-

About

- About Listly

- Community & Support

- Howto

- Chrome Extension

- Bookmarklet

- WordPress Plugin

- Listly Premium

- Privacy

- Terms

- DMCA Copyright

- © 2010-2025 Boomy Labs

Kathy Waite

Kathy Waite

Listly by Kathy Waite

Asymetric information means the person advising you knows more than you do about a subject . Thats fine when that person has your best interests at heart. In financial services many do but there is no fiduciary standard , as with Doctors and other professionals.

Remember the majority are commission or even if they are salaried have sales targets to achieve ( or leave) .

They represent the company they work for and shareholders interests first and you second.

Thats why in Canada we only have a suitability standard not fiduciary , it gives them licence to sell their own offerings even if they are not the best thing for you.

Its a bit like saying potato chips and soda are suitable as food , doesn't mean they are good for you all the time.

Wise up and avoid the sharks!

Even if you remember 10% of what you hear you will be better armed to discriminate between technical terms, jargon to intimidate or BS

This 2 minute video explores an important subject: Biased advice from financial professionals regarding retirement saving and related matters

Your advisor does not have to put your interest first unlike your lawyer or Doctor. He can sell you whats suitable not best.

Ok so chips and pop are suitable as food but not good for you!

I love Canada but we so need to protect those who don't know they are being taken advantage of

Don't make decisions when you are under stress or feeling very optimistic about the future, either can skew your judgement.

University of Cambridge in England research confirms successful investing is about controlling what you can. You can’t control what the market does, but you can control what you do in response.

People on testosterone supplements compared to placebo took more investment risks because they thought things might be better in future and so took more risk.

The majority of fund managers are young , male and competitive so what does that tell us about their decision making?

A good advisor knows as much about the psychology of finance as the math

Taking more risk does not get you more return long term ask me to show you what I mean k@yournwm.ca

Plans before products!

A short 6 minute clip intended as a John Oliver story pitch. Created by a somewhat disturbed, but recovering Canadian broker who is trying to protect the pub...

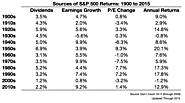

Vangaurd’s John Bogle on a recent Bloomberg interview discussing his simple formula for estimating future stock market returns:

To say " Vanguards" John Bogle is an understatement he started the company and they manage trillions! At 90 plus he has seen some of life and markets and is one to listen to

If you are shopping for a new investment advisor don't be sweet talked into believing they can deliver huge returns. Better to get market average at less risk and for low costs consistently than the odd flash in the pan wonder year.

Mutual funds are so similar all they can compete on is the promise of out performance , yet on 3% deliver that.

Realistic returns also help us be realistic about the plans we make

In Canada its very hard to measure how your fund has done against the market.

In a mutual fund you pay 2 to 3% but what did you get for that?

In Europe managers are voluntarily declaring their AS , active share , this reveals how much the fund differs from the benchmark

Instead of hiding their performance from investors the best and brightest are voluntarily publishing this easy to follow standard.

Take a look at your statements , what did you pay for your investment this year?

How did it do compared to others?

Did achieve what you need to meet your goals?

NOW ask yourself what are they hiding?

the truth is every 13 years about 1/3 of your savings disappear in fees.

You are probably under performing the market by 2% so your fund costs you 4.5%

And what has it averaged?

Take off the fees.............often less than inflation.

You may as well have sat in a GIC or interest account at no risk

Michael Kitches , Leading authority on industry change in the USA

Most people think financial advisors are sales people. Time has moved on and a new breed has expertise in helping you figure out what is important to you and then get you from A to B.

Text book smarts are not all thats required pick some one with "life" experience.

Choose someone you can communicate with but also who works for you , not representing a company. Reps of companies may not put your interests first.

Fee only financial planners work for you not the institution on their business card.

Financial advisors do no have to put your interests first

There’s a horrendous lie being told by the brokerage industry and its army of lobbying groups. It goes something like this:

“Middle-class Americans are not worth serving if we can’t charge them egregious fees and sell them products that they do not need.”

What affects the limbic systems of advisors who have a fiduciary duty to their clients versus those who don't?

That’s why I’m such a strong believer in fiduciary duty. When commissioned advisers take the uneducated for a ride, all they’re doing is, in my opinion, stealing money. Yes, I said that. I believe that if you’re a commissioned mutual fund salesperson, you’re stealing money from your clients.

What you need to know about your financial advisor. - Molly McCluskey, John Reeves, and Ilan Moscovitz - Investment planning

The financial advisors at Edward Jones come from diverse backgrounds and are provided with a great deal of training and development opportunities. Many of the former Edward Jones advisors we spoke with, however, told us that the role is primarily about gathering assets and generating revenue for the firm.

The team of financial advisors at Edward Jones has extremely high turnover, and many of the less-experienced advisors are probably unqualified to make investment recommendations. Ultimately, we found that the firm’s very business model -- which, again, is representative of broker-dealers at large -- is structured in favor of revenue generation, at the expense of providing the best possible investment advice. Importantly, our findings come despite the fact that the current and former Edward Jones advisors we spoke with are people of integrity.

Maintaining higher fixed costs in retirement increases exposure to sequence risk by requiring a higher withdrawal rate from remaining assets.

Reverse mortgages too young can be a time bomb, used properly like any power tool they are useful , just don't misunderstand what you sign up for and chop your fingers off!

Not to be confused with HELOC, home equity line of credit

Financial scams are rolling off the assembly line double-time these days, as clients are sold products and services appealing to their post-crisis fears of volatility rather than their now-chastened esprit de greed.

1) he belongs to my church / club he will look after me

2) i am being offered something special as I am high net worth , usually its over priced packaged up garbage

read and beware

Are you afraid of outliving your savings? Our round table of experts discusses the financial security challenges Canadians face as they reach retirement.

Regulators “have dropped the ball” says Glorianne Stromberg

They hold themselves out as offering advice, but it’s all a sales transaction. Their compensation structures are designed to force those so-called advisors or representatives to deal in those products (proprietary products or those underwritten by the company), or they’re without a job. They’re setting up irreconcilable conflicts of interest on all sides of every transaction.” G. Stromberg article

Longtime TD bank employees are speaking out about increasing pressure to meet sales goals — pressure they say is forcing them to sign up customers for products that can put them into debt, or risk being fired.

i teach people how to be the shareholder they are making money for not the client they are making it on

A customer’s best defence against upselling is to know which sales pitches are worth listening to, and which to shut down

Rob Carrick offers tips on how to protect yourself from unwanted products and what to do if your bank signed you up for something you didn't ask for.

If you saved $100,000 in a mutual fund you might end up with $432,000 . Use a fee only advisor at 1% and have $732,000

The first person runs out of money at 79 , the second at 93 if still lucky enough to be here !

Pay for the help you need don't get gouged on fees!

A group spokesperson blames the lack of a best-interest standard on Canada’s ‘dysfunctional’ regulatory system

The Royal Bank of Canada will pay almost $22 million in compensation to clients who were charged excess fees on some mutual funds and investments products.

After executing thousands of missions, here's how Admiral William McRaven, author of Make Your Bed , discovered the source of his confidence.

I agree nothing is more important than experience.

I have 30 years worth of watching families deal with the good and bad in life.

Call me to help you make the most of what you have

Experience to understand how decisions unfold, having a plan B.

Advisors can help their clients through a preventive approach or by changing their mindsets

Registered Retirement Consultant. Your Net Worth Manager Fee Only Financial Planning for regular people in Saskatchewan and across Canada

Retirement designer and money ninja !