-

About

- About Listly

- Community & Support

- Howto

- Chrome Extension

- Bookmarklet

- WordPress Plugin

- Listly Premium

- Privacy

- Terms

- DMCA Copyright

- © 2010-2025 Boomy Labs

Value Folio

Value Folio

Listly by Value Folio

A user generated list of the top value investing blogs on the internet. Vote for your favorites! Please add any value investing blogs that we missed. Please only add high quality, active, value investing blogs

Stock market investing advice focused on undervalued stocks and value investing principles. Subscribe free or become a premium member today

Focused on special situation (spin-offs, demutualizations, bankruptcies) and hedge fund (Warrenn Buffett, David Einhorn) investing ideas.

Essential links, resources, commentary, and stock valuation write-ups for value investors. Plus, timely conviction pick notifications.

How to Value a Stock: Learn how to value a stock using stock price calculators, investing spreadsheets, tutorials, how to's and analysis to help you master how to value a stock and beat the market.

Focused on microcap value investing and providing new value investment ideas. Focuses on net-net stocks, NCAV, low price to book, special situations, and other value stocks.

The purpose of this blog is to provide investment education, share investment ideas, answer readers’ questions, and interview interesting guests.

I am a Professor of Finance at the Stern School of Business at NYU. I teach classes in corporate finance and valuation, primarily to MBAs, but generally to anyone who will listen.

This blog is a medium to share investment ideas and education material with the investment community and potential clients.

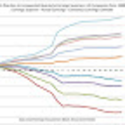

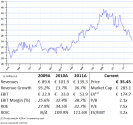

We focus on undervalued small-cap stocks. Usually with a large cash cushion. We have developed a valuation formula that has been highly successful, especially on small tech stocks. Since 2006, we have closed out 49 stock positions with an average gain of 37%. 9 stocks have been taken over.

Exploiting Market Anomalies With Data That Has Been Overlooked Underappreciated Or Ignored.

"There Are No Bad Assets Just Bad Prices"

Stock Market Investing, Value Stock Investments and Analysis, focusing on small-cap, undervalued stocks and special situations investments that beat the market.

A contrarian investment blog influenced by value investing, with some macro and special situation investing.

Reasoning, valuation, discussion, analysis, critique, and most importantly constant learning about value investing.