-

About

- About Listly

- Community & Support

- Howto

- Chrome Extension

- Bookmarklet

- WordPress Plugin

- Listly Premium

- Privacy

- Terms

- DMCA Copyright

- © 2010-2025 Boomy Labs

Sandi Martin

Sandi Martin

Listly by Sandi Martin

October's list of the best Canadian personal finance news, articles, and blog posts from around the internet, expertly curated for interest and relevance. You can follow this list right here in List.ly, by following me on Twitter (@sandimartinspf), or by signing up for Spring in your inbox here: https://springpersonalfinance.com/contact/

If you focus on earning points but carry a balance on your credit card, you might pay much more in interest than you'll earn on points. This video explains why. If you can't see the embedded video, click here to view it on YouTube.

After nearly 15 years in banking, I have witnessed firsthand how banks operate and make money. That has influenced how I choose products and interact with financial institutions. Here is my advice on how you can get the most from your bank.

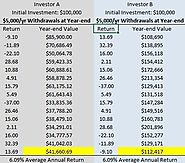

One often overlooked risk in investing is "Sequence of Return Risk". That is the idea that two investors that are periodically adding or withdrawing funds from their portfolio can experience the exact same average returns but end up with vastly different results.

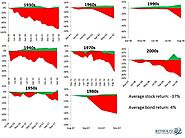

You should expect year-to-year stability in investing returns if there is something special about a year. But there's not. A money manager is looking for exploitable opportunities, not all of which will fit neatly into a time period governed by the gravitational pull of a celestial ball of gas. Anyone using astrology to measure future returns is considered a lunatic, but almost everyone uses it to measure past returns.

A great analysis of what financial planning really is...and what an overwhelmingly asset-centric industry has spent many years distorting it into. (Remember, a "financial planner" who is paid based on how much money you have invested with them is naturally going to emphasize how important your investments are and downplay or ignore other important parts of your financial life...like your budget...that they're not directly compensated for addressing):

"The very label 'financial planning' is being distorted. It's being turned into a euphemism for investment management and retirement planning by a retirement-centric industry, as though accumulating a giant portfolio for retirement is the only financial problem anyone ever faces."

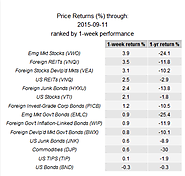

There was a scary chart flying around a couple months ago showing how basically no asset class was working for investors. These numbers, provided by James Picerno at The Capital Speculator, showed that every major asset class or category showed a negative one year return through early September: This was pretty crazy - stocks, bonds real estate, commodities, foreign, domestic, it didn't matter.

My wife and I welcomed a son into the world on Sunday. It's the coolest experience anyone could ask for. His only interest right now is keeping us awake 24/7. But one day -- a long time from now -- he'll need to learn something about finance. When he does, here's my advice.

"Nothing gives you high double-digit gains without the occasional double-digit loss, unless you’re Bernie Madoff."

"Investing, as it turns out, is awfully similar. Shortcuts would be great. The financial version of the “One Weird Trick” advertisement is the local guy on the radio promising stock market returns without the risk. I have to tell you, if you think you can change your overall health and fitness by taking a supplement or eating some super berries, you’re going to be a sucker for what the financial industry can come up with."

"Finally, while there is certainly a risk that bonds deliver lousy returns going forward, I view the chances of significant nominal drawdowns as pretty far down the list of concerns, regardless of what the Fed does. Even as the ten-year yield soared to 15% in 1981, the nominal drawdown was just 16%. To put this into perspective, the Dow has fallen sixteen percent in just a month ten different times."

Investors have been nervous about the possibility of rising interest rates for a number of years now. Since bond prices fall as interest rates rise, this possibility has many investors worried about their exposure to interest rate risk.

September's list of the best Canadian personal finance news, articles, and blog posts from around the internet, expertly curated for interest and relevance. You can follow this list right here in List.ly, by following me on Twitter (@sandimartinspf), or by signing up for Spring in your inbox here: https://springpersonalfinance.com/contact/

Fee only/advice only financial planner at Spring Financial Planning, ex-banker, curmudgeon.

Co-host with the really loud laugh on Because Money