-

About

- About Listly

- Community & Support

- Howto

- Chrome Extension

- Bookmarklet

- WordPress Plugin

- Listly Premium

- Privacy

- Terms

- DMCA Copyright

- © 2010-2025 Boomy Labs

Kathy Waite

Kathy Waite

Listly by Kathy Waite

How to save money in retirement. Pay less tax in retirement. How to make your pension and savings last . How to spend in retirement not run out. How to invest in retirement to reduce risk . Worried about retirement read this. I think i don't have enough to retire . www.yournwm.ca

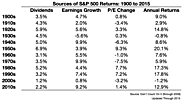

Vangaurd’s John Bogle on a recent Bloomberg interview discussing his simple formula for estimating future stock market returns:

To say " Vanguards" John Bogle is an understatement he started the company and they manage trillions! At 90 plus he has seen some of life and markets and is one to listen to

If you are shopping for a new investment advisor don't be sweet talked into believing they can deliver huge returns. Better to get market average at less risk and for low costs consistently than the odd flash in the pan wonder year.

Mutual funds are so similar all they can compete on is the promise of out performance , yet on 3% deliver that.

Realistic returns also help us be realistic about the plans we make

Here are a couple of tax credits that will likely be unfamiliar to most full-time workers—the annual pension credit and the age tax credit.

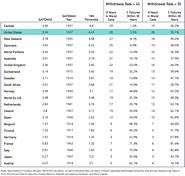

Determining the best retirement income strategy depends on how you measure what is "best", from wealth to spending to Monte Carlo or with a utility function!

Some people want to spend more younger and are not worried if they run out ( final wealth ) , other people the certainty of not running out of money is more important

Is less risk the thing that will help you sleep at night?

Every one is different

As we head into the years traditionally known as retirement years, our focus on what will feel rewarding begins to change. Some of us will embark on something close to what our parents called retirement … no further working and pursuit of hobbies and other pursuits such as hobbies and philanthropic endeavors. Others of us will still choose to work, but we will have different expectations, often much less dependent on earnings and more on fulfillment.

In Canada Moshe Milevsky prof at Schulich business school is vocal on this subject

Retirees face market risk, which concerns how market volatility causes average investment returns to vary over time. Sequence of returns risk—the heightened vulnerability individuals face regarding the realized investment portfolio returns in the years around their retirement date—adds to the uncertainty related to overall investment returns.

Its always been recorded as 4% , i test this out with financial planning software for families but Pfau shows here its still a relevant assumption.

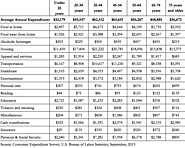

However spending isn't the same in all of retirement .

People tend to spend more early on and then slow down and then more as they age.

An argument in support of the 4% rule is that the post-1926 U.S. historical period included a number of calamitous market events (Great Depression, Great Stagnation of the 1970s, etc.). As such, the argument goes, it is hard to imagine an even more dire situation awaiting future retirees. The historical success of the 4% rule suggests that we can reasonably plan for its continued success in the future.

An argument in support of the 4% rule is that the post-1926 U.S. historical period included a number of calamitous market events (Great Depression, Great Stagnation of the 1970s, etc.). As such, the argument goes, it is hard to imagine an even more dire situation awaiting future retirees. The historical success of the 4% rule suggests that we can reasonably plan for its continued success in the future.

"Which means the real key to retirement success may not be about saving early and often for the long term at all, and that instead a significant post-child-rearing-phase “catch up” sprint is the normal path to retirement success. In turn, this suggests that the most crucial phase of retirement saving is not figuring out how to save during the early working years, and instead is about ensuring that the transition into the empty nest phase is used as an opportunity to catch up on retirement savings – after all, just 15 years of saving 30% of income once the kids are out of the house is still enough for an astonishing number of households to stay on track for retirement!"

eight key messages and themes

The safety-first school of thought was originally derived from academic models of how people allocate their resources over a lifetime to maximize lifetime satisfaction. This approach was originated in the 1920s in the research of people like Frank Ramsey and Irving Fisher. Academics have studied these models since the 1920s to figure out how rational people make optimal decisions. In the retirement context, the question to be answered is how to get the most lifetime satisfaction from limited financial resources. It is the basic fundamental question of economics: How do you optimize in the face of scarcity? In more recent history, Nobel Prize winners such as Paul Samuelson, Robert Merton, Franco Modigliani, and William Sharpe have explored these models.

The art of making the most of what you have Plans before products Helping you retire while still young enough to enjoy it

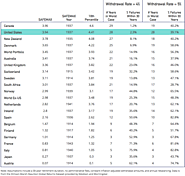

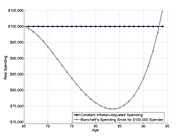

An important simplifying assumption in William Bengen’s research is that retirees spend constant inflation-adjusted amounts throughout retirement. This may be at odds with the spending patterns of many retirees. An exploration of the data should give us an idea of how people actually change their spending during retirement.

A more recent contribution to the retirement spending debate is David Blanchett’s May 2014 article from the Journal of Financial Planning, “Exploring the Retirement Consumption Puzzle.” Blanchett’s “puzzle” concerns how spending tends to decrease both at and then during retirement at a real spending averages rate of about 1% per year.

Ok so if you read around my lists you will realize I like writing by Dr Pfau . I find him along with Dr Moshe Milvesky to be very factual. I have trouble with some of the proclamations from insurance company, bank , fund company, marketing departments. They either try to persuade you that you are doomed and to save double or over promise results from their wonderful products

If we follow what the academics tell us and then compare that to the product pushers we have far more chance of getting a happy outcome.

Lately I’ve been noticing an increasing number of stories about people who have managed to save a decent chunk of money in a relatively short period of time to be able to retire at a very young age. Here are a few I’ve seen recently along with some advice from each.

As we head into the years traditionally known as retirement years, our focus on what will feel rewarding begins to change. Some of us will embark on something close to what our parents called retirement … no further working and pursuit of hobbies and other pursuits such as hobbies and philanthropic endeavors. Others of us will still choose to work, but we will have different expectations, often much less dependent on earnings and more on fulfillment.

As I argue in my latest online column for MoneySense, published this morning, I believe that the next big wave to be surfed by the baby boom generation will NOT be retirement, but Semi-Retirement. Click on highlighted link to access: Why semi-retirement is the future.

Terri Tysowski is delighted with her latest job. She urges older workers to be open to new career possibilities

‘There’s a bit of a herd mentality,’ warns a prominent investment adviser

Jonathan Chevreau reviews "Retirement STILL Rocks!" an update to a book about how to live your best life during retirement, financially and more.

But despite soaring prices for some popular items at the grocery store, the broader cost of living is not the prime culprit

Acting on the fear of leaving money on the table in the event of early death may not be a wise choice when you take statistics into consideration

Registered Retirement Consultant. Your Net Worth Manager Fee Only Financial Planning for regular people in Saskatchewan and across Canada

Retirement designer and money ninja !