-

About

- About Listly

- Community & Support

- Howto

- Chrome Extension

- Bookmarklet

- WordPress Plugin

- Listly Premium

- Privacy

- Terms

- DMCA Copyright

- © 2010-2024 Boomy Labs

Zack Miller

Zack Miller

Listly by Zack Miller

Much new research being done on how Google search volume can influence stock prices. Here's a list of some of the best research on Google and investing.

Source: http://www.tradestreaming.com/2012/01/29/using-google-to-forecast-an-earnings-pop-or-plunk/

Number of Pages in PDF File: 55 Keywords: Information Demand, Earnings Announcements, Information Content, Price Discovery Roulstone, Darren T., Drake, Michael S. and Thornock, Jacob R., Investor Information Demand: Evidence from Google Searches Around Earnings Announcements (January 24, 2012). Journal of Accounting Research, Forthcoming. Available at SSRN: http://ssrn.com/abstract=1991455

Number of Pages in PDF File: 45 Keywords: attention, internet search, individual investor, IPO, price momentum Da, Zhi, Engelberg, Joseph and Gao, Pengjie, In Search of Attention (June 4, 2009). AFA 2010 Atlanta Meetings Paper. Available at SSRN: http://ssrn.com/abstract=1364209 or doi:10.2139/ssrn.1364209

Number of Pages in PDF File: 36 Keywords: Search Volume, Earnings Surprises, Revenue Surprises Da, Zhi, Engelberg, Joseph and Gao, Pengjie, In Search of Fundamentals (March 15, 2011). AFA 2012 Chicago Meetings Paper. Available at SSRN: http://ssrn.com/abstract=1589805 or doi:10.2139/ssrn.1589805

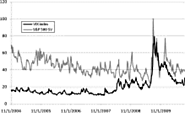

Number of Pages in PDF File: 34 Keywords: realized volatility, forecasting, investor behavior, noise trader, search engine data JEL Classifications: G10, G14, G17 Dimpfl, Thomas and Jank, Stephan, Can Internet Search Queries Help to Predict Stock Market Volatility? (October 24, 2011). Available at SSRN: http://ssrn.com/abstract=1941680 or doi:10.2139/ssrn.1941680

Number of Pages in PDF File: 30 Keywords: Google Insights, stock liquidity, trading activity, stock returns Bank, Matthias, Larch, Martin and Peter, Georg, Google Search Volume and its Influence on Liquidity and Returns of German Stocks (August 27, 2010). Financial Markets and Portfolio Management, Vol. 25, No. 3, pp. 239-264, 2011.

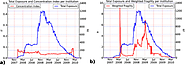

We study information demand and supply at the firm and market level using data for 30 of the largest stocks traded on NYSE and NASDAQ. Demand is approximated in a novel manner from weekly internet search volume time series drawn from the recently released Google Trends database. Our paper makes contributions in four main directions. First, although information demand and supply tend to be positively correlated, their dynamic interactions do not allow conclusive inferences about the information discovery process. Second, demand for information at the market level is significantly positively related to historical and implied measures of volatility and to trading volume, even after controlling for market return and information supply. Third, information demand increases significantly during periods of higher returns. Fourth, analysis of the expected variance risk premium confirms for the first time empirically the hypothesis that investors demand more information as their level of risk aversion increases.

Systemic risk, here meant as the risk of default of a large portion of the financial system, depends on the network of financial exposures among institutions. However, there is no widely accepted methodology to determine the systemically important nodes in a network. To fill this gap, we introduce, DebtRank, a novel measure of systemic impact inspired by feedback-centrality. As an application, we analyse a new and unique dataset on the USD 1.2 trillion FED emergency loans program to global financial institutions during 2008–2010. We find that a group of 22 institutions, which received most of the funds, form a strongly connected graph where each of the nodes becomes systemically important at the peak of the crisis. Moreover, a systemic default could have been triggered even by small dispersed shocks. The results suggest that the debate on too-big-to-fail institutions should include the even more serious issue of too-central-to-fail.