-

About

- About Listly

- Community & Support

- Howto

- Chrome Extension

- Bookmarklet

- WordPress Plugin

- Listly Premium

- Privacy

- Terms

- DMCA Copyright

- © 2010-2025 Boomy Labs

Kathy Waite

Kathy Waite

Listly by Kathy Waite

Kathy Waite Regina Saskatchewan coaches would be Net Worth Managers, those converting from commission fee only practices or new to the industry financial planners on how to apply what they read in text books to real life.

Across Saskatchewan and Canada she acts as a mentor for those who believe in putting clients interest first .

Plans before products!

Training in the family office concept and business best practices.

Kathy Waite Saskatchewan Regina Retirement Income specialist and financial planner, net worth manager, all round money ninja!

This is why i call my service net worth management. Financial planner ( people think you have to be rich and its like accountant ) money coach ( thats for people in financial difficulties ? )

Money isn't math its life , money is for doing things with

Where your life and finances over lap is the area I inhabit

Kitches says the following. Its why I adopted a fee for service. I have many clients with wealth or company pensions, farms, rentals that can get no help from investment companies as its not investable assets they can make a commission on . They still need advice on planning , taxes, income drawdown etc

> What would the new business model of Financial Life Management entail? Most likely, some form of financial planning retainer fees, either as an annual or monthly financial life management retainer, or perhaps some form of income-and-net-worth retainer fee. Which in turn opens up a new set of clientele w*ho may not even have the assets for a traditional wealth management *AUM model (but does have the interest and financial wherewithal to pay for financial life management).

Determining the best retirement income strategy depends on how you measure what is "best", from wealth to spending to Monte Carlo or with a utility function!

Much of the movement away has been led by advisers looking for cheaper and easier ways to build client portfolios.

We've heard time and time again how active managers will out-perform in down markets, but it never seems to happen, because active managers seem to mess up in bear markets as well,” said Don Phillips, a managing director at Morningstar.

“There is a subset of active managers that can and will beat the index, and I think you can make smart choices among active managers, but you need to find the ones that keep costs low and take a longer term view,” he said. “But just buying the indexes is never a terrible choice, which is why the outlook is not good for active management, in terms of net flows.”

Nobody yet is ready to call for the eventual extinction of actively managed funds, but some believe the shrinkage will continue.

I am 47 I started work in an investment bank at 16 and went to college and their training school.

How come 31 years later we have still have articles that women are different?

Duh?

It just reminded me what a left brain male dominated industry I swim in

.

The typical retirement plan report is centered around a spreadsheet that purports to anticipate our future wealth annually for the next three decades despite all evidence that such forecasts are well beyond human capabilities. Even if these forecasts were credible, such a presentation makes it difficult to explain or understand the underlying strategy and it places too much planning focus on terminal wealth.

The first thing I would expect from a planner is to hear my Mission Statement repeated back to me in the planner's own words to assure me that the most important goals of my retirement had been accurately communicated.

Next, I would want the planner to explain her recommended strategies to achieve each of the goals of the mission statement. Addressing the goals one by one, I would want to hear not only how the goal would be achieved, but why the selected strategy is the best choice. For me, that would include a brief explanation of alternative choices and why they were rejected. I want to understand what decisions were made on my behalf.

How much would you expect to pay for this plan? The are very few people who have the expertise required to deliver, in a customized way, what you are describing. We can't do it for less than 20 hours, and we charge $200 an hour.... even then we often eat time and spend far more hours than what we charge for. Yet, people balk at the price.

A little over a year ago, Tower Paddle Boards started letting employees leave by lunchtime and offering 5 profit-sharing.

New paper makes the case for advisers to charge clients flat fees versus fees based on assets

Moving to a retainer removes conflicts of interest and makes you a professional paid for what you know not for what you sell

Good advice on engaging clients , .in other words stop selling and start listening! What are they looking for ? How can you help them? Dump the sales presentation and solve their problems

Kathy Waite Regina saskatchewan, fee only financial planner, money coach.

Welcomes newbie advisors, look after yourself as it takes a lot of energy to look after your clients

It’s hard to know where to start when it comes to investing. Rob Carrick lays out four simple ways to do it

Most investment shops reward managers for short-term results, and few consider risk-adjusted returns.

The investment industry has arguably deemed risk-adjusted returns as the best measure of portfolio manager skill. However, most investment firms focus on total returns when determining manager bonuses. In fact, of the firms included in the exhibit, only AllianceBernstein, Eaton Vance, T. Rowe Price, and TIAA consider risk-adjusted returns when measuring their portfolio managers.

Your retirement will not be the same as your grand parents , you drive more modern cars and live a connected life with iPhones and other devices. So why use the same investments they used? Find out about ETFS . call 306 535 2255 for more info

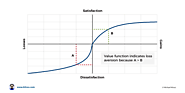

Why the research on loss aversion suggests that losses may not truly hurt more than gains feel good, and how this research may apply to financial planners working with their clients.

The overriding caveat with robos is that they are portfolio managers, not financial planners who tell you whether you can afford to buy a house or when you can retire.

I also believe in indexing not active. I constantly see 75% to 85% of active funds underperform the benchmark. So a Robo may be cheap but if you are leaving returns on the table you are not helping your self long term

Registered Retirement Consultant. Your Net Worth Manager Fee Only Financial Planning for regular people in Saskatchewan and across Canada

Retirement designer and money ninja !