-

About

- About Listly

- Community & Support

- Howto

- Chrome Extension

- Bookmarklet

- WordPress Plugin

- Listly Premium

- Privacy

- Terms

- DMCA Copyright

- © 2010-2025 Boomy Labs

list.ly blog

list.ly blog

Listly by list.ly blog

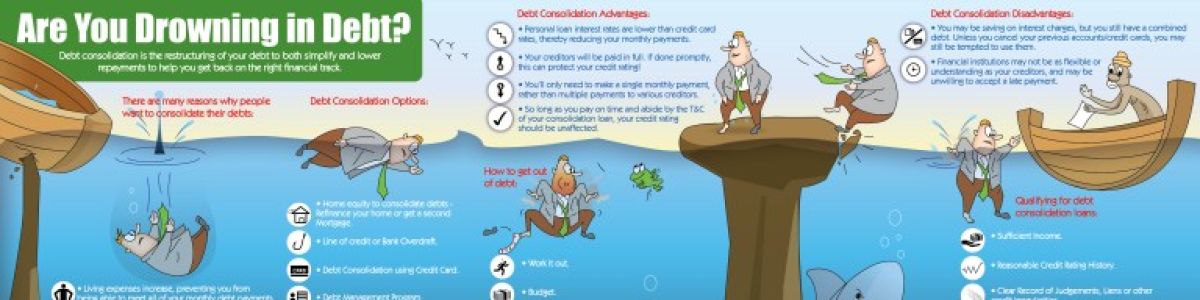

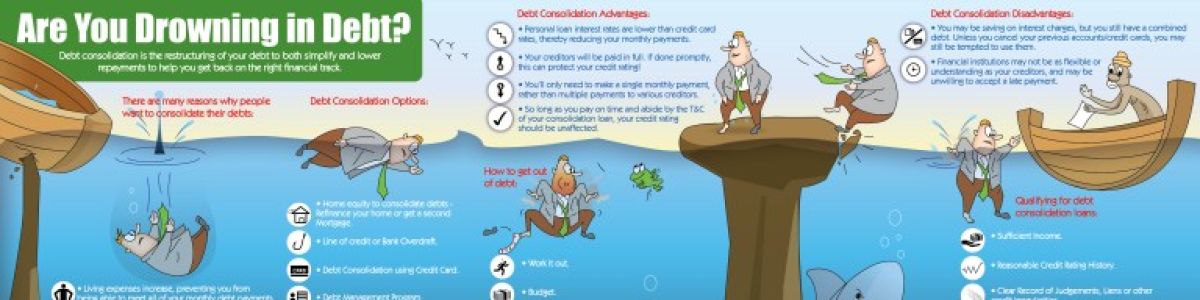

Many people try to get out of debt, but life slaps them in the face hard enough. When getting out of debt is a priority, here are things to do to eliminate ... tips and strategies to get you started on a debt-free life: ...More people than ever are currently benefiting from free debt advice, Find out where you can get free, local, confidential debt advice ...If you are living debt free with a decent emergency fund, please share this. Smart Strategies to Eliminate Your Debt. Follow these eight tips to get out of the red as quickly as possible. A balance transfer can help you dig out of credit card debt faster Here are some practical ways you can quickly tackle your maxed out cards and take your first real steps toward getting ...One of the smartest strategies for getting out of debt is to make minimum payments on all of your debts and credit cards except for one.

Source: http://debtpro.co/

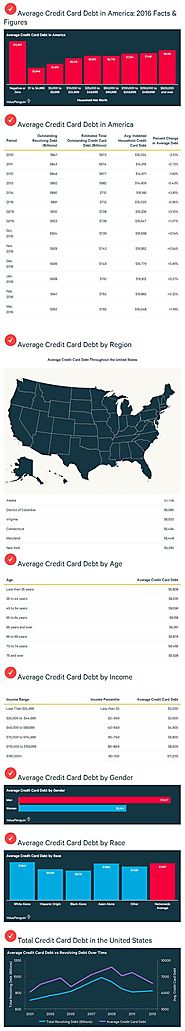

We break down statistics regarding average credit card debt in America, carving the data up geographically, by demographic, and analyzing how these changed over time.

Troubled borrowers who can offer a substantial lump sum may be able to free themselves from years of wage garnishments, tax refund seizures and other collections efforts, according to student loan experts at vantageacceptance.

What is a credit card hardship program? Know how to get enrolled and things which you should keep in mind before applying for a hardship program

Read these 13 Awesome Tips For Negotiating Credit Card Debt for getting debt relief

Debt settlement, also known as debt arbitration, debt negotiation or credit settlement, is an approach to debt reduction in which the debtor and creditor agree on a reduced balance that will be regarded as payment in full.[1] During a negotiation period, all payments by the debtor are made to the debt settlement company, which typically withholds payments to the creditors, even if the debtor has paid a lump sum or made payments. Once all the debtor's accounts are in default due to this non-payment, the debt settlement company has leverage to force the debtor to accept a reduced lump sum payment as settlement. The debtor's credit rating goes down significantly due to the default, especially if the debtor was not behind on payments before the negotiation period commenced. Even though the accounts are "settled," the default appears on the debtor's credit record for seven years. Nevertheless, some debtors prefer this method of debt reduction over bankruptcy.

Do you have bad credit? Need to Consolidate Your Debt? Know all the options for debt consolidation for people with bad credit.

et on closer scrutiny, it becomes apparent that they experience common problems arising at similar stages in their development. These points of similarity can be organized into a framework that increases our understanding of the nature, characteristics, and problems of businesses ranging from a corner dry cleaning establishment with two or three minimum-wage employees to a $20-million-a-year computer software company experiencing a 40% annual rate of growth.

Bills could be swindling !

Specially medical bills are something that one can never put to another day. Medical bills are those payment receipts wh…

Learn how to either get credit card debt relief yourself or how to get a good agency to do this for you. Covers all little known options. Expert debt consolidation advice on what to do next & debt management solutions. Get help with credit card debt o payments.

If you’re a business owner trying to get small business loans bad credit can stop you from getting .... Read the rest of this article on Open to Export.

Credits: vantageacceptance.com

Read more:

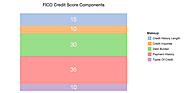

The Only Infographic Guide You Would Ever Need For A Good Credit Score

What is Credit Score and How To Maintain It?

A credit score is a three-digit number, typically between 300 to 850, which credit bureaus calculate based on information in your credit report. It is a simple,

Forbes Welcome page -- Forbes is a global media company, focusing on business, investing, technology, entrepreneurship, leadership, and lifestyle.

If your debt is overwhelming, you might consider transferring your credit card balance to another card. If the card has a low interest rate (or better yet, zero interest), you can put more toward your principal and get out of debt sooner. It’s not a move to make lightly, though. Here are a few balance transfer rules to follow.

Have ever been caught up in a credit card fraud? Our experts explain top 5 credit card scams to be aware of in 2016 to safeguard your finances

If you have plans to move in with your girlfriend or to get married, there are so many discussions that you can have, but it is not necessary to discuss money matters. In fact, it is one of the worst topics that most of the couples want to avoid. But if you do then, it can lead to unfavorable implications for both your credit and finances.

Debt is that unsecured amount that a consumer must and has to pay to the Bank in all the possible circumstances. Credit Card Debt is a sum of money borrowed by the consumer for purchases and other financial needs through card system where the credit card company pays on the behalf of the consumer. The debt keeps on increasing through interests and penalties imposed by the bank and it is always recommended to pay it off as soon as possible. Here is how you can manage your credit card debt effectively better:

Why would you need a secured credit card? Read to know more about secured credit cards like benefits, difference between unsecured & secured and much more.

Get familiar with these five key credit card debt consolidation tips so that you can save your hard-earned money. We help you choose the best options.

![Credit Cards (Detailed): Things To Know Before Applying [INFOGRAPHIC]](http://media.list.ly/production/297422/1882098/item1882098_185px.jpeg?ver=8798578571)

One of the key #benefits of having a #credit card is that if you use it wisely, it can have a #positive effect on your #credit score. When you use you

Have bad or average credit, looking to grow or rebuild your credit, than select from these best unsecured credit cards for 2016