you are pitching to me?

How do you choose which investment products to recommend?

Do you have any business relationships with any outside financial firms?

The goal here is not necessarily to rule someone out simply because of how they answer these questions. What you’re looking for is transparency. A lack of transparency is a huge red flag. Here are a few other red flags to look for in the financial services industry:

Constantly selling past performance instead of process.

Constantly pushing financial products instead of providing financial advice.

Placing you in highly-priced, in-house funds or strategies when similar lower-cost options are available.

Offering financial solutions before getting to know you and your unique circumstances.

Life would be a whole lot easier for those looking for a trusted source of financial advice if there was a simple rule, title or designation could let them know exactly who to work with and who to avoid. In the absence of that perfect world scenario, a good way to understand who is sitting on the other side of the table is to see how transparent they are and how they handle your personal situation.

In reality people spend more with the novelty of retiring and having more time on their hands. They are happy and healthy so enjoy!

We often slow down and spend less in our 70's but then care or home assistance expenses crop up as we age

Its fine as long as we know this and plan for it

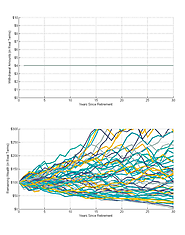

The first method to be tested is the original constant inflation-adjusted withdrawal strategy introduced in William Bengen’s 1994 article, “Determining Withdrawal Rates Using Historical Data.” This will serve as a baseline for subsequent comparison with other strategies. Bengen’s rule says to adjust spending annually for inflation and maintain constant inflation-adjusted spending until the portfolio depletes.

Kathy Waite Saskatchewan fee only financial planner and retirement forecaster has been talking for years about different ways to live

Your retirement will not be the same as your parents

My plan for later years is sipping wine with friends on a communal porch.........

Whats your plan?

Kathy Waite fee only financial planner, retirement income specialist , Saskatchewan and Canada . Money makeovers and portfolio second opinions . Myth buster , financial detective, money ninja

Dinnie Greenway loves riding horses, and she's not letting a little thing like age stop her. The 96-year-old says horseback riding is an addiction that has kept her going her whole life.

This is quite personal for me. Any one who knows me, knows we live on an acreage , 4 horses multiple other animals. My grandmother lived to 87 , had late onset Parkinson's but knew who we were and where she was to the end. Given she smoked liked a chimney and lived through the blitz in world war 2, worked at London airport making sandwiches for 30 years and had my Mum at 42, not the best of health care at times, I always assumed longevity was in the family. 2016 my Mum died of multiple issues at 72 . She hated hospitals and didn't take her medication but it was still a shock. Dad has alzheimer's at 75 doesn't know who we are half the time and is in virtually 1 :1 care . That scares the $%%^& out of me as I had actually assumed like Warren Buffet and Jack Bogle I would still be running the family business at that age! Bossing the grand kids around.

The Queen of England is riding at 90 and so is this lady ..........I have been upset summer 2016 my back has been bad and I haven't got on as much as usual, gained weight, but I have stuck to my pysio appointments and am determined to be like these ladies! If attitude has anything to do with it I will make it to 150 lol .

Whats your family history ? How does it make you feel about your future? How does it make you feel about what you are spending your time on now?

Many people feel trapped and want to make a change . I can work with you to help that be a reality .Money makeovers to transform what you currently have.

As I argue in my latest online column for MoneySense, published this morning, I believe that the next big wave to be surfed by the baby boom generation will NOT be retirement, but Semi-Retirement. Click on highlighted link to access: Why semi-retirement is the future.

Registered Retirement Consultant. Your Net Worth Manager Fee Only Financial Planning for regular people in Saskatchewan and across Canada

Retirement designer and money ninja !