-

About

- About Listly

- Community & Support

- Howto

- Chrome Extension

- Bookmarklet

- WordPress Plugin

- Listly Premium

- Privacy

- Terms

- DMCA Copyright

- © 2010-2025 Boomy Labs

Kathy Waite

Kathy Waite

Listly by Kathy Waite

The highlights of the blogs and videos I have read to save you reading through so many to find the best

Well Charlie , the Rockefellers are rich but not so rich the can afford a beginner like you..........and so the education began

The advent of the mutual fund was one of the greatest innovations in the field of finance. However they are highly priced and under perform, you lose about 1/3 of your return in fees

If pure logic and rational decision making was used by investors to decide whether to buy mutual funds or ETFs, then mutual funds would already be extinct. Then again, if everyone acted rationally, casinos would not exist either ….

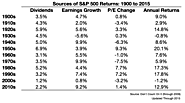

Vangaurd’s John Bogle on a recent Bloomberg interview discussing his simple formula for estimating future stock market returns:

To say " Vanguards" John Bogle is an understatement he started the company and they manage trillions! At 90 plus he has seen some of life and markets and is one to listen to

If you are shopping for a new investment advisor don't be sweet talked into believing they can deliver huge returns. Better to get market average at less risk and for low costs consistently than the odd flash in the pan wonder year.

Mutual funds are so similar all they can compete on is the promise of out performance , yet on 3% deliver that.

Realistic returns also help us be realistic about the plans we make

I don’t like to admit it, but over the years and due to circumstances largely beyond my control, I have turned into a skeptic.

why do advertisers continue to seduce us with their old version of retirement if it doesn’t reflect the current reality? You know the images: a seemingly care-free, happy couple sitting on a beach in the Caribbean while sipping on a strawberry daiquiri, or the happy couple playing golf on a picturesque golf course beside the ocean. You can almost hear the sound of the putt going into the hole for a birdie.

Why don’t advertisers show us the other side of retiring: the loss of socialization, loss of income, loss of purpose, loss of mattering? Because telling the truth doesn’t sell stuff!

Some financial advisers question the idea of having a bond-free portfolio.

We need to be candid about the realities facing today's pre-retirees.

Read up on sequence of returns . Kitches, Pfau and Milevsky

The sequence of your returns matters more than the actual return if you can't sit out market volatility

Pensionise some of your nest egg. Either be prepared to live on CPP, OAS and any DB pension with your savings for gravy or take some of it and buy an annuity if you get stressed.

lifes to short to be that stressed

Know the basics are covered what ever happens

To quote the great Jack Bogle " no one knows nothing " plan accordingly

This could be an eye-popping, jaw-dropping year for many mutual fund investors. By next summer, advisory firms that sell mutual funds will have to express their fees to clients in dollar amounts on a regular basis. Fees are normally expressed in percentages.

It’s the culmination of a long and complicated industry initiative called Client Relationship Model Phase 2 (CRM2), aimed at making fees more transparent. Investors will receive the bottom line on what they pay their advisers, but it tells only part of the mutual-fund fee story.

Ben Carlson writes: I grew up in the finance industry working in the institutional consulting world. Most consultants provide a wide range of services but what they’re all really selling is their due diligence capabilities for choosing money managers to invest on behalf of these large pools of capital. They often use buzzwords like ‘alpha’ and ‘access’ to get their clients’ attention, but very few allocators of institutional money ever really spend much time judging the results of these manager-of-managers.

I agree with him . Picking money managers should not be the main focus for 95% of all institutional clients.

A financial planner or consultant could add more value to these relationships if they focused their time on client engagement, education, asset allocation, investment policy and the unique goals of the clients they are working with.

Eight smart snowbird tips for Canadians and Americans getting ready to spend their winters down south, gleaned from the Snowbirdadvisor.ca website

Remote consultations with Doctors. I find this fascinating , along with self driving cars, drones to deliver medication and groceries I think we will be able to stay in our own homes much longer as we age

Patients will first have to download an app on their computer or mobile phone and then at an allocated time they must log on and speak to their GP using their built-in camera or webcam.

Wearing a Fitbit type of tracker they will know our vital signs

I do think though we all need to make an effort to keep up with technology or we won't be able to use all the benefits

Kathy Waite, financial detective, retirement designer and money ninja . Interviewed about her career and why she runs her business the way she does as a fee for service planner. Not representing a company just her clients, even though it attracts the ire of main stream financial advisors.

She says : " I keep busy , I have a wait list , theres about 50 like me in Canada and most only take very high net worth . I don't discriminate, compared to 80,000 who are paid to sell you things clients love that I work for them, i sit on their side of the table"

How often do we hear people complain they have to go back to work as the market has dropped , their investments are down? Kathy Waite fee only financial planner in Regina Saskatchewan. says this is all predictable and she knows how to avoid it . Contact her to find out how www.yournwm.ca

Kathy Waite Regina saskatchewan, fee only financial planner, money coach.

Welcomes newbie advisors, look after yourself as it takes a lot of energy to look after your clients

Registered Retirement Consultant. Your Net Worth Manager Fee Only Financial Planning for regular people in Saskatchewan and across Canada

Retirement designer and money ninja !