-

About

- About Listly

- Community & Support

- Howto

- Chrome Extension

- Bookmarklet

- WordPress Plugin

- Listly Premium

- Privacy

- Terms

- DMCA Copyright

- © 2010-2025 Boomy Labs

Kathy Waite

Kathy Waite

Listly by Kathy Waite

Interesting, timely or ridiculous news and views of the month

I am 47 I started work in an investment bank at 16 and went to college and their training school.

How come 31 years later we have still have articles that women are different?

Duh?

It just reminded me what a left brain male dominated industry I swim in

.

That’s what my partner and I told each other the day we decided to start saving for a home. Real estate can be tough, so we started our plan early. In some ways, it was madness. We still had to pay monthly rent and a first baby was on the way. It meant cutting back on activities we enjoyed, little extras and big extras.

Trying to figure out what the future holds in terms of geopolitical events is a fool’s errand. No one knows what’s going to happen. The same applies to finance and economics.

Finding Your Sweet Spot

As we head into the years traditionally known as retirement years, our focus on what will feel rewarding begins to change. Some of us will embark on something close to what our parents called retirement … no further working and pursuit of hobbies and other pursuits such as hobbies and philanthropic endeavors. Others of us will still choose to work, but we will have different expectations, often much less dependent on earnings and more on fulfillment

In Canada Moshe Milvesky Prof at Schulich business school is vocal on this subject

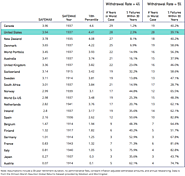

Retirees face market risk, which concerns how market volatility causes average investment returns to vary over time. Sequence of returns risk—the heightened vulnerability individuals face regarding the realized investment portfolio returns in the years around their retirement date—adds to the uncertainty related to overall investment returns.

Try to spend a bit more to 75 then cut back until health care costs etc kick in

That way you enjoyed your best health years

Financial scams are rolling off the assembly line double-time these days, as clients are sold products and services appealing to their post-crisis fears of volatility rather than their now-chastened esprit de greed.

Just because you deal with the high net worth part of an organization doesn't mean you are getting the special secret goodies

The typical retirement plan report is centered around a spreadsheet that purports to anticipate our future wealth annually for the next three decades despite all evidence that such forecasts are well beyond human capabilities. Even if these forecasts were credible, such a presentation makes it difficult to explain or understand the underlying strategy and it places too much planning focus on terminal wealth.

The first thing I would expect from a planner is to hear my Mission Statement repeated back to me in the planner's own words to assure me that the most important goals of my retirement had been accurately communicated.

Next, I would want the planner to explain her recommended strategies to achieve each of the goals of the mission statement. Addressing the goals one by one, I would want to hear not only how the goal would be achieved, but why the selected strategy is the best choice. For me, that would include a brief explanation of alternative choices and why they were rejected. I want to understand what decisions were made on my behalf.

How much would you expect to pay for this plan? The are very few people who have the expertise required to deliver, in a customized way, what you are describing. We can't do it for less than 20 hours, and we charge $200 an hour.... even then we often eat time and spend far more hours than what we charge for. Yet, people balk at the price.