-

About

- About Listly

- Community & Support

- Howto

- Chrome Extension

- Bookmarklet

- WordPress Plugin

- Listly Premium

- Privacy

- Terms

- DMCA Copyright

- © 2010-2025 Boomy Labs

Kathy Waite

Kathy Waite

Listly by Kathy Waite

In the news March . Great video on credit cards to avoid currency fees in the US. Cost of living going up. 2016 Budget what does it mean to you ?

This was not written this month but I just found it and having seen the mistake happen numerous times liked the article.

These days, it seems as though almost everyone has an idea of how you can get ahead as an investor. However, no matter how good the investment advice sounds, you need to do a gut-check. Can you trust this person? And why is he or she sharing such a great tip with you?

Flat fee advice based on the help you want , not based on how much you have.

This means small accounts can get help and large dont get gouged.

Whats on your mind? What keeps you up at night? What excites you? Net Worth Management helps you make the most of what you have and get to where you want to ...

When Shakespeare wrote “Some are born great, some achieve greatness, and some have greatness thrust upon them,” he wasn’t referring to financial management — but I have found the insight quite relevant in this field.

I think I need to take a week off in August lay under a tree and read Kahnemans works

In Thinking, Fast and Slow, Daniel Kahneman introduces the concept of what you see is all there is (WYSIATI). WYSIATI occurs when people jump to conclusions based on limited information. In many aspects of life, rules of thumb can be helpful.

People think a cash flow plan is a budget. Its not, its about making your money do what you want it to do.

A cash flow plan actually gives you permission to spend on things you care about without feeling guilty

Whether you are 27 or 67 knowing your numbers helps you live the life you want to

The financial planning process sounds boring, but really I think it’s about getting clear about what’s important to us. In other words, think of it as the overlap between your money and your life. To figure that out, we need to measure what we actually do against what we say we value. Sometimes, we’ll find a gap, and both the calendar and the checkbook can help reveal that gap.

The introduction of the Canada Child Benefit and nixing of the fitness credit—here are six changes from the federal budget that will impact parents

http://www.yournwm.ca/blog/what-does-this-2016-canadian-budget-mean-to-you

Video and summary on my blog

During the holiday season, I wrote an article about over-consumption – the gist being that the over-consumption of credit can leave us with debt troubles and how over-consumption of the wrong foods can leave us with harmful health debt.

Buy whats in season , buy bulk and freeze

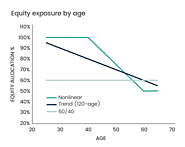

In the early 1990s, Barclays Global Investors launched a one-step investment strategy that promised automatic diversification to retirement investors while aiming to meet investors’ long-term savings goals.

Since then because there is no one to advise you on your company pension most have moved to " glide path " funds . You pick one based on your age and it gets " safer" as you get older.

There are some benefits but automatic also means lack of control

Registered Retirement Consultant. Your Net Worth Manager Fee Only Financial Planning for regular people in Saskatchewan and across Canada

Retirement designer and money ninja !