-

About

- About Listly

- Community & Support

- Howto

- Chrome Extension

- Bookmarklet

- WordPress Plugin

- Listly Premium

- Privacy

- Terms

- DMCA Copyright

- © 2010-2025 Boomy Labs

Kathy Waite

Kathy Waite

Listly by Kathy Waite

Making the most of the next stage of your life. Learning from other people experiences.

Do you get your advice from the sales and marketing department at a big bank , insurance or investment company with their hidden agenda to push their own products?

Here I list some of the great thinkers and commentators of our time.

Dinnie Greenway loves riding horses, and she's not letting a little thing like age stop her. The 96-year-old says horseback riding is an addiction that has kept her going her whole life.

This is quite personal for me. Any one who knows me, knows we live on an acreage , 4 horses multiple other animals. My grandmother lived to 87 , had late onset Parkinson's but knew who we were and where she was to the end. Given she smoked liked a chimney and lived through the blitz in world war 2, worked at London airport making sandwiches for 30 years and had my Mum at 42, not the best of health care at times, I always assumed longevity was in the family. 2016 my Mum died of multiple issues at 72 . She hated hospitals and didn't take her medication but it was still a shock. Dad has alzheimer's at 75 doesn't know who we are half the time and is in virtually 1 :1 care . That scares the $%%^& out of me as I had actually assumed like Warren Buffet and Jack Bogle I would still be running the family business at that age! Bossing the grand kids around.

The Queen of England is riding at 90 and so is this lady ..........I have been upset summer 2016 my back has been bad and I haven't got on as much as usual, gained weight, but I have stuck to my pysio appointments and am determined to be like these ladies! If attitude has anything to do with it I will make it to 150 lol .

Whats your family history ? How does it make you feel about your future? How does it make you feel about what you are spending your time on now?

Many people feel trapped and want to make a change . I can work with you to help that be a reality .Money makeovers to transform what you currently have.

Longer average life expectancy mean it's time to redefine what comes after we stop working.

This is interesting written from the perspective of an entrepreneur instead of personal finance people

Kathy Waite Saskatchewan fee only financial planner and retirement forecaster has been talking for years about different ways to live

Your retirement will not be the same as your parents

My plan for later years is sipping wine with friends on a communal porch.........

Whats your plan?

Eight smart snowbird tips for Canadians and Americans getting ready to spend their winters down south, gleaned from the Snowbirdadvisor.ca website

I thought my productive days were over but the past eight years has showed me that ‘keeping work keeps you young’

Whats known as an " encore act" career is becoming increasing common as we live longer and want to stay active.

Turning an interest into part time income for extra spending , social life or to get the staff discount!

Maybe it’s because work is satisfying. Maybe it’s because we’re trapped. Or maybe, as Ryan Avent suspects, it’s because of a troubling combination of the two

His parents idea of retirement compared to his idea of retirement .

Remote consultations with Doctors. I find this fascinating , along with self driving cars, drones to deliver medication and groceries I think we will be able to stay in our own homes much longer as we age

Patients will first have to download an app on their computer or mobile phone and then at an allocated time they must log on and speak to their GP using their built-in camera or webcam.

Wearing a Fitbit type of tracker they will know our vital signs

I do think though we all need to make an effort to keep up with technology or we won't be able to use all the benefits

I don’t like to admit it, but over the years and due to circumstances largely beyond my control, I have turned into a skeptic.

why do advertisers continue to seduce us with their old version of retirement if it doesn’t reflect the current reality? You know the images: a seemingly care-free, happy couple sitting on a beach in the Caribbean while sipping on a strawberry daiquiri, or the happy couple playing golf on a picturesque golf course beside the ocean. You can almost hear the sound of the putt going into the hole for a birdie.

Why don’t advertisers show us the other side of retiring: the loss of socialization, loss of income, loss of purpose, loss of mattering? Because telling the truth doesn’t sell stuff!

How to pack like a pro: this graphic offers practical, usable tips on what to pack, how to deal with different types of clothing, and other packing problems

The baby boomer travel survival guide: eight tips to help the over-50 traveller stay safe and healthy while still seeing the whole wide world

Behavioral finance has uncovered various biases which are great for day-to-day survival, but somewhat maladaptive for long-term investing.

Any one of my clients will tell you I often say " if money were about math it would be simple , its mostly emotion "

Research proves we should avoid using recent or current market behavior to predict future market behaviour and believing you know more than other investors

The fields of behavioral finance and behavioral economics have uncovered various biases humans have which are great for day-to-day survival, but somewhat maladaptive for long-term investing.

If you chose to build up savings rather than pay down your mortgage, you're not alone. But retiring with debt is a bad idea, says Jonathan Chevreau

Kathy Waite says "A roof over your head is security and control. I have seen several seniors recently have to move when landlords decided to sell. One had no family to help and had to hire expensive removal help. Another couldn't find anywhere with a small lock up for her motability scooter and plug in "

The old saying that money can’t buy happiness isn’t true. We know, for instance, that buying experiences can lead to happiness, and it trumps buying things. But what else do we need to think about when we try to buy happiness?

Kathy Waite Saskatchewan . fee only financial planner . If you think it doesn't you don't know how to spend it , which is probably not on YOU

Experiences are more enjoyable than stuff , I hear this from seniors all the time.

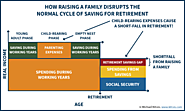

Ok so we all know some one who did 35 years in a federal job and have $4000 month pension but its probably notYOU!

most have had 4 to 8% in a group RRSP some years , lots only in the year a company made a profit

Coupled with helping kids with education, weddings, first homes,

How the heck do you save for you?

Good article on the reality of family life

Conventional wisdom that baby boomers are behind on retirement may grossly understate their ability to save during the empty nest red zone phase!

The 10 best things to see in Quebec City, a historic, atmospheric place that's called the most European place in North America. From The Travelling Boomer Paul Marshman was a journalist now retired.

He takes his photography seriously and says which sense etc he uses.

His tips are boomer friendly and its reasonable cost

I have been thinking about the travel I did in my 20's and 30's to France, Italy, Greece, Tunisia and many of these places dont feel safe any more. We are so lucky to live in a huge land with so much diversity .

As we age travel insurance gets more expensive. My father in law had a 1 inch patch of skin cancer on his cheek 3 years ago and his insurance cost the same as his plane ticket! ridiculous.

Staycations in Canada or even going south seem more attractive. I am hankering to see Lake Tahoe its supposed to be like the french riviera

Once a default option is established, it tends to stick.

In retirement we start to think and feel differently about ourselves and the world around us but change is scary.

Unlike traditional economics, which assumes that people make decisions with the logic and rationality of Mr. Spock, BE combines psychology and economics to show how people make decisions in real life. When faced with complex financial choices, people tend to act more like Homer Simpson than Mr. Spock. They get swept away by emotion, they rely on intuition and hunches, and they take mental shortcuts that lead them astray.

Over time, Prof. Kahneman and his team discovered the existence of dozens of mental blind spots, known as cognitive biases, that cause people to make irrational decisions. Examples of these cognitive biases include:

Status quo bias. When faced with difficult decisions, inertia sets in and people tend to stick with the status quo.

Loss aversion. People dislike losing twice as much as they like winning, and they avoid selling items at a loss.

Present bias. People tend to prefer to receive smaller payments now than significantly larger payments in the future.

Choice overload. When faced with too many choices, people tend to become overwhelmed and freeze.

As I argue in my latest online column for MoneySense, published this morning, I believe that the next big wave to be surfed by the baby boom generation will NOT be retirement, but Semi-Retirement. Click on highlighted link to access: Why semi-retirement is the future.

An 89-year-old who put an ad in a paper saying he wanted a job because he was dying of boredom is offered work at a restaurant.

His wife died 2 years ago and he was lonely

I hear this all the time, people leave a job they are burnt out with and find something new for the social interaction and distraction

Seniors tell me being home alone isn't as much fun as it sounds. You need a hobby , clubs, family around or get out and do what he is doing but because you want to not have to

Pete Stoopnikoff, 92, says two of his adult children pressured him to hand over property and accounts worth more than $4 million, leaving him reluctant to even drive his car because he can’t afford the gas.

I know there is two sides to every story but I have seen many cases where people sign money or assets over to kids, then live longer than expected , the kids get into financial difficulties and use them for themselves or they are caught up in a divorce proceeds.

If you suspect any one is being taken advantage of there are some good tips here about how to whistle blow without being seen to be after the money yourself.

Visiting every country in the world: presenting two fascinating videos that cover every country on the globe, with strange and crazy facts about each

‘Put away for tomorrow’ philosophy allows man to pursue second career as a United Church minister

Retiring in Mexico is a dream for many northerners: the Travelling Boomer takes a close look at San Miguel de Allende, one of the most popular destinations

Really good tips on how to enjoy your trip. The baby boomer's guide to European travel: The Travelling Boomer offers sage advice for surviving Europe's wonky streets, staircases and electricity

An elderly couple moving to an assisted living apartment call their son in another state for help in moving their belongings. A widow in her 90s finds it difficult to clean her home, yet refuses to hire help. These people are not wealthy, but neither are they poor. Each has more than enough to pay a moving company or cleaning crew, without risk of running out of money before running out of life. Yet they resist, insisting that they cannot afford these services. Why do people behave this way?

Registered Retirement Consultant. Your Net Worth Manager Fee Only Financial Planning for regular people in Saskatchewan and across Canada

Retirement designer and money ninja !