-

About

- About Listly

- Community & Support

- Howto

- Chrome Extension

- Bookmarklet

- WordPress Plugin

- Listly Premium

- Privacy

- Terms

- DMCA Copyright

- © 2010-2024 Boomy Labs

Sandi Martin

Sandi Martin

Listly by Sandi Martin

September's list of the best Canadian personal finance news, articles, and blog posts from around the internet, expertly curated for interest and relevance. You can follow this list right here in List.ly, by following me on Twitter (@sandimartinspf), or by signing up for Spring in your inbox here: https://springpersonalfinance.com/contact/

Source: http://blog.springpersonalfinance.com

The biggest problem most investors have with a diversified portfolio is that it rarely “works” over the short-term. Asset allocation is a long game. There could be cycles that last a number of years before you’re able to see the benefits of holding assets that have different risk and return characteristics.

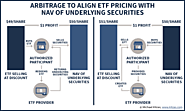

A fundamental point – sometimes forgotten by investors given the seemingly infinite and stable liquidity of ETFs – is that in the end, ETFs can’t really be any more liquid than their underlying securities (because the creation/redemption process will ultimately be constrained by the liquidity of the underlying holdings), but since ETFs remain marketable throughout, the potential emerges for what can be significant gaps between the market pricing of ETFs and their (presumed) NAV.

We set out to determine if it makes sense for incorporated individuals to withdraw additional salary or dividends in excess of their living expenses to contribute to the RRSP or TFSA, respectively. To do this, we modelled the total after-tax value of $1 of active small business income in the personal hands of the individual. This is best explained with examples:

August's list of the best Canadian personal finance news, articles, and blog posts from around the internet, expertly curated for interest and relevance. You can follow this list right here in List.ly, by following me on Twitter (@sandimartinspf), or by signing up for Spring in your inbox here: https://springpersonalfinance.com/contact/

Probate is not so much for the beneficiaries as it is for financial institutions and the province, so the fact that the siblings will sign off is of little consolation.

An index fund is nothing special. It’s systematic, disciplined, rebalanced occasionally, transparent, low-turnover, low-cost, and low-maintenance. It’s one of the reasons they’re so hard to beat by even brilliant fund managers. You know exactly what you’re getting. Actively managed funds can do all of these things, even if they can’t exactly match the cost structure of an index fund. Instead of worrying about passive versus active, think in terms of disciplined strategies versus undisciplined strategies.

"If you’re waiting for your uneasiness to go away before you pull the trigger, you’ll wait in vain"

Upon entering retirement, you have several options in front of you in terms of allocating between stocks, bonds, and income annuities. Let us consider a simple example and four different approaches.

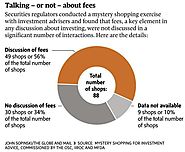

We all know that if a person makes bad financial life choices, their investment results are almost meaningless to the outcome of their financial lives. We now have research validating the fact that most people's financial lives really aren't influenced by their investing, and many advisers are focusing on all the wrong things.

Can you see yourself going to a grocery store and buying a week's worth of groceries without checking the prices? The question has to be asked in light of how people buy investments. Somehow, the keen shopping instincts we've developed in an online world of instant information turn to mush when we invest.

Fee only/advice only financial planner at Spring Financial Planning, ex-banker, curmudgeon.

Co-host with the really loud laugh on Because Money